Birol believes rebalance is now coming in 2H of 2018

Back in July—on the U.S.’s Independence Day—Fatih Birol, the chief of the International Energy Agency (IEA) said he believed the oil market would rebalance in the second half of 2017, “but further output increases among key producers such as Nigeria and Libya could hamper this process,” Reuters reported from Birol’s appearances at the World Economic Forum in Davos.

“In the current context we see the market rebalancing in the second half of the year. But if production increases in some of the key producers this may change the picture,” Birol told Reuters on the sidelines of an Energy Institute event. “Whatever OPEC does, if the prices go up, there will be a response from shale oil producers,” Birol said.

Today, two days prior to the much anticipated OPEC meeting on Nov. 30, Birol pushed out his prediction of a rebalance by one year. “If we have strong demand growth and if producers continue to stick to their policies we may well see tightening of the markets… I expect this sometime next year, towards the second half of [2018]…,” he told Reuters on the sidelines of an energy conference in Norway.

Birol was wrong with his July 4 prediction for a 2017 balance, and this one is likely to be a dart toss as well, plus he is stating the obvious with the ifs being the continuation of “strong demand growth” and “if producers continue to stick to their policies,” meaning if the OPEC-non OPEC group decides on Thursday to extend their production cut agreement through the end of 2018.

“It’s up to OPEC countries to decide what are they going to do, but what we see is that the market is already on its way towards rebalancing… Therefore the price (of oil) that we have today, above $60, is a good number for most oil investments to be profitable,” Birol said, according to today’s report from Reuters.

IEA says higher oil prices are not ‘a new normal’

Two weeks ago on Nov. 14, the IEA released an article outlining causes for the runup in the price of crude oil. The report was entitled, “OMR: Another new normal?”

“The events in Saudi Arabia have added extra momentum to the rally that has driven oil prices from lows of $45/bbl (Brent) in late June to around $63/bbl recently.

“To date, we have not seen any impact on the Saudi energy sector. However, we have seen real interruptions in Iraq where shipments from the north fell by an estimated 170 kb/d in October, as well as lower production in Algeria, Nigeria and Venezuela. In recent weeks, we also saw lower-than-expected production in the US, Mexico and the North Sea.

“These supply disruptions, geopolitical concerns, a growing expectation that the OPEC/non-OPEC output accord will be extended through 2018 at the end of the month, and with demand growth still robust, largely explain firmer prices.

“Does it mean the market has found a ‘new normal’ where the accepted floor might have moved from $50/bbl to $60/bbl? This might be a tempting view, assuming supply disturbances will continue and tensions in the Middle East will not ease. However, if these problems do prove to be temporary, a fresh look at the fundamentals confirms the view we expressed last month that the market balance in 2018 does not look as tight as some would like, and there is not in fact a ‘new normal’.

“This month’s Report backs this up,” the IEA said. “We have reduced our demand numbers by 50 kb/d for 2017 and by 190 kb/d for 2018. The 2017 revision is not very large, although it includes a more significant downward revision in 4Q17 of 311 kb/d. This is partly because of northern hemisphere heating degree day numbers for the early winter season, revised demand data for some Middle East countries e.g. Iraq and Egypt, and modest changes elsewhere.

“We have also taken general account of prices rising, in broad terms, by about 20% since early September. For 2018, our demand outlook has been adjusted to reflect a lower estimate for heating degree days in the early months plus some impact from higher prices.

Overall market balance: IEA’s reduction in demand growth and supply cancel each other out

“For the overall market balance, our changes to demand growth, which remains robust, and supply largely cancel each other out.

“Using a scenario whereby current levels of OPEC production are maintained, the oil market faces a difficult challenge in 1Q18 with supply expected to exceed demand by 0.6 mb/d followed by another, smaller, surplus of 0.2 mb/d in 2Q18.

“The reality is that even after some modest reductions to growth, non-OPEC production will follow this year’s 0.7 mb/d growth with 1.4 mb/d of additional production in 2018 and next year’s demand growth will struggle to match this. This is why, absent any geopolitical premium, we may not have seen a “new normal” for oil prices.

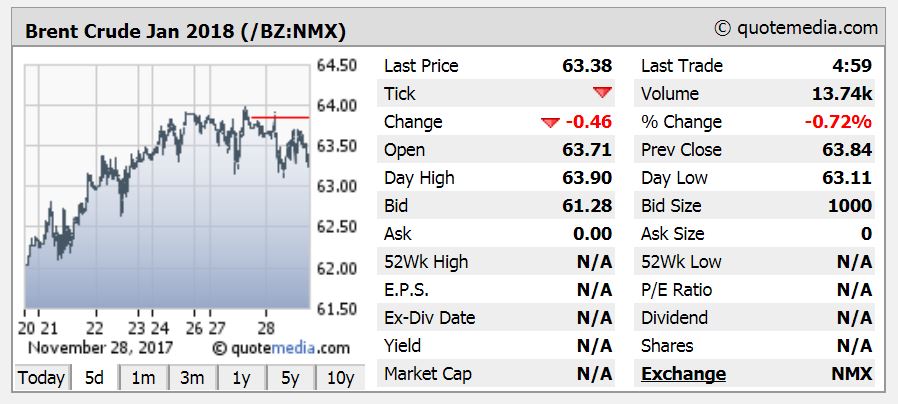

Brent near term contracts priced at $63.90 for a high today.