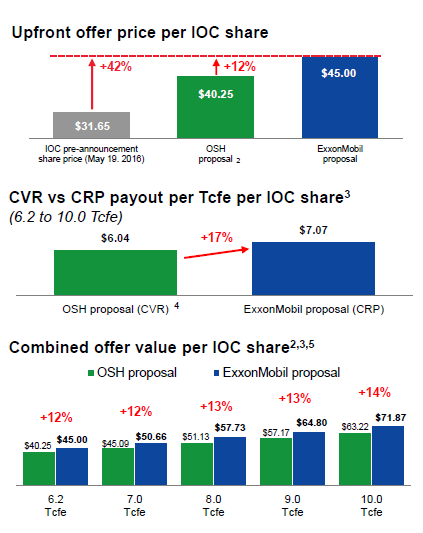

Paying a contingent resource payment of $7.07 per IOC share for each Tcfe of resource in Elk-Antelope field above 6.2 Tcfe

InterOil Corporation (ticker: IOC) announced today that more than 80% of its shareholders approved of the ExxonMobil Corporation (ticker: XOM) acquisition of the company. Exxon will acquire InterOil in an all-stock deal valued at $2.5 billion, with a contingent resource payment comprised of $7.07 per IOC share for each Tcfe of gross resource certified in the Elk-Antelope field above 6.2 Tcfe – up to a maximum of 10 Tcfe.

The InterOil acquisition would add more natural gas to Exxon’s portfolio, and offer more supply for the company’s $19 billion PNG LNG plant. InterOil proposed a second LNG facility in the country, meaning that the acquisition would not only offer more reserves to feed XOM’s facility, but also put a stop to a potential competitor before its plans get off the ground.

Oil Search Limited also hoped to acquire IOC, making its own offer in June. InterOil encouraged its shareholders to vote for XOM’s offer, however, calling it a “superior proposal.”

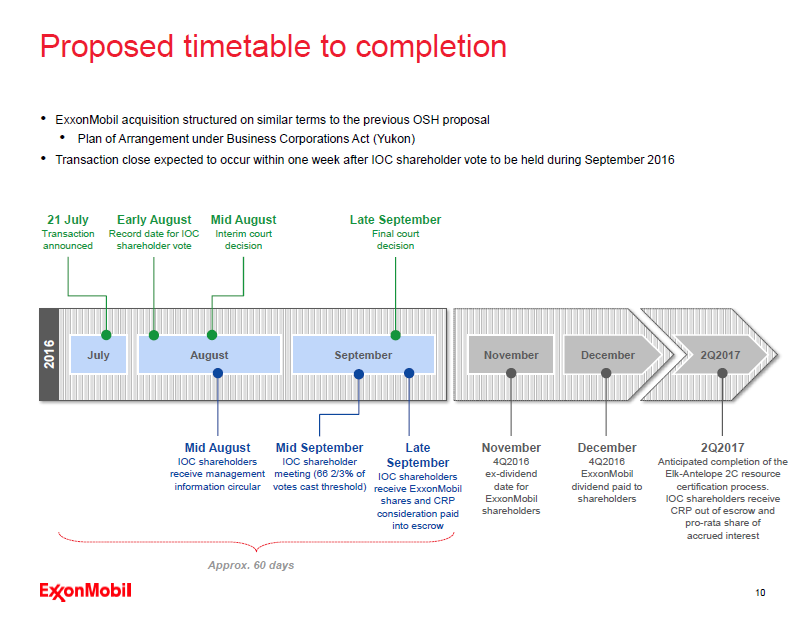

The transaction is expected to close by the end of September 2016. InterOil intends to seek a final order with respect to the plan of arrangement at a hearing in the Supreme Court of Yukon, which is scheduled for September 27, 2016.

“This acquisition provides ExxonMobil access to six additional licenses in Papua New Guinea, totaling about 4 million acres,” said Exxon VP of Investor Relations Jeff Woodbury during the company’s Q2 conference call. “Elk-Antelope complements our existing discovered undeveloped resources, such as P’nyang, better positioning the co-ventures to expand the existing operation with additional LNG trains.”