CNG fueling stations are sprouting up at transit facilities and truck stops, but over-the-road electric trucks loaded with technology, creative leases, battery swapping and free fuel are coming to U.S. on-ramps

Last week, Pennsylvania’s Governor Tom Wolf celebrated the opening of the first of 29 compressed natural gas (CNG) fueling stations planned as part of a Public Private Partnership in his state.

PennDOT Deputy Secretary for Multimodal Toby Fauver and P-3 Office Director Mike Bonini joined officials from Trillium CNG, Cam Tran, and state and local to mark opening of the facility.

“This innovative P3 is allowing us to help transit agencies save money and take advantage of plentiful supplies of natural gas produced right here in Pennsylvania,” Governor Wolf said. “We applaud Trillium for reaching this first milestone and look forward to continued progress on this initiative.”

The $84.5 million statewide project calls for Trillium to design, build, finance, operate and maintain CNG fueling stations at 29 public transit agency sites through a 20-year P3 agreement.

Transit agencies aren’t the only users. The public gets to fill up with CNG at six transit agency sites, and the PPP has the option to add to additional sites in the future. The CNG station in Johnstown is available to the public, including for trucks, the governor’s office said in a press release.

Financing the venture and access to a speedy build via public-private partnership (P3)

PennDOT will receive a 15 percent royalty, excluding taxes, for each gallon of fuel sold to the public, which will be used to support the cost of the project. The team has guaranteed at least $2.1 million in royalties over the term of the agreement.

Using the P3 procurement mechanism allows PennDOT to install the fueling stations faster than if a traditional procurement mechanism was used for each site, resulting in significant estimated capital cost savings of more than $46 million, according to the governor’s press release.

When the project is completed, the fueling stations will supply gas to more than 1,600 CNG buses at transit agencies across the state.

A list of the transit agencies participating in the Pennsylvania P3 project, in order of construction-start timeline, follows:

- Cambria County Transportation Authority, Johnstown Facility (2017), includes public fueling.

- Central Pennsylvania Transportation Authority, York Facility (2017), includes public fueling.

- Mid Mon Valley Transportation Authority (2017)

- Cambria County Transportation Authority, Ebensburg Facility (2017)

- Westmoreland County Transportation Authority (2017)

- Centre Area Transportation Authority (2017)

- Beaver County Transportation Authority (2017)

- Crawford Area Transportation Authority (2017)

- New Castle Area Transportation Authority (2017), includes public fueling.

- Lehigh and Northampton Transportation Authority, Allentown Facility (2017)

- County of Lebanon Transportation Authority (2017)

- Altoona Metro Transit (2017)

- Central Pennsylvania Transportation Authority, Gettysburg Facility (2017)

- Butler Transportation Authority (2018)

- Indiana County Transportation Authority (2018), includes public fueling.

- County of Lackawanna Transportation System (2018), includes public fueling.

- Erie Metropolitan Transportation Authority (2018), includes public fueling.

- Mercer County Regional Council of Governments (2019)

- Fayette Area Coordinated Transportation System (2019)

- Monroe County Transportation Authority (2019)

- Area Transportation Authority of North Central PA, Bradford Facility (2019)

- Area Transportation Authority of North Central PA, Johnsonburg Facility (2019)

- DuBois, Falls Creek, Sandy Township Joint Transportation Authority (2020)

- Lehigh and Northampton Transportation Authority, Easton Facility (2021)

- Luzerne County Transportation Authority (2021)

- Schuylkill Transportation System (2021)

- Transit Authority of Warren County (2021)

- Capital Area Transit (2021)

- Port Authority of Allegheny County (2021)

Trillium CNG acquired by Love’s Travel Stops

Trillium CNG provides ground-up CNG fueling station solutions—from design/build to equipment installation, maintenance and financing the operation for site owners. Trillium was acquired by Love’s Travel Stops in 2016. Love’s is a privately held national travel stop business with more than 15,000 employees that caters to the long haul trucking industry.

Combined, Love’s and Trillium operate 65 public-access CNG facilities. Trillium CNG reported that it delivers more than 55 million gallons of CNG per year. Frank Love, co-CEO of Love’s said, “This acquisition shows Love’s has a long-term commitment to CNG,” said Love. “Together with Trillium, we can help new and existing customers extend their commitment to CNG. We will continue to make investments in the alternative fuel industry to give customers more access to a cleaner-burning fueling solution with a stable cost.”

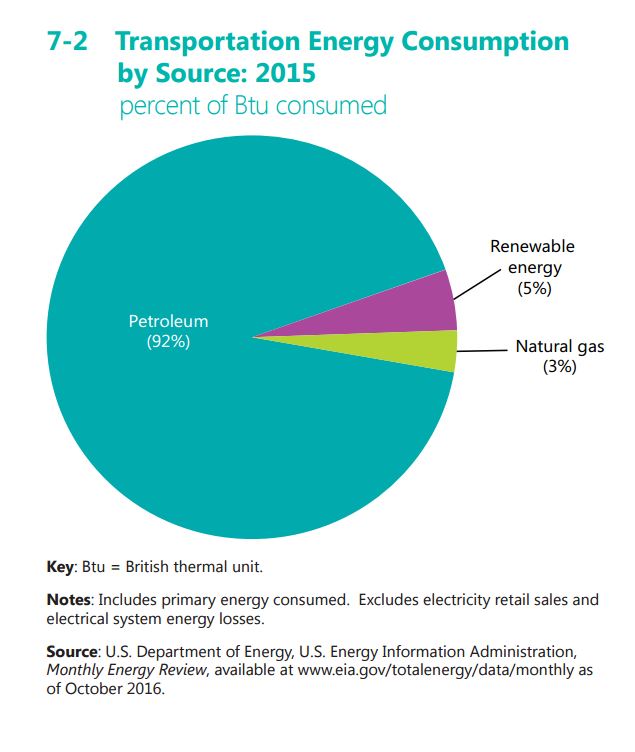

The idea of fuel cost stability as a chief concern for the trucking industry is key, as transportation cost swings can quickly affect the entire economy up and down the supply chain.

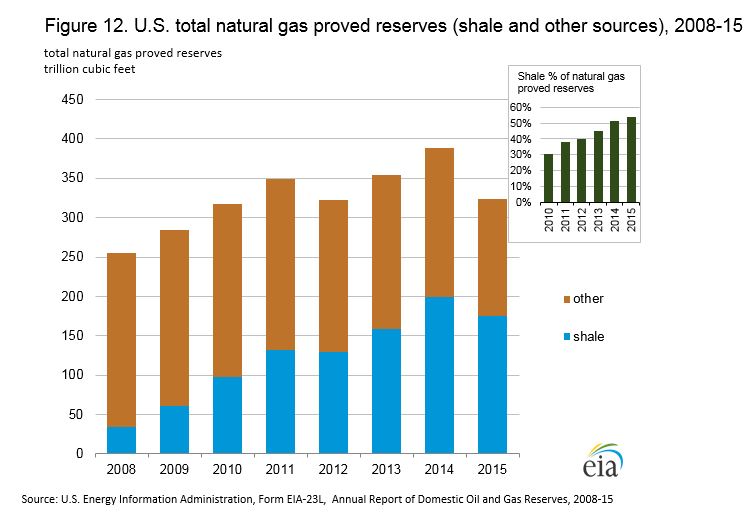

Up to 300 Tcf of natural gas to refuel vehicles

The U.S.’s gas basins have made headlines since the start of the shale boom for their tremendous potential resource and growth of production. The Utica and Marcellus shale basins of Ohio and Pennsylvania have provided 85-90% of U.S. shale gas production growth since start of 2012, Forbes reports. The Marcellus’ home turf is Pennsylvania and West Virginia. Recently, the USGS quadrupled its resource estimate for the Bossier and Haynesville gas plays in the Southern U.S./Gulf of Mexico region from 70 Tcf to 304 Tcf. By comparison, last December the EIA put total U.S. natural gas proved reserves at about 325 Tcf as of the end of 2015. Large supplies that outweigh demand would point to lower prices hanging around.

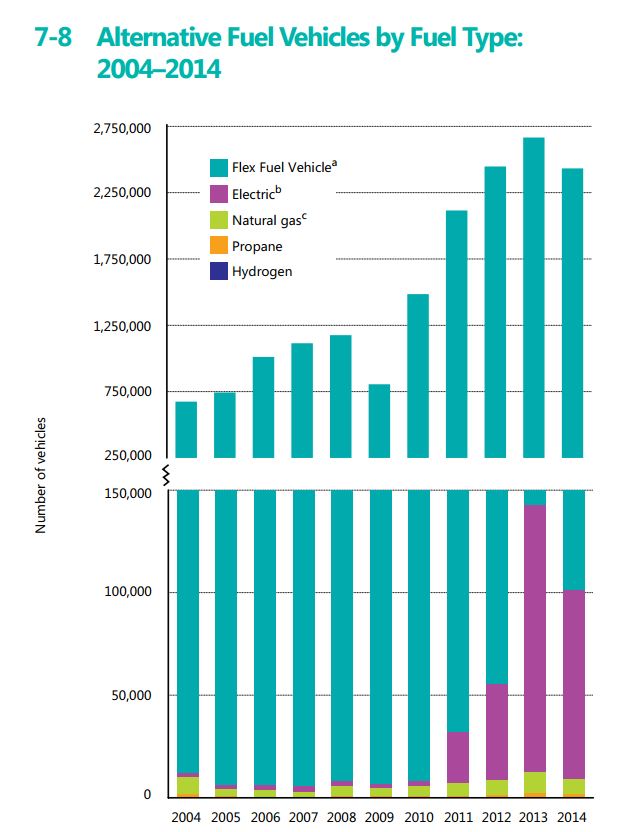

Consumer and over-the-road fleet looking toward CNG—slowly

According to the website CNGnow.com, the U.S. has about 250,000 natural gas vehicles (NGVs) on the road, less than 0.1% of total U.S. vehicles – mostly owned by fleets. The heavy- and medium-duty market segments—city transit buses, refuse trucks and similar sized trucks—being the biggest users of CNG.

The report says Brazil, Argentina, and Iran already have more than 1 million NGVs each, but in the U.S. one factor that has slowed the adoption of CNG vehicles within the light-duty market is the limited number of vehicles that can be purchased directly from the manufacturer with a CNG-ready engine. However, that is starting to change, largely associated with transit agencies sharing their fueling facilities and other additions. Announcements of CNG fueling station grand openings have been in the news in Washington, Ohio, Pennsylvania, California, Oklahoma and other states in the past year.

Diesel’s price advantage only one barrier to faster natural gas adoption

The biggest issues with wide adoption of natural gas equipment, diesel prices aside, are the upfront cost of the equipment and range limitation, reports CCJ News.

“You’re looking at an upcharge these days of a minimum of $40,000 to $50,000 between a natural gas powered truck and a comparably spec’d diesel powered truck,” says ACT Research Vice President Steve Tam.

For natural gas to really take off in the market, Ryder’s Vice-President of Supply Management Scott Perry says the financial investment required for the technology has to be more in line with more traditional platforms, or the price of the fuel would have to be dramatically different, CCJ reported.

More adoptions of natural gas for commercial trucking fuel came with the introduction of several Cummins Westport CNG engines for medium duty trucks and over the road tractors in the past several years. Also, last year Ford began offering its popular F-150 consumer pickup in a CNG-powered version and Freightliner has taken up the CNG mantle on the heavy side, but it’s slow going to move a whole industry from diesel to CNG, particularly in an environment of lower diesel prices.

But an EV innovator and a former natural gas executive are making news with their efforts to introduce electric over-the-road trucks. But how real is electric over-the-road trucking?

Pull over: here come the electric trucks

Tesla says it’s going to create an electric-powered 18-wheeler fleet that will capture 10% of the U.S. market

Last week Morgan Stanley released a report about Tesla’s dive into the electric trucking business that got the industry talking. Tesla said it would target 10% of the annual “big rig” truck sales.

Trucks.com looked at the idea of Tesla taking a significant chunk of the new long haul truck market. “A production rate of just 25,000 trucks annually would give Tesla 10 percent of new big rig sales, but would fit into its existing vehicle and battery factory without too much incremental investment.

“One cost would be the build out of a network of 1,500 battery swapping stations along U.S. highways. It would be separate from the passenger car charging network Tesla already has. The analysts estimate that Tesla would spend $1.7 billion to enter the heavy-duty truck segment, including the swapping stations.

“Such a business might add about $5 billion to Tesla’s $50 billion stock market valuation, according to the Morgan Stanly analysts.

“We believe an autonomous, electric truck can be a game changer for trucking carriers and by significantly lowering operating costs, improving productivity and even driving industry consolidation,” the analyst wrote.

“They estimated that an autonomous, electric truck could be 60 to 70 percent less expensive to operate compared with a human-driven diesel big rig. The cost savings come from drivers, fuel, maintenance and insurance,” the website reported.

Tesla not the only U.S. company looking to disrupt diesel trucking: Nikola Motors raised $2.3 billion in its first month taking deposits for its hydrogen electric tractor

Elon Musk’s Tesla Model 3 is not the only drawing board electric vehicle collecting deposit money. One designer of futuristic hydrogen electric trucks started taking $1,500 deposits for pre-orders last year. Nikola One is a hydrogen electric long-haul sleeper created by Salt Lake City-based Nikola Motor Company.

According to a company press release last summer, Nikola raised $2.3 billion in reservations in the first month, totaling more than 7,000 truck reservations with deposits. “Our technology is 10-15 years ahead of any other OEM in fuel efficiencies, MPG and emissions. We are the only OEM to have a near zero emission truck and still outperform diesel trucks running at 80,000 pounds,” Nikola founder and CEO Trevor Milton said in a press release.

Free fuel comes with this truck: 1st million miles of fuel included in the lease

The first million miles of fuel is included with every truck sale, offsetting 100% of the monthly lease for every owner, the company said.

“An average diesel burns over $400,000 in fuel and racks up over $100,000 in maintenance costs over 1,000,000 miles. These costs are eliminated with the Nikola One lease,” the company said.

The Nikola One over-the-road tractor utilizes a fully electric drivetrain powered by high-density lithium batteries according to the company. The 320-kilowatt-hour battery array is charged by a proprietary onboard hydrogen fuel cell affording single-fill range of 800 to 1,200 miles. The driveline delivers more than 1,000 horsepower and 2,000 foot-pounds of torque which is “nearly double that of any semi-truck on the road,” the company said.

Reporting from Nikola’s unveiling event last December, Fleets and Fuels said, “A Nikola One truck in U.S. Xpress livery was the centerpiece of the Nikola launch event. It’s the working vehicle that’s achieved the equivalent of 15 miles per diesel gallon with no emissions, Milton says. ‘This could be the game-changer we’re all looking for’, U.S. Xpress chairman and CEO Max Fuller said at the event.”

Nikola changed fuel concept from CNG to Hydrogen

According to Fleets and Fuels, the concept was initiated as a compressed natural gas-fueled vehicle with a vertically integrated network of CNG fueling stations this past spring (F&F, May 15). Late in the summer, Nikola said it would go with hydrogen instead (F&F, August 30).

The firm said it plans to establish a network of 364 hydrogen fueling stations. Construction is to commence in 2018 and the first will open in late 2019, the magazine reported.

Prior to establishing Nikola, Milton was CEO of dHybrid Systems, a natural gas storage technology company that was acquired in October 2014 by Worthington Industries (ticker: WOR). Nikola Motors is privately held.

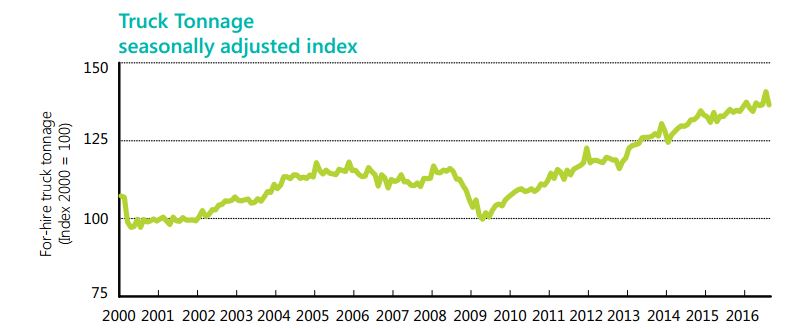

Growth industry: tonnage of freight hauled by U.S. trucks is on a steadily increasing 7-year trend

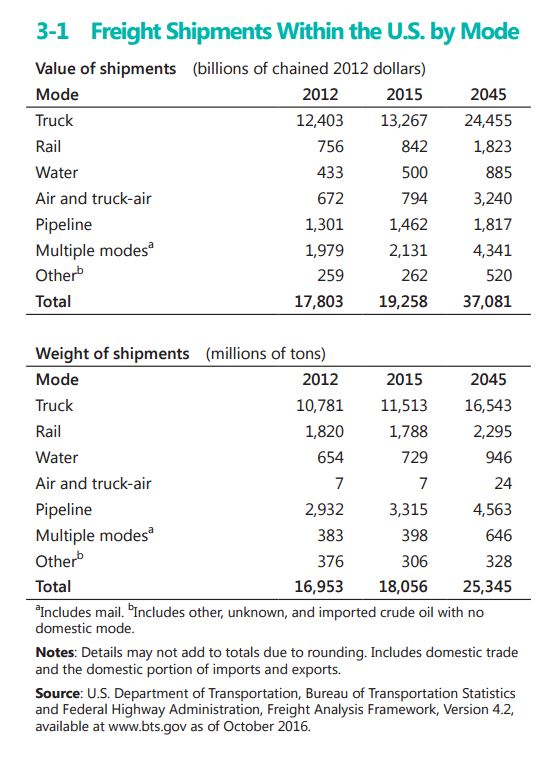

The U.S. DOT projects $24 trillion in value of shipments will be handled by the U.S. trucking industry in 2045. According to the agency that represents 16.5 billion tons of goods by truck. The amount of shipments by truck in the U.S. dwarfs all other modes of transport.