Fraser Institute Study Compares How Texas and Alberta Managed Public Finances between 2004 and 2014

A new report from the Fraser Institute, titled “One Energy Boom, Two Approaches: Fiscal Restraint Has Left Texas in Better Shape than Alberta,” concludes that Alberta’s undisciplined spending and fiscal mismanagement rather than the drop in energy prices was been responsible for its history of deficits and mounting debt during and since the energy boom of 2004 to 2014.

Texas enjoyed slightly faster growth in terms of per capita gross domestic product, while Alberta produced a slightly faster rate of job creation. Although each jurisdiction outperformed the other on some metrics, both had comparably strong overall economic performances.

What differentiated Alberta and Texas during the boom was how well their governments managed public finances. Texas ran five straight surpluses between fiscal years 2009 and 2013 due to controlled spending during the boom. During the same period, Alberta increased its spending at a greater rate than Texas and ran four deficits, eroding its financial position.

Net Assets as Percent of GDP, Public Spending on Two Different Paths

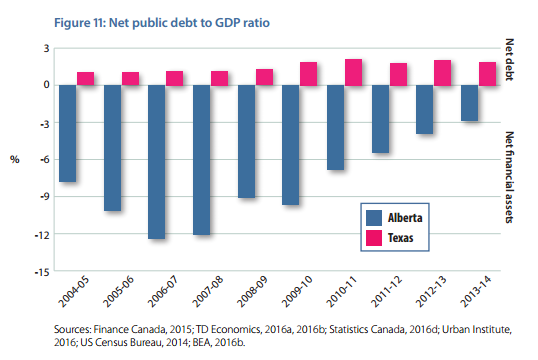

Alberta’s held net assets in 2006/2007 represented 12.4 percent of provincial GDP; this number declined to 2.9 percent of GDP by 2013/2014. The province’s decline in assets occurred despite generally high commodity prices and provincial resource revenue. Texas saw very little change in its financial asset position during this period.

Program spending per person in Alberta increased 49 percent compared to 37.3 percent in Texas. Public sector employment grew twice as fast in Alberta (2.6 percent) as in Texas (1.2 percent).

With Alberta in a tight financial position, the fall in energy prices caused the budget deficit to balloon and asset erosion to accelerate. Alberta is expected to become a net debtor for the first time since 2000/2001, and is projected to see a rapid run-up in debt over the next several years. The province doesn’t expect to balance the budget again until at least 2024.

Petro-States, Take Notice

While not a petro-state, Alberta relies heavily on its energy sector as a major driver of economic growth. This means Alberta is more prone to pronounced economic booms and slumps than most other jurisdictions.

The authors conclude that this feature of the Albertan economy makes it especially important for governments to manage public finances cautiously and prudently during good economic times in preparation for revenue dips and other challenges.