Four contract renewals add three years to backlog

Q3 Highlights

- Net loss of $6 million, or ($0.16) per share

- Adjusted EBITDA of $3.1 million

- Fully-burdened margin per day, excluding construction costs, of $4,521 per day. No reactivation expenses during Q3

- Renewal of four term contracts, adding three rig years to backlog

- Sequential backlog increases to $75 million on Sept. 30, 2017

- Net debt, excluding capitalized leases, of $44.3 million, on a borrowing base of $107.5 million

ICD recently completed a final rig conversion, entering Q4 with 100% fleet utilization. Dayrates for pad optimal rigs have improved to the high-teen to low-$20,000 per day range. The signed contract extensions rerated dayrates up $2,000 to $3,000 per day from prior levels.

Q3 operating revenues totaled $23.4 million and revenue-per-day was $18,034. Operating costs in Q3 totaled $18.2 million, these costs included $0.4 million in rig construction costs. Fully-burdened operating costs, excluding reactivation and rig construction costs, was $13,513 per day in Q3.

Aggregate cash outlays for capital expenditures in Q3, net of disposals, were $9.6 million including $4.7 million of payments for second quarter deliveries. ICD expects cash outlays, before disposals, for capital expenditures for the remainder of 2017 to be approximately $3.5 million. On Sept. 30, ICD had $5.7 million of assets classified as held for sale.

As of Sept. 30, ICD had drawn $47.0 million on its $85.0 million revolving credit facility and had net debt, excluding capital leases, of $44.3 million. The borrowing base under the ICD’s credit facility was $107.5 million.

Drilling operations

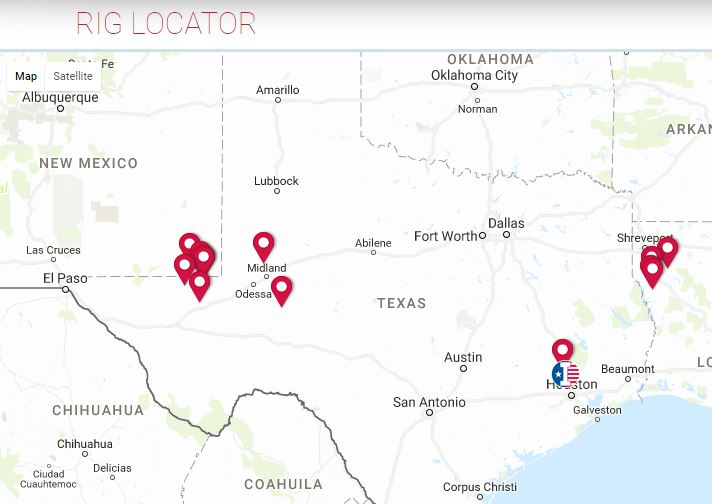

- All 14 of ICD’s ShaleDriller® rigs are contracted and operating under term contracts

- Approximately $23.8 million backlog revenue is expected to be realized during the remainder of 2017

- ICD began its first contract with an international major, operating in the Delaware Basin

- Second longest well drilled in the Austin Chalk last quarter

- New field records for both lateral length and drilling rate in the Delaware Basin

- New technologies aimed at lowering fuel consumption and use of highline power, resulting in materially decreased operating costs for rigs

- Plans are underway to complete two half-built 200 Series rigs

- Rig construction expenses are expected to be approximately $450,000 during Q4

Conference call Q&A

Q: When will you complete those two rig builds that are halfway paid and halfway finished? Will it be within the next quarter or two?

ICD: Dayrates are where they need to be in, so we think so. If we get a two-year term relative to the ABL, we’re good to go. Also, we have had two-year terms in the last couple of quarters, so that’s part of the conversation right now. We’ll have to link that up with the delivery date and where we’d like to get those out as fast as we can.

Q: Could there be a possibility of a partnership with a like-minded E&P? Are those conversations still going?

ICD: They are. The type of rig we’re talking about is substantially different than the 200 Series. So, we’re talking about 1 million pound mass, 2000 horsepower rigs, extended walking capabilities, vastly expanded mud handling capabilities. These are associated with mega pad drilling and the very lowest levels of the Wolfcamp and that’s probably a $28 million to $30 million proposition. So, that type of rig is in demand. There’s nothing like it available right now.

There’s a handful of heavy rigs that are out there doing some of that work but they’re suboptimal. So, the conversations we’re having surround the demand for this equipment, its unavailability and around financial terms, that would make sense for everybody involved to begin construction of that type of equipment.

Q: Could you elaborate on what you guys are doing with regard to using electrified power or grid power?

ICD: We’re setting the rigs so they can all run highline power. The issue there is that highline power is typically dirty. So we have to rectify, take it back to AC. When you do that, you don’t run your gen sets. So it’s good for the operator and it’s good for us, and then also on an operating cost basis because we’re not running the gen sets.

Q: Can you talk to us about data analytics and how big a role that may play both on the new rig design and also on your current fleet?

We’re capturing an enormous amount of data through the computer systems on the rigs

ICD: So, there’s two things to think about there. One is data capture and we already do that. So, we have an enormous amount of data that we capture through the computer systems on the rigs that’s available to clients and that’s used. It’s very client specific but I think we’re gravitating toward an environment where the capture of that data and the integration of it into historical drilling curves and cost structures will become more and more prevalent.

The second answer is that there are systems that go onto the rig, particularly because we have Omron’s systems that eliminate directional drillers and they do a lot of things in terms of speeding up drilling, risk reduction and cost reduction. And we’re in active conversation with two providers of that type of equipment and we’ll make a decision in the next quarter or so about which way we’re going to go. That is a cost adder, so that wouldn’t be included in the base dayrate. If a client wanted us to switch a system like that on, there would be an additional per day cost associated with it.