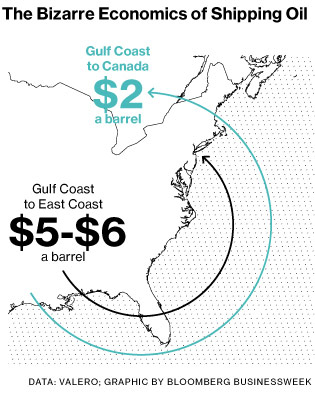

The Jones Act is the nickname for a 94-year-old law entitled the Merchant Marine Act of 1920 that allows only U.S.-made, U.S.-manned, and U.S.-flagged ships to transfer goods or passengers between U.S. ports. Although it was meant to protect domestic U.S. seaborne commerce from foreign competition, in today’s global economy, it has the effect of making shipping oil between U.S. ports, for example, surprisingly expensive.

The Jones Act also imposes strict safety regulations which apply to all U.S.-made ships, even those not intended to sail between U.S. ports. The design requirements increase the cost of all ships built in the U.S. According to the Heritage Foundation, “In 1955, there were 1,072 U.S.-built commercial ships. By 2000, the U.S. Jones Act–eligible fleet consisted of just 193 ships, and by 2014 that number had fallen to just 90.”

Thanks to the growth of U.S. shale gas production, exporting Liquefied Natural Gas (LNG) is becoming a more realistic prospect. Two U.S. LNG plants are approved to export gas, one is under construction and several others are in the approval stage. However, most U.S. shipyards aren’t ready to build LNG carriers.

According to Bloomberg, U.S. LNG transport ships are about five times as expensive to build as their Asian-built counterparts. Higher labor costs and additional safety requirements drive U.S. shipbuilding prices up, making it more difficult for some shipbuilders to win LNG carrier contracts. Foreign companies are already equipped to build LNG carriers, making them a faster and cheaper alternative to U.S. ship builders. To keep from violating the Jones Act’s “U.S.-made to U.S.-ports only” law, LNG export companies who buy foreign vessels will refrain from trading within the U.S.

However, some people see this as foreign shipyards stealing away U.S. projects and jobs, while others argue that the U.S. should keep all of its natural gas for its own use. As it stands now, the Jones Act does not affect how U.S. exporting industries trade with foreign countries. However, that nearly changed earlier this year.

LNG exporters almost lost their right to use foreign-made ships for foreign exports. California Representative John Garamendi (D) proposed an amendment to HR 4005, also known as the Coast Guard and Maritime Transportation Act of 2013. His amendment would only allow U.S. made LNG carriers to export LNG from the U.S.

“If you’re going to export it, let’s do that in a way that further strengthens the American economy by exporting that gas on American-made ships with American crews,” Garamendi said in a phone interview with Bloomberg. “I’m not here to make the gas industry happy — I’m interested in building the American economy and the manufacturing sector, of which the shipbuilding industry, for strategic defense purposes, has to remain strong.”

Garamendi’s amendment included a 10-year grace period for foreign-built LNG carriers, but its restriction to only using U.S. built ships is a rule that no other U.S. industry would be subject to. Given how far behind U.S. shipyards are in LNG carrier technology, the restriction for LNG exports to be limited to U.S.-made ships could slow growth of the U.S. LNG export industry. LNG exporters need assurance that their LNG can be economically transported to customers.

The amendment was not accepted, but Garamendi has said he will continue to fight for this amendment as the bill goes forward, and a Trade Winds article said, “U.S. industry sources are hopeful that… [the] US-built proposal could remain a possibility in an alternative form in future legislation.”

The biggest concern about the Garamendi amendment moving forward is that the amendment does not include a grandfather clause. Thus, if the Garamendi amendment is passed in a similar form the future, no foreign-made LNG ships will be able to export LNG from the U.S., even if they were purchased, used, and manned by U.S. citizens before the amendment’s existence. The 10 year grace period may sound sufficient for transitions, but the effective grace period would be much shorter. The 10 years begins once the amendment is passed, but LNG exporting facilities will not be operational for another two to three years, due to time needed for regulatory approvals and construction.

Rob Bryngelson, Chief Executive at Houston’s Excelerate Energy LP, a developer and builder of floating LNG processing facilities, said: “The US does not have any yards currently capable of building LNG carriers, and the time and cost it would take to be in a position to do so would make the final product uncompetitive by world standards.”

The U.S. shipyard currently closest to having LNG tanker building capacity is the General Dynamics NASSCO shipyard in San Diego, California – Garamendi’s home state. American Petroleum Tankers is paying an undisclosed amount of money to NASSCO to build four Jones Act approved, LNG conversion-ready product tankers.

Fred Harris, President of General Dynamics NASSCO, said in a news release, “By continuing to bring the most economical and environmentally sound technology to Jones Act operators, these ECO tankers show our continued commitment to be one of the most innovative shipyards in America.”

Rob Kurz, CEO of APT, said, “This investment demonstrates our continued commitment to building and operating ships for the U.S. Jones Act trade. We are proud to bring new U.S.-built tonnage into the market at this exciting time, helping our country achieve its long-standing strategic objective of energy independence.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.