Increased natural gas production is projected to satisfy 60% to 80% of a potential increase in demand for added liquefied natural gas (LNG) exports from the Lower 48 states, according to recently released EIA report.

The report, Effect of Increased Levels of Liquefied Natural Gas Exports on U.S. Energy Market, considered the long-term effects of several LNG export scenarios specified by the Department of Energy’s Office of Fossil Energy.

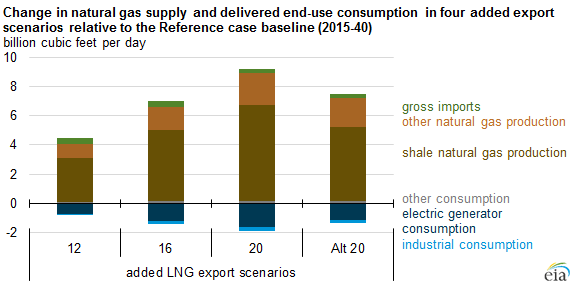

In the export scenarios that EIA was asked to analyze, LNG exports from the Lower 48 states start in 2015 and increase at a rate of 2 billion cubic feet (Bcf) per day per year, ultimately reaching 12, 16 or 20 Bcf/d. EIA also included a 20-Bcf/d export scenario (Alt 20-Bcf/d) with a delayed ramp-up to identify the effect of higher LNG exports implemented at a more credible pace.

In the export scenarios that EIA was asked to analyze, LNG exports from the Lower 48 states start in 2015 and increase at a rate of 2 billion cubic feet (Bcf) per day per year, ultimately reaching 12, 16 or 20 Bcf/d. EIA also included a 20-Bcf/d export scenario (Alt 20-Bcf/d) with a delayed ramp-up to identify the effect of higher LNG exports implemented at a more credible pace.

LNG exports from the Lower 48 states in the baselines have projected 2040 levels ranging from 3.3 Bcf/d (LOGR case) to 14.0 Bcf/d (HOGR case). Estimated price and market responses to each pairing of a specified export scenario and a baseline will reflect the additional amount of LNG exports needed to reach the targeted export level starting from that baseline.

With the exception of one baseline/scenario pairing, higher natural gas production satisfies 60% to 80% of the increase in natural gas demand from LNG exports during 2015-40. With the exception of the HOGR case, more than 70% of the increased production comes from shale resources.

The EIA Projected average natural gas prices at the producer level are 4% to 11% above the Reference case across export scenarios during 2015-40. “Generally, natural gas prices increase relative to their respective base cases, with the greatest impact during the 2015-25 timeframe when LNG exports are ramping up,” the EIA said.

The EIA Projected average natural gas prices at the producer level are 4% to 11% above the Reference case across export scenarios during 2015-40. “Generally, natural gas prices increase relative to their respective base cases, with the greatest impact during the 2015-25 timeframe when LNG exports are ramping up,” the EIA said.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.