The International Energy Agency (IEA) expects non-OPEC production to drop by nearly 500 MBOPD in 2016 as a result of declining activity in the new commodity environment. The projection, made in the Agency’s Oil Market Report for September, reinforces a Citigroup forecast earlier in the week that said United States volumes alone could fall by as much as 500 MBOPD by year-end 2015.

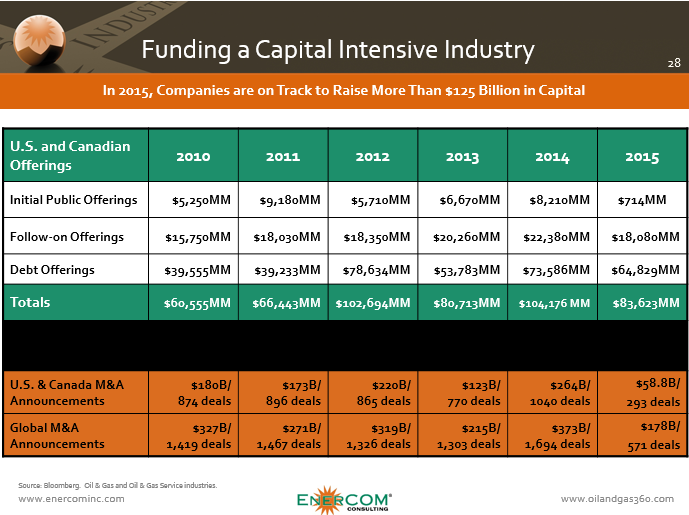

Citigroup attributes the drop to a capital market that is “sharply contracting” after oil and gas companies raised liquidity by the billions earlier in the year. “Capital markets thus far have plugged shale’s funding gap but are showing signs of tightening, with impacts for drilling, oil supply and global prices,” said Richard Morse and Ed Morse, analysts of Citigroup. According to data compiled by EnerCom Analytics, oil and gas companies have raised nearly $65 billion to date in 2015 through debt offerings. At the nine-month mark of 2015, proceeds from debt offerings are already 20% higher than 2013 and are on pace to exceed already exceed 2014’s total by 15%.

Shale Taking the Hit

The capital intensity of shale plays and shrinking drilling programs from E&Ps will reduce U.S. tight oil production by 400 MBOPD next year, says the IEA. Citigroup’s estimate was slightly less, at 250 MBOPD. The IEA’s projection, however, lines up perfectly with that of the U.S.-based Energy Information Administration, who projects 2016’s production to drop to 8,800 MBOPD from 2015’s average of 9,200 MBOPD.

Several CEOs hinted at further budget reductions during a conference in New York this week. Barclays analysts estimate producers could cut their budgets by 15% in 2016, after the same E&Ps cut budgets by an average of 35% in 2015. Marathon Oil (ticker: MRO) plans on trimming its budget by at least 18% while Continental Resources (ticker: CLR) downwardly revised its 2015 budget by 12% on Tuesday. Reuters says heavyweights like Anadarko Petroleum (ticker: APC) and Apache Corp. (ticker: APA) also hinted at future adjustments, while WPX Energy (ticker: WPX) publicly admitted their plans on a reduced year-over-year budget.

That Time of Year Again: Redeterminations Approaching

Borrowing base reaffirmations were a common topic in both Q2’15 conference calls and at breakout sessions hosted at EnerCom’s The Oil & Gas Conference® 20. Any reductions in bank redeterminations will surely reduce the cushion for E&Ps trying to balance their respective budgets while maintaining their revenue streams. As previously mentioned, several companies were able to raise capital through debt and equity markets in the first round of redeterminations earlier this year, but several analysts believe the market won’t be as generous as it was before.

Buddy Clark, Chairman of Energy Practice at Haynes and Boone law firm, told the Financial Times that banks will take unique approaches this time around, aiming to frontload most money offers in hopes that oil prices (and therefore, revenues) will pick up in the later part of 2016.

“The hope is that the market will pick up in time to allow them to sell equity to shore up the balance sheet,” said Mr. Clark.