The Iraqi government agreed on December 2 to an oil export deal with the northern region of Kurdistan, ending a dispute over oil exports with Iraq’s northern region. Earlier this year, the Iraqi government cut off funding to the Kurdish autonomous region in retaliation for the Kurds trying to sell oil produced in the north independently. The Iraqi government claims to have exclusive rights to market Kurdish oil.

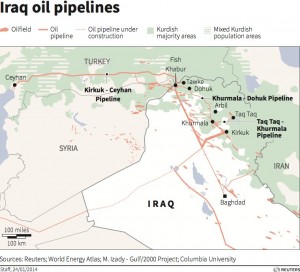

Three weeks ago the two governments began the process of coming to an agreement over oil exports, which cumulated in the December 2 deal. Under the terms of the agreement, Kurdistan is committed to provide 250 MBOPD to the Iraqi state run State Oil Marketing Organization (SOMO), whereupon SOMO will sell the oil, reports Business Insider. Kurdistan also agreed to facilitate SOMO’s export of 300 MBOPD of oil from fields in Kirkuk, which cannot reach export terminals via federal territory due to security risks.

In exchange, the government in Baghdad will grant the Kurdish government a new $500 million payment in December 2014 to ease near-term budget pressure. Throughout 2015, the Kurds will see their monthly budget transfers from Baghdad restored, including a $100 million a month to pay the salaries of Kurdish Peshmerga fighters that have been fighting ISIS and ISIL forces in the region.

In addition to the agreed upon items, there is a high probability that the Kurdish region will maintain control of all oil production in excess of the 250 MBOPD transferred to SOMO. This excess is currently 150 MBOPD, but could be as high as 250 MBOPD by the second half of 2015. The Kurds will be able to independently export the remainder of the region’s production.

Kurdish region only a part of higher production in Iraq’s future

Regions in Iraq outside of Kurdistan are also expecting increases in production in the near future. The Badra field, operated by Gazprom Neft (ticker: GZPFY) and located in central-eastern Iraq near the Iranian border, expects to double production capacity by the end of the year, according to Eurasia Press Inc.

In the 90 days up to late November 2014 around 15 MBOPD were released from the Badra oilfield into Iraq’s main pipeline system. Once the field has been achieving this level of production over a 90 day period, the consortium of investor companies will be reimbursed for costs incurred and paid a fee of $5.50 per BOE produced.

Commercial shipments of crude oil from Badra began three months ago. Two wells are currently in production at the field; a third well has been drilled and tested and is soon to be commissioned and a further six exploration wells are currently being drilled. The second phase of the central gathering point (DSP) is expected to be developed by the end of the year, and will increase the DSP’s capacity to 120 MBOPD from 60 MBOPD.

Oryx Petroleum Corp. (ticker: OXC) has also reported that its Demir Dagh-7 well in Kurdistan will be tied into the Demir Dagh production facilities in the coming weeks, taking total Demir Dagh gross productive capacity to more than 15 MBOPD by the end of 2014. The company also plans to tie in the Demir Dagh-3 well in early 2015 with the Demir Dagh-8 through 11 wells slated for potential tie-ins, subject to successful drilling and testing.

Oryx’s gross oil production averaged 4,400 BOPD for the month of October 2014 with the highest single daily production rate reaching under 7,000 BOPD.

Is more better?

While the deal was certainly welcome news to the Iraqi and Kurdish governments who had been at odds, the increased production will only add to expanding over-production being seen in global markets.

Oil prices have fallen more than 40% since June as global demand slows and North American production booms, all while OPEC continues producing at the same levels, despite calls from member countries to cut back. Even more production from countries like Iraq might contribute further to the increasing supply glut.

Iraq’s oil minister Adel Abdul-Mehdi told reporters in Vienna during OPEC’s Thanksgiving meeting that his country is targeting production of around 3.8 MMBOPD next year, an increase of around 500 MBOPD compared with output in October, reports The Wall Street Journal. Keeping production at such a high level could have unintended consequences.

In a price scenario in which oil prices drop to $40 (with netback to Iraq of around $30 per barrel), both Baghdad and Kurdistan will be critically underfunded, reports Business Insider. The Kurds could be tempted to withdraw from the deal in order to make an additional $170 million per month selling the oil independently, causing the deal to disintegrate and tensions to re-escalate amid continued concerns of attacks from ISIS and ISIL in northern Iraq.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.