By: Larry Busnardo, EnerCom

The natural gas crisis unfolding in Europe appears to be intensifying as Russia has dialed back natural gas supplies to the region. European countries have been scrambling to determine how to meet their winter needs for heating and power generation. New supplies are ultimately needed to ensure the region’s short-term and long-term energy independence.

European countries have begun lining up alternative natural gas supplies, including LNG from the United States and other piped natural gas from Norway. In addition, Germany is keeping coal plants in operation that it had planned to shut down to reduced greenhouse gas emissions and has the option of reactivating two nuclear plants that are to be decommissioned. The European Union has also approved a plan that requires natural gas consumption to be reduced by 15% by March 2023, which is the forecasted amount needed to offset the supplies from Russia. While these measures are sure to provide temporary help, a longer-term solution needs to come in the form of new drilling to increase domestic energy production.

The United Kingdom (“UK”) remains one of the countries most impacted due to the lack of investment in new oil and gas fields that has contributed to a sustained production decline in recent years. Without further investment, the UK will have to import approximately 80% of its natural gas by 2030 and around 70% of its oil; this would mark a dramatic increase from the current level of 60% and 20%, respectively. This is set to change as there are several high impact exploration projects already planned for the North Sea that could bolster the UK’s energy security and productive capacity.

The UK North Sea is proving to be an ideal exploration region due to a supportive government that has been vocal in its desire to see new investment. It has pushed ahead regulatory approvals of new development projects to maximize production from its North Sea resource base.

To further validate the UK’s North Sea vast resource potential, Shell will be commencing drilling of its Pensacola prospect in October 2022. The well is located in the UK Southern North Sea and is one of the higher impact exploration prospects to be drilled there in recent years. In addition, it was recently announced that Shell has made a favorable well investment decision on its Selene prospect. The Selene prospect is currently viewed as a significant unappraised structure in the Southern North Sea and is in the vicinity of several important legacy discoveries and located near existing infrastructure. Each of these prospects contains a prospective resource potential greater than 300 Bcf of natural gas.

Horizon Energy Global Corporation (“Horizon”) is also set to materially benefit from the renewed interest in the UK North Sea. Horizon has strategically targeted and assembled a substantial acreage position in a shallow water exploration project in the Mid North Sea High (“MNSH”) area of the Southern North Sea. Horizon has methodically assembled and controls a high-value, contiguous offshore position of approximately 600,000 acres in one of the largest offshore undeveloped basins in the UK North Sea. Horizon’s licenses are surrounded by major and large independent oil companies in an area historically overlooked by industry due to a lack of modern 3D seismic data and previous lack of drilling activity. Based on the acquisition and interpretation of newly acquired state-of-the-art 3D seismic data, Horizon recently completed a comprehensive technical and commercial evaluation of its substantial prospect inventory offshore in the MNSH area of the UK North Sea. Horizon has recently selected the initial prospect it intends to target and is proceeding with the requisite planning to drill an exploration well, currently planned for late 2023 or early 2024.

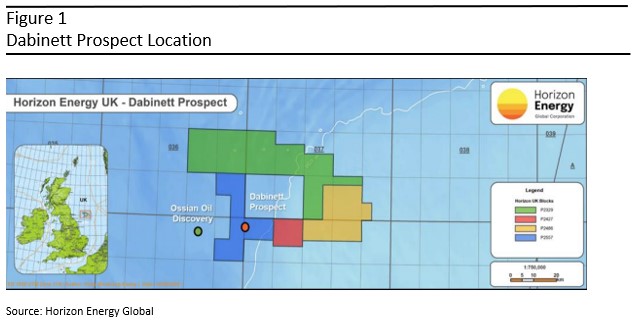

The well will be drilled on the Dabinett prospect within Petroleum License P2557 (see Figure 1). Horizon currently holds an 87.5% working interest in P2557 and is open to participation by third parties. The well location is situated approximately 6 miles east of the Ossian oil and gas discovery well drilled by One-Dyas and Spirit Energy in 2019, further de-risking Horizon’s opportunity. The Dabinett prospect is fully covered by a newly acquired, advanced, depth-migrated 3D seismic survey. Horizon also has 3D seismic coverage over the nearby Ossian discovery. These data sets support Horizon’s geological interpretations and significantly mitigate the risk of the Dabinett prospect.

The Dabinett prospect is situated in shallow water of approximately 100 feet and is suitable for drilling with a standard jack-up rig. The primary reservoir target is the Zechstein Haupt dolomite with gross interval estimated at 200 feet with vertical relief of 450 feet, at a drilling depth of approximately 7,500 feet (see Figure 2). Secondary targets exist beneath the Base Permian Unconformity in both the Carboniferous Scremerston and Fell sandstones. The Dabinett prospect has an estimated mean prospective resource of about 200 million barrels of oil, or if natural gas over 650 billion cubic feet, making it significantly larger than each of Shell’s two announced drilling prospects.

Horizon also holds the majority interest in four contiguous Petroleum Licenses, including P2557, which comprise approximately 600,000 acres and contain multiple follow-on prospects to the Dabinett prospect. Horizon has identified prospective resources of over two billion barrels of oil and natural gas equivalents from its top prospects which cover multiple geological objectives. Modern 3D seismic data fully covers all the licenses, and high grading of the prospects is the focus of ongoing technical work.

The UK’s North Sea Transition Authority (formerly known as the Oil & Gas Authority) has identified the MNSH as a premier exploration area “because of the high hydrocarbon volume potential and recent exploration success in proximity to infrastructure, with new modern seismic data.” Given Horizon’s substantial and contiguous acreage position in the heart of the MNSH play, Horizon is well positioned to capitalize on its vast opportunity set.

To learn more about Horizon and its premier drilling opportunities, please visit the Company’s website at www.horizonenergyglobal.com

Larry Busnardo is a Director at the energy consulting firm EnerCom, Inc. He has over twenty-five years of diverse experience in corporate finance, capital markets, investor relations, sell-side equity research, corporate strategy and ESG.

EnerCom, Inc. is the energy industry’s leading communication experts. We can help you with corporate strategy, ESG, media and government and stakeholder relations to effectively communicate your company’s story. Contact: services@enercominc.com