The 5.2 MMBO crude oil inventory draw is the largest since December 2016

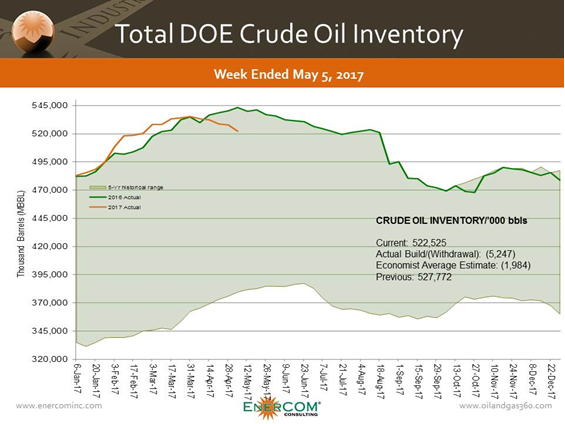

U.S. crude oil inventory levels fell 5.2 MMBO in the week ended May 5, according to the EIA, sending traders into action yesterday. Oil markets have been waiting for signs that a production cut from OPEC would affect swelling inventories.

Draw was almost triple analysts’ predictions

The draw on inventories was the largest so far in 2017 and surprised markets that were expecting a draw of just 1.8 MMBO for the week. U.S. inventories now stand at 522.5 MMBO taking crude inventories to their lowest levels since February.

Stocks at Cushing, Oklahoma, fell by 438 MBO, while crude imports into the country fell 799 MBOPD, the biggest weekly drop since mid-February. The drop in imports brought total crude brought into the country to 6.9 MMBOPD, the first time imports have been below 7.0 MMBOPD since early March.

Oil prices up, but could the rally lose steam?

Crude oil prices rose following the news, with NYMEX crude closing up 3.25% for the day, but some are worried that the most recent draw may not become a reoccurring event. U.S. crude production also rose as refinery run rates declined, according to the EIA. WTI was up over 1% again Thursday.

“The headline crude oil drawdown number is certainly supportive, but it could be something of a shooting star. The refinery utilization rate has come down quite a bit, after topping out a couple of weeks ago,” said John Kilduff, partner with energy hedge fund Again Capital.

Crude production in the U.S. rose to 9.31 MMBOPD from 9.29 MMBOPD a week earlier. Refinery runs fell 4148 MBOPD and utilization rates dropped 1.8% to 91.5% of overall capacity after hitting a record 94.1% three weeks earlier.

“Growing oil output in the U.S., which reached its highest level since August 2015, will remain a thorny issue for price bulls,” said Abhishek Kumar, senior energy analyst at Interfax Energy’s Global Gas Analytics.