Inadequate pipeline capacity to U.S. and no pipelines to move oil to tidewater ports forces Canadian oil to sell at a big discount

Canada’s shortage of pipeline capacity is continuing to drive down the price of Canadian oil and it’s going to cost Canada’s energy sector billions, according to a new study from Canadian think tank Fraser Institute.

“Without adequate pipelines to tidewater ports, Canadian oil producers are forced to sell their product in the U.S. at dramatically discounted prices, which results in substantial losses for the energy sector and the economy more broadly,” said Kenneth Green, senior director of natural resource studies at the Fraser Institute.

Fraser said the lack of adequate pipeline capacity has created an overdependence on the U.S. market and an increased reliance on oil-by-rail—which by nature is more costly and less safe as a mode to transport oil.

Discount for Canada’s heavy oil

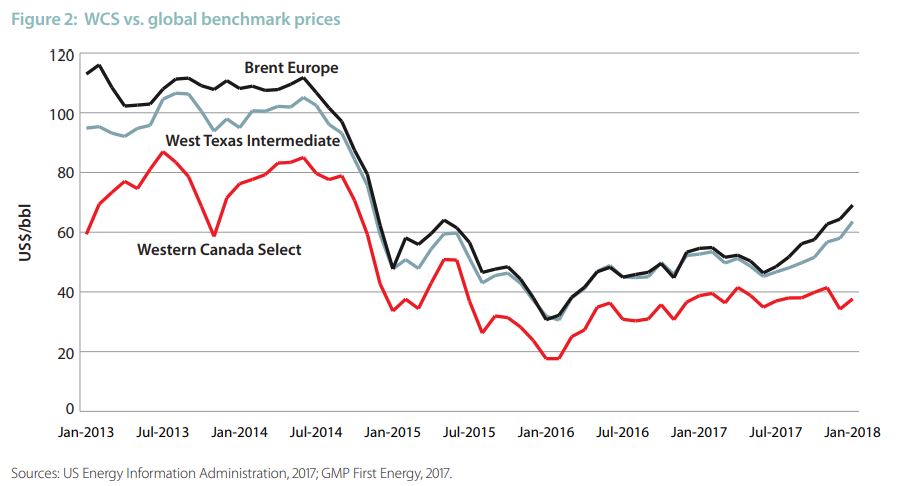

The heavy oil extracted from Canada’s oil sands—Western Canada Select—sells at a large discount to West Texas Intermediate (WTI) crude oil, which is coming out of U.S. shale basins like the Williston Basin in North Dakota, the Permian and Eagle Ford basins in Texas and the Denver-Julesberg Basin in Colorado.

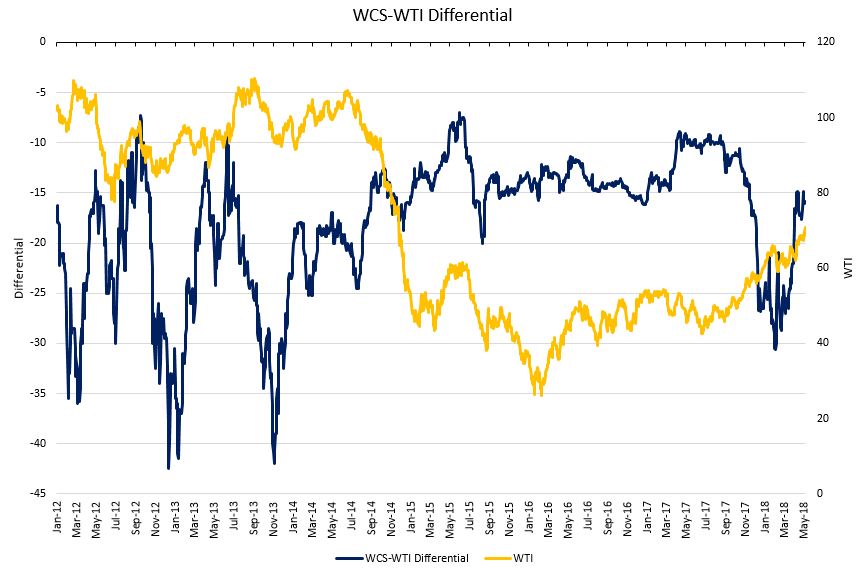

Fraser’s researchers calculate that the WCS/WTI price differential of US$26.30 per a barrel, will result in CAD$15.8 billion in lost revenue for Canada’s energy sector. Between 2012 and 2017, the price difference averaged US$16.54 per barrel, costing Canadian producers an estimated CAD$20.7 billion in foregone revenues.

Pricing difference for Canadian heavy oil includes taking into account its higher sulphur content and higher cost to transport out of Canada

Oil refiners generally expect to pay less for heavy WCS crude oil compared to light, low-sulphur WTI crude oil.

The second component of the natural differential between WCS and WTI is the cost of transportation from Western Canada to U.S. refining hubs. According to the Canadian Association of Petroleum Producers, the 2017 tolls to ship heavy oil from Hardisty to Cushing are between US$5.45 and $6.85 per barrel, depending on which pipeline system is used, Fraser said in its report.

Another side effect: excess oil inventories are filling Alberta’s storage tanks

The inadequate transport capacity dilemma is also reflected in rising crude oil inventories in Alberta in recent years. Many oil producers have been forced to put excess production into storage tanks until sufficient capacity is available. Specifically, based on data provided by the Alberta Energy Regulator, crude oil inventories increased by 47 percent between January 2013 and January 2018. Higher inventory leads to lower price points.

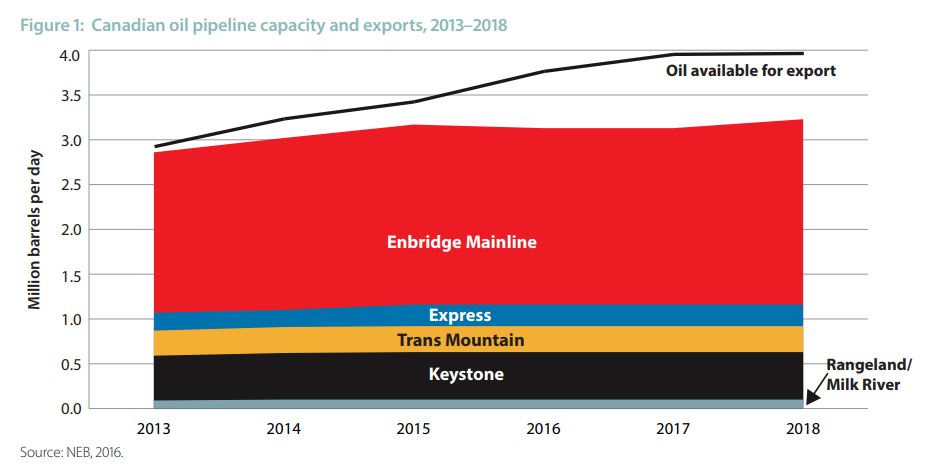

Given the steady growth in oil production and lack of adequate takeaway capacity, Canada requires new pipeline infrastructure to transport heavy crude production from Western Canada to Gulf Coast refining hubs and overseas markets.

B.C. premier says pipeline for Alberta’s oil sands will not be allowed to traverse his province; Alberta premier says we need to get our oil out of Canada, economy is suffering

The leaders of the governments of Alberta and British Columbia have feuded over proposed pipelines that would take Alberta’s oil to the west coast of British Columbia for shipment to Asia, where energy demand is high. In the lead up to this situation, several pipeline projects have been stalled and some were cancelled. Cancelled projects include Enbridge’s Northern Gateway and TransCanada’s Energy East and Eastern Mainline projects.

Others have suffered long delays due to political and environmental actions. The Keystone XL pipeline, which would take Canadian oil from Hardisty, Alberta, to the U.S. Gulf coast refineries is still reeling from almost eight years of delays under the Obama administration, prior to the Trump administration’s 2017 approval.

Canada’s remaining pipeline projects—the Trans Mountain Expansion and the Line 3 Replacement Project—along with Keystone XL—are barely able to inch forward in the development and approval process, compared to the urgent need Canada’s oil industry has for their added capacity. They still face delays related to environmental and regulatory concerns, political opposition, and market uncertainty.

Three remaining projects would add 1.5 MMBOPD in transport capacity if they all receive approvals and are built

Fraser reports that the Trans Mountain Expansion, the Line 3 Replacement Project, and Keystone XL would increase export capacity for Western Canada’s oil producers by 1.5 million barrels per day. But even if these projects overcome regulatory hurdles, no new capacity will come online until the latter half of 2019.