Shell is projecting estimated peak production of 40 MBOEPD from Kaikias

Shell Offshore, Inc. (ticker: RDS.A) started production early at the first phase of the Kaikias project, a subsea development in the U.S. Gulf of Mexico with estimated peak production of 40,000 BOEPD.

Shell has reduced costs by around 30% at this deep-water project since taking the investment decision in early 2017, lowering the forward-looking, break-even price to less than $30 per barrel of oil.

Upstream Director Andy Brown said costs were reduced with a simplified well design and by incorporating existing subsea and processing equipment.

Kaikias is located in the Mars-Ursa basin around 130 miles (210 kilometers) from the Louisiana coast and is owned by Shell (80% working interest), as operator, and MOEX North America LLC (20% working interest), a wholly owned subsidiary of Mitsui Oil Exploration Co., Ltd.

In the first quarter of 2018, Shell’s deep-water projects have produced around 731,000 BOEPD, globally. According to the company, over the past four years, Shell’s focus on competitive growth has led to planned cuts of around 45% on average for both global deep-water unit development and operating costs.

Notes from Shell

- Cycle time from discovery to production for Kaikias phase one is less than four-years

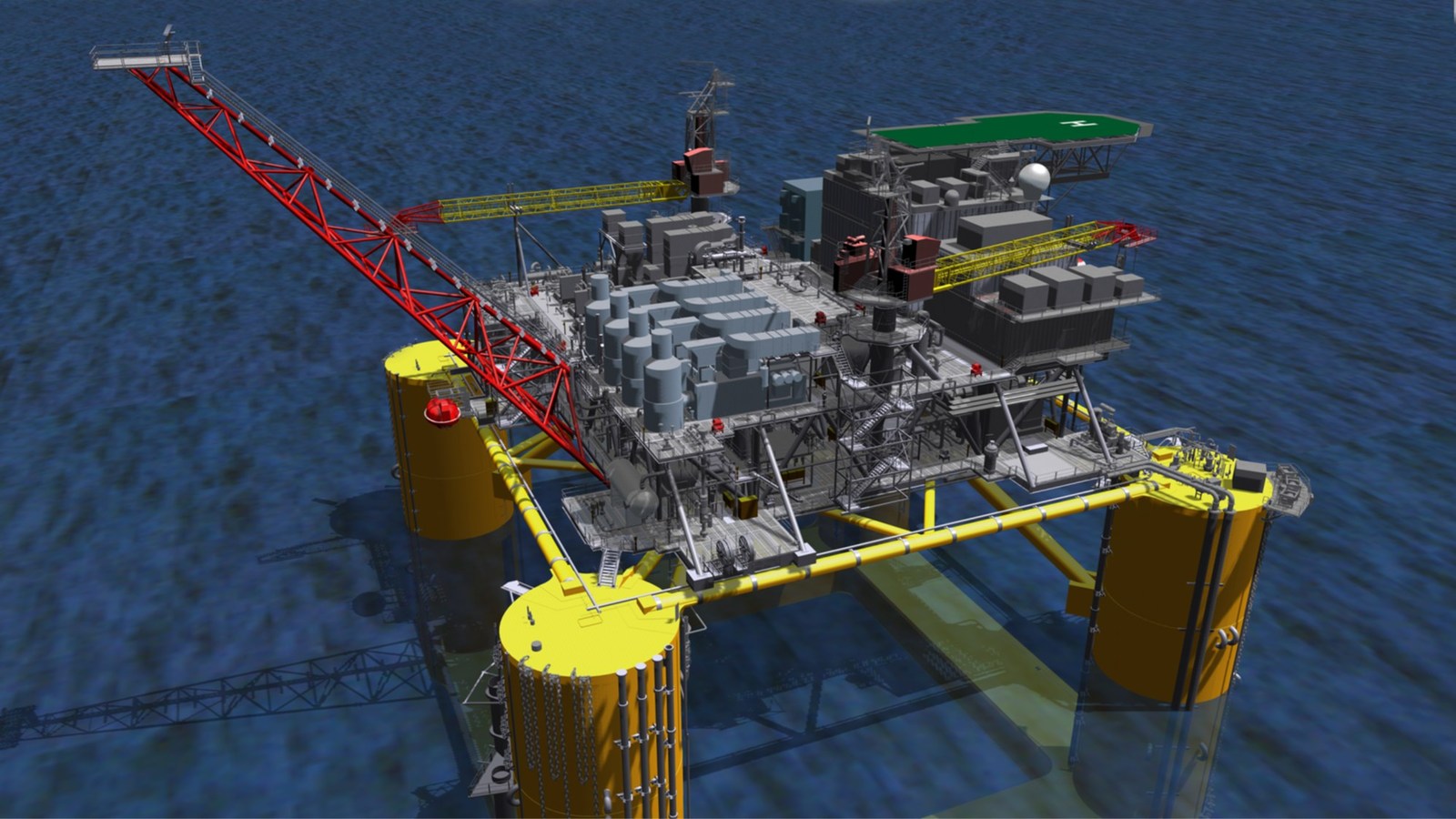

- The Kaikias development, located in around 4,500 feet (1,372 meters) of water, sends production from its four wells to the Shell-operated (45%) Ursa hub, which is co-owned by BP (23%), Exxon Mobil (16%) and ConocoPhillips (16%). From the Ursa hub, volumes ultimately flow into the Mars oil pipeline

- The forward-looking, break-even price presented above is calculated based on all forward-looking costs associated from final investment decision. This typically excludes exploration and appraisal costs, lease bonuses, exploration seismic and exploration team overhead costs. The forward-looking, break-even price is calculated based on estimates of resources volumes that are currently classified as 2p and 2c under the Society of Petroleum Engineers’ Resource Classification System. As this project is expected to produce over multiple decades, the less than $30 per barrel projection will not be reflected either in earnings or cash flow in the next five years

- The direct unit operating costs exclude feasibility, research and development, decommissioning and restoration and idle rig expense

- The estimated peak production presented above are 100% total gross figures

Project Vito

Earlier this year in April, Shell finalized its investment decision for the deep-water development, Vito, which is also located in the U.S. Gulf of Mexico.

The company said it estimates a forward-looking, breakeven price to be less than $35 per barrel.

Vito will be Shell’s 11th deep-water host in the Gulf of Mexico and it is currently scheduled to begin producing oil in 2021.

According to Shell, Vito is expected to reach peak production of approximately 100,000 BOEPD. The development currently has an estimated recoverable resource of 300 MMBOE.