Undoubtedly, the dominant factor in the oil market for the next twelve to twenty-four months will be the progress of the pandemic, which will reduce economic activity and thus oil demand to an uncertain degree and with unpredictable timing. My take is that once inventories are no longer filling, prices will recover somewhat, with Brent reaching $35-40 and WTI $5 below that. Until the inventory overhang is significantly reduced, prices will not reach $50. I will suggest certain indicators that might provide guidance as to the likely path that prices will take.

First, without a doubt there will be continued cases of covid19 and in particular, countries with less developed health systems are likely to be hard hit. Oil demand will be more influenced by the path in the advanced, wealthier nations, some of which are already moving towards reopening. The biggest concern is of a second wave in the near future, before testing has reached levels necessary to control hot spots, and countries like South Korea, China, Italy and Germany will serve as test cases. If breakouts in those countries can be identified and contained quickly without new lockdowns, the implication is that oil demand will be largely recovered by mid- to late-summer. If not, and new restrictions are imposed, demand will remain depressed and inventories will continue filling.

The vital question of storage adequacy (or the end of it) can be addressed by some indirect indicators, including the level of contango on the futures market, which is a less than perfect measure of storage costs. The recent decline in the contango, which was $10/barrel over the coming three months but now is under $5/barrel, implies that some holders of empty capacity released it when prices for storage were very high. It also suggests that the traders’ perception of the likelihood of full storage and large-scale involuntary oil production shut-ins have eased. If the contango begins increasing in June, the implication is that storage is becoming scarce.

Tanker rates also act as an analog for storage costs, especially given the potential for their use as floating storage. Rates have declined since earlier in April, partly reflecting the new OPEC+ production cuts which reduced the oil being exported. The production cuts are scheduled to hold through the end of June and then be decreased slightly, but it seems inevitable that storage will be filling through the month of June. The IEA’s April Oil Market Report the market might return to balance in July, that is, the loss in demand would be more than offset by the OPEC+ production cuts, shown below. (Needless to say, they described that forecast as “fraught with uncertainties”.)

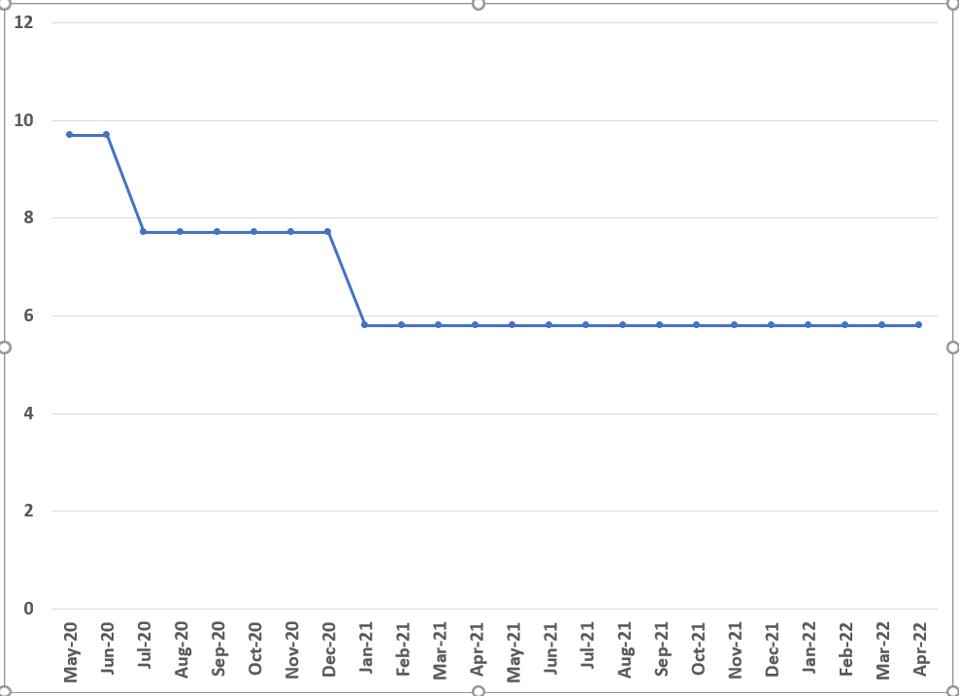

OPEC+ Scheduled Production Cuts (mb/d) THE AUTHOR FROM OPEC INFORMATION

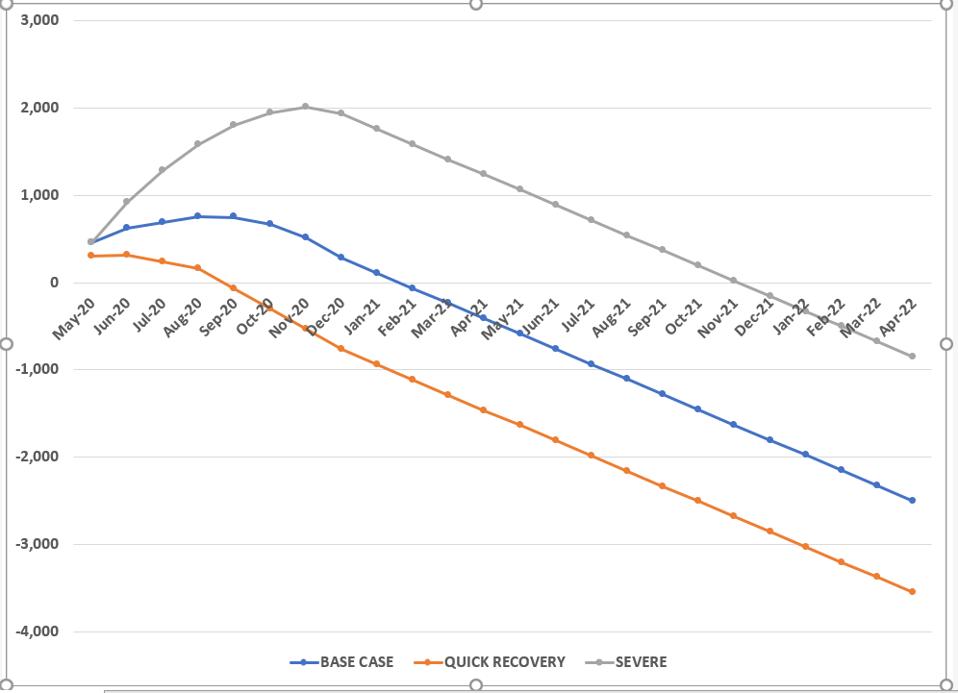

There is every possibility that onshore inventories will not be overwhelmed, and tanker rates should be an indication of that. Should they fail to recover significantly, it would mean that floating storage has not been essential (although no doubt utilized in some areas). The OPEC+ production cuts are officially planned to last so long that tanker rates should not recover for months, unless there is a large increase in floating storage. If tanker rates rise before OPEC+ increase production, that is a signal that onshore storage is filling up. The figure below shows three scenarios of cumulative inventories under different demand scenarios, with the base case being similar to the IEA’s. Inventories will rise sharply, but might not actually become completely full.

Scenarios for Inventory Builds (mln bbls) THE AUTHOR

Some minor indicators should be monitored. For example, data from EZPass showing tolls paid in different states would be very helpful in understanding commuting, since the majority of tolls are paid by commuters, not vacationers. Consumer spending will be difficult to predict but reports from credit card providers like Mastercard MA should provide an early indicator of a return to economic activity and especially whether or not consumers feel confident enough about their own financial situation that they are will to spend at pre-pandemic levels. Of course, there could be an initial burst and then retreat as stores reopen. And if spending is heavier at discount stores then that would indicate consumers remain wary and there might not be an economic boom in the near future.

International air travel is likely to be severely constrained as long as quarantines are imposed on incoming travelers. Most business trips will be untenable if a two-week quarantine is required, and that period would make most vacations would be unattractive.

Rising Chinese imports could indicate economic recovery and rising demand, but could also reflect purchasing cheap oil for later usage. Analyzers of satellite data have recently said that Chinese oil inventories seemed to have peaked, but clearly this could change if Chinese buyers snap up cheap cargoes. Similarly, as I noted previously, an increase in products supplied (which is used as a sign of demand levels) could initially reflect downstream restocking, and if gasoline deliveries drop again, then the initial recovery was exaggerated.

The most important post-pandemic question concerns how well OPEC+ will comply with the projected cuts once inventories begin to decline. Probably the best indicator that cohesion is breaking down will come when the Saudis, as the dominant partner, begin to complain about overproduction, and especially by the Russians. At that point, the price recovery will slow and possibly reverse.

Sadly, as if often said of recessions, we won’t really know what is happening until it has happened. Watching oil prices minute by minute tells us what traders think is occurring with regard to supply and demand, which is based on the news, real or faked, but as days and weeks pass, the price of oil increasingly tracks the fundamentals of supply and demand.

Michael Lynch-Author