Heavy hitting U.S. shale producers lower production guidance 10% or more for ‘16

U.S. shale producers are beginning to announce production cuts as the global glut is keeping prices lower for longer. There is a marked difference as companies begin to report their 2016 guidance from this time last year when prices were still in the $40-$50 range. Many U.S. shale producers last year stressed that they could continue pumping, and indeed shale production proved much more resilient than many expected.

A year later, however, with oil prices thus far fighting to stay in the $30s, many of the preeminent shale producers are beginning to lower production guidance. Already Continental Resources (ticker: CLR, ContRes.com), Devon Energy (ticker: DVN, DevonEnergy.com), EOG Resources (ticker: EOG, EOGResources.com), Marathon Oil (ticker: MRO, MarathonOil.com) and Whiting Petroleum (ticker: WLL, Whiting.com) have announced lower expected levels of production this year compared to 2015.

Continental, Devon and Marathon all plan to produce roughly 10% less than last year, according to company statements, while EOG looks at cuts of about 5% from 2015. Whiting’s 2016 production guidance has a midpoint of 48.7 MMBOE, down about 18% from the company’s 2015 production of 59.6 MMBOE.

Many producers are targeting their highest return assets while they wait for prices to stage a recovery. EOG CEO Bill Thomas said the company would only pump wells with rates of return at 30% or higher, assuming $40 per barrel oil prices. CRL and WLL both have said they plan to add to their backlog of drilled uncompleted wells in North Dakota, leaving more resources ready for production should prices make it commercially viable.

“We just don’t want to bring anything else on in this environment until we see a recovery happen,” Continental Chief Executive Harold Hamm told analysts and investors on a call last week.

CRL Vice President of Crude Logistics and Hedging Kirk Kinnear told Oil & Gas 360® earlier this month that the company believes a full recovery will take as long as the downcycle, meaning every added month of depressed prices will add an additional month to the tail end of the recovery as well.

Mixed market reaction to lower production guidance

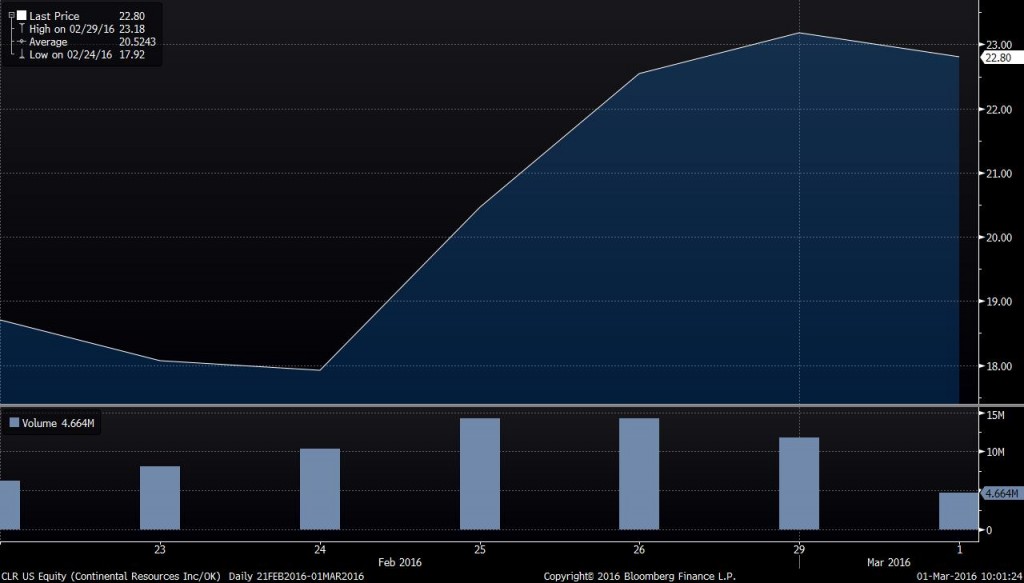

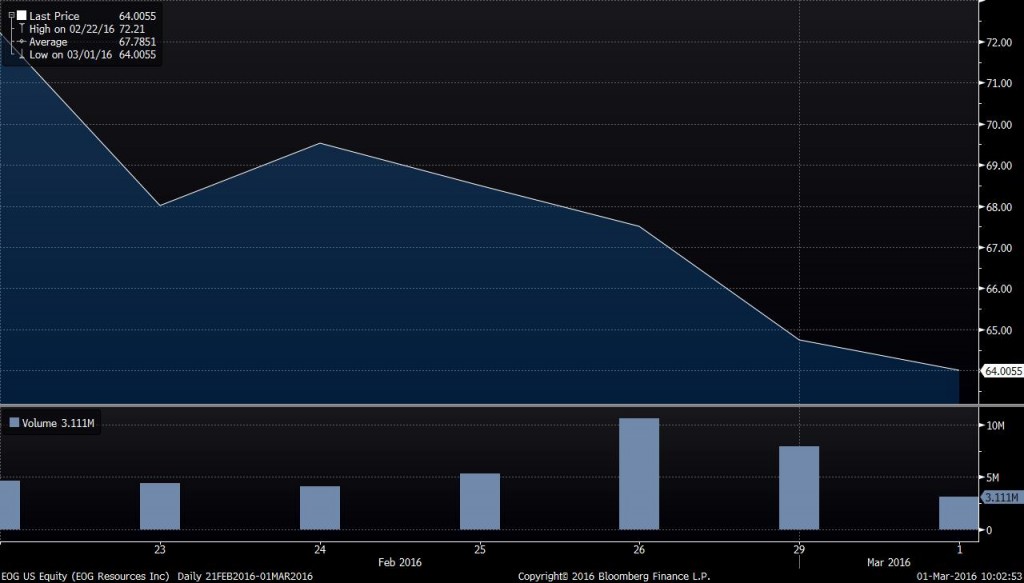

The markets treated each of the companies that announced 2016 production cuts differently, with some posting gains, and other losses, in the last week. Continental Resources’ stock rose following its press release on February 24, while EOG Resources’ stock has been down in the days following its press release on February 25.

Continental’s performance seems to reflect its strong metrics relative to other E&P companies in EnerCom’s E&P Weekly. CRL boosts an asset intensity of just 41%, capital efficiency of 260%, a debt-to-market cap of 85%, and an EBITDA margin of 76%, compared to medians for the E&P companies tracked by EnerCom of 106% asset intensity, 107% capital efficiency, 184% debt-to-market cap, and a 51% EBITDA margin for the group.

While EOG’s asset intensity is higher, and its capital efficiency lower, the company’s debt-to-market cap of just 18% leaves it in a strong position to weather the price downturn.

A breath of hot air: OPEC hints of halting production growth

Nigerian Oil Minister Emmanuel Ibe Kachikwu said Monday that he believes a wider production freeze among OPEC is likely, which could slow the growth of global oil production further. The minister believes that a deal among OPEC countries could help to push prices back into the $45-$50 range.

Iran and Iraq have both publically supported the freeze, though neither one plans to join, meaning their production could continue growing, despite Ibe Kachikwu’s optimism. It is difficult to predict how much of an effect the two may have, however.

Iraq had the second largest growth in production last year after the U.S., but it seems continued growth may be unsustainable. International oil companies were asked to submit “conservative” spending plans to Iraq, with the central government unsure it would be able to pay the IOCs enough to continue expanding.

“Because of the drop in our oil-sales revenues, the Iraq government has sharply reduced the funds available to the Ministry of Oil,” Iraqi official Abdul Mahdy al-Ameedi worte. “This will…reduce the funds available for the reimbursement of petroleum costs to our contractors.” Ameedi added that the oil ministry did not expect lower funding to “reduce production from the levels that were [already] stipulated.”

How much growth Iran may be capable of is also hard to tell, with the country’s oil ministry hoping to add 1 MMBOPD of production to the markets with the end of international sanctions. Many remain skeptical of whether or not this is a realistic goal, though.

“It’s very difficult to believe Iranian propaganda. We believe 300-400 MBOPD of production is possible by the end of the year,” Kinnear said.

Turning the spigots back on – shale boom comes off “hold”

If prices do begin to respond to lower production, operators are likely to look at bringing more production back on line, which could collapse prices further, Jamie Webster, senior director of oil markets for IHS told The Wall Street Journal.

“It wouldn’t surprise me if it were single digits,” Mr. Webster said of the potential for oil prices to fall below $10 a barrel if U.S. producers decide to accelerate drilling.

Concern over mass amounts of oil production coming back to market immediately may be overstated though, Kinnear told Oil & Gas 360®.

“Each completion is going to be a decision by the operator, made on the economics of that particular well. Even in areas that don’t have pad drilling, you’ll see that these [drilled uncompleted wells] will just be part of regular operating procedures,” said Kinnear. “It’s not going to be as big a factor as one might think.”

“It takes a lot of time and a lot of completion crews to [get that production back online]. It’s not like a light switch.”