Lilis Energy, Inc. (ticker: LLEX) produced 575,229 net BOE in 2017, or 1,575 BOEPD on average. These production numbers represent an increase of 350% year-over-year. Average Q4 2017 production increased 206% to 1,925 BOEPD.

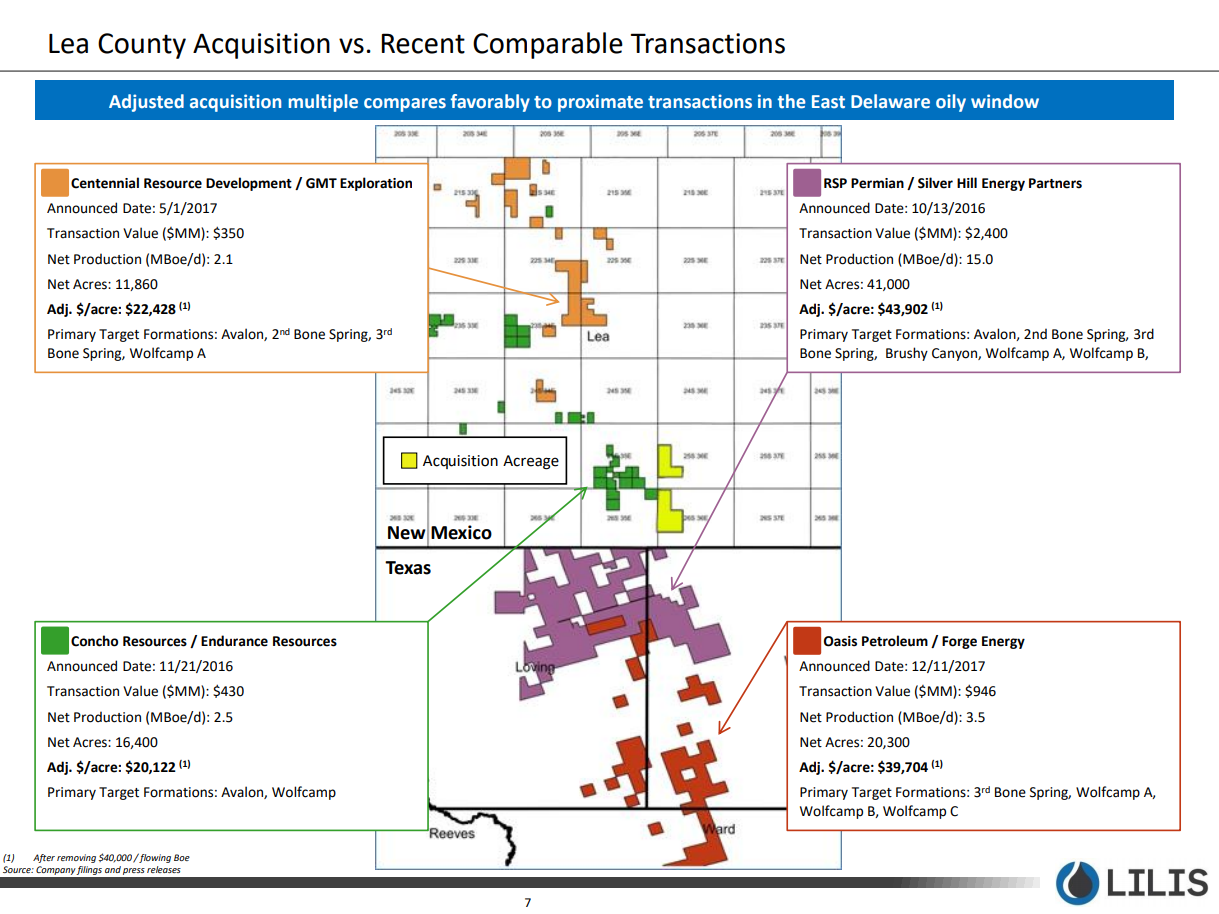

“The last year in 2017 has been a very transformational one for Lilis. We positioned ourselves as a pure play Delaware Basin operator with a substantial, contiguous net acreage base currently with ~16,000 net acres. We expect to be at ~19,000 net acres by the end of the first quarter in 2018, upon completion of our announced acquisition. More importantly, our acreage has been acquired at very attractive acreage costs, substantially below implied acreage valuations in the public market for comparable companies,” Lilis Executive Chairman Ron Ormand said in a statement.

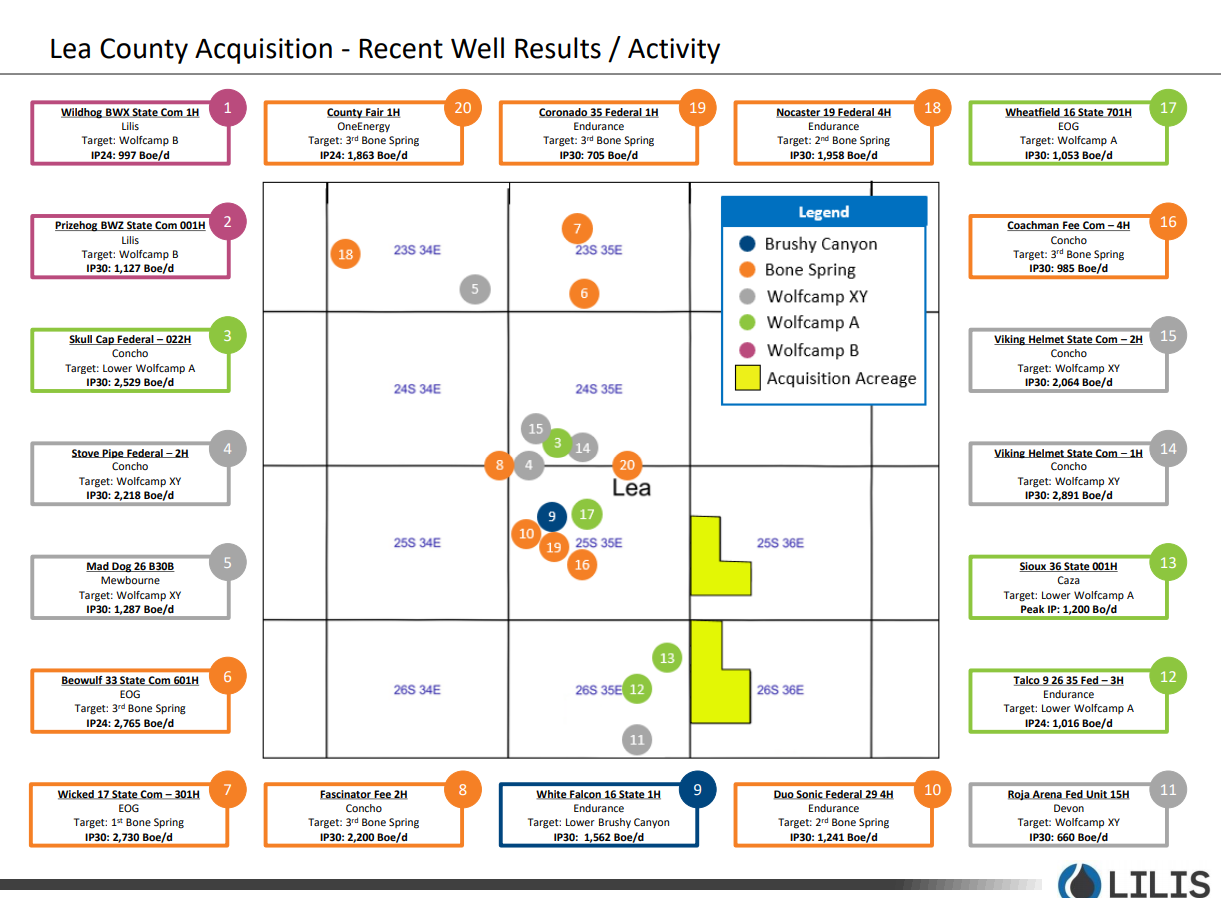

“Our midstream system is expected to be fully operational in March 2018, which will allow us to flow our wells unconstrained and accelerate our completions program. Thus, we expect our production to reach approximately 5,000 BOEPD in March. Our development plan in 2017 focused on proving out the Wolfcamp B in our acreage and accumulating a sizable net contiguous acreage position in the Delaware Basin. Our focus in 2018 will be more on delineation and de-risking of our acreage, both geographically and geologically. We plan to move farther east on our acreage in addition to targeting various geological formations including the Wolfcamp XY, Wolfcamp A and the Bone Springs. Our 2018 plan will include 14 gross / 11 net operated wells drilled, including drilling a minimum of three longer lateral wells with an expected 2018 exit rate of 7,500 BOEPD,” Ormand said.

The company said that it is currently operating a two-rig drilling program in the Delaware Basin and its $100 million D&C CapEx program is fully funded.

Delaware Basin results, 2018 plan

Lilis has drilled and successfully completed eight operated horizontal Wolfcamp B wells. The company is currently in the process of completing and flow testing five wells, including one in the eastern acreage and one in the Wolfcamp XY.

The company is also currently drilling two wells, including one Wolfcamp XY and one in the eastern portion of its acreage. The company’s approved 2018 D&C budget includes plans to drill the following benches:

Zone Est. Gross Well Count

Wolfcamp A 4 – 6 wells

Wolfcamp B 4 wells

Wolfcamp XY 2 – 4 wells

Bone Springs 3 wells

Increasing take-away capacity

On August 10, 2017, the company entered into a long-term gas gathering, processing and purchase agreement to support its active drilling program in the Delaware Basin. During the fourth quarter of 2017 and the first quarter of 2018, Lilis said that production was significantly impacted by natural gas pipeline take-away limitations on production volumes. The new midstream solution should alleviate the production capacity issues.

Reserves

According to Lilis, over the course of 2017, the company increased its proved reserves by over 950%.

The company’s year-end 2017 proved reserves of 11,453 MBOE consisted of 4,275 MBOE proved developed producing reserves and 7,178 MBOE proved undeveloped reserves. For 2017, crude oil reserves increased 6,621 MBbls, while NGL reserves increased 1,601 MBbls from 2016. At December 31, 2017, the company’s proved natural gas reserves increased 12,188 MMcf to 16,060 MMcf, compared to 3,872 MMcf at December 31, 2016.