Carrizo, Reliance sell their JV

Kalnin Ventures continues to grow in the Marcellus, announcing a pair of deals today for a combined $210 million.

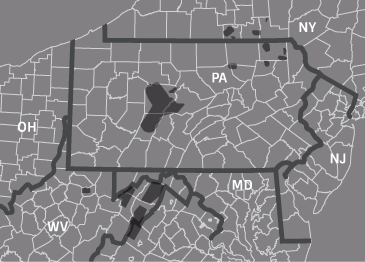

The first deal involves the purchase of much of Carrizo’s (ticker: CRZO) Marcellus Shale assets. According to Carrizo, its Marcellus position amounts to 16,000 net acres with 131 Bcfe of reserves. Net production from these assets averaged 40 MMcf/d through 2017 so far. Kalnin Ventures will pay $84 million in cash for Carrizo’s northeast and central Pennsylvania assets, with price-based contingent payments that could total up to $7.5 million. Carrizo had no planned drilling or completion activity on the properties in 2017.

The second deal is with India’s Reliance Industries (ticker: RIL). Reliance will receive $126 million for its interest in Pennsylvania Marcellus properties. These properties are all operated by Carrizo in a JV formed in 2010. Reliance owned 60% of the properties, while Carrizo owned 40%. Reliance holds two other non-op positions in the U.S., one with Chevron (ticker: CVX) in the Marcellus and one with Pioneer (ticker: PXD) in the Eagle Ford.

Kalnin becomes an operator for first time

This set of deals is the fifth completed by Kalnin, which now has interests in 355 active wells. Kalnin first bought a 29.4% stake in some Range Resources (ticker: RRC) properties in 2016, then bought a set of non-op properties for a total of $63 million. Further deals involved purchasing additional non-op interest in the Marcellus. In just over one year the company has invested $417 million to grow from no production to a net 160 MMcf/d. The company is now one of the top 20 natural gas producers in Pennsylvania and continues to seek growth.

This most recent transaction is unique, however, in that it is the first time Kalnin has purchased an operated position.

Christopher Kalnin commented on the purchase, telling Oil & Gas 360® today, “This deal is unique from our previous four in that it provides us the opportunity to naturally expand into an operator position while also acquiring additional midstream assets.

“However, it is similar to prior deals in that we are acquiring profitable assets and enhancing them with technology and big data. Our experience as a non-operator, and now operator, coupled with our high-quality asset base and proprietary technology, has put us in a compelling position to expand further in the ‘super core’ of the Marcellus.”

Oil & Gas 360® interviewed Kalnin at the 2017 EnerCom conference in Denver in August. “There’s a niche in the market for partners who want to come in and bring capital, bring some technical and data analytics expertise and work with operators to help them turbocharge their growth and their cash flows. We see that in the Bakken, the Marcellus, the Permian the Eagle Ford and the Montney,” Kalnin told Oil & Gas 360®’s Angie Austin in an exclusive video interview.

Kalnin’s presentation webcast at the EnerCom conference is available to view here.