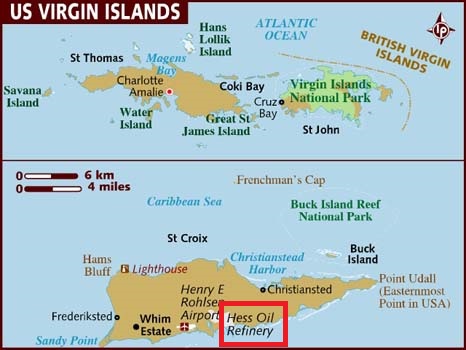

The U.S. Virgin Islands filed a lawsuit against Hess Corp. (ticker: HES) for approximately $1.5 billion, saying the company violated its contract by shuttering its refinery in St. Croix.

Prior to being shuttered, the facility was once the world’s largest refinery, and was responsible for employing 2,500 people, or about one in four workers in the Virgin Islands. The facility began operations in 1965, and was designed for a maximum capacity of 545 MBOPD, according to the filings with the Environmental Protection Agency. As of February 17, 2012, the facility had ceased all operations.

Within hours of the lawsuit’s filing, the Hess subsidiary that owns the refinery, Hovensa LLC, filed for Chapter 11 bankruptcy, reports the Associated Press. Filing Chapter 11 will allow Hovensa to sell the refinery for use as a storage facility, an outcome the government of the Virgin Islands has tried to avoid.

To attract the business of such a major operation, the Virgin Islands offered considerable tax breaks to Hess, which realized more than $6.2 billion in tax breaks and other benefits by 1992, according to a Government Accountability Office report from that year. The case filed against Hess focuses on the most recent set of tax breaks agreed upon between the government of the Virgin Islands and the company, which went into effect in 2002 and was meant to last for 20 years.

By shutting down the facility before 2020, the government of the Virgin Islands claims Hess violated its end of the deal, and is seeking $150 million per year in benefits to the people of the territory from 2012 to 2022, reports the Caribbean Journal.

“This is not about a business disagreement,” said U.S. Virgin Islands Governor Kenneth Mapp. “It is about Hess breaking the law. The Territory of the Virgin Islands expect that the law is followed by every entity that does business here. Hess violated the law and its obligations to the people.”

The territory’s government will not pay legal fees to challenge Hess. Instead, the Washington law firm it hired, Cohen Mistein Sellers & Toll PLLC, will fund the lawsuit in return for 20-28% of any proceeds from the outcome of the case.

In an emailed response, Hess spokeswoman Lorrie Hecker told the Associated Press, “We believe this suit is wholly without merit.” A separate announcement from Hovensa called the end of the refinery’s operations “unavoidable given Hovensa’s financial condition,” and said that a bankruptcy filing and sale was the best option for the residents and government of the Virgin Islands.

Company managers tried to sell Hovensa last year, only to have a possible deal scuttled by Virgin Islands lawmakers, who refused to pass needed legislation, Chief Restructuring Officer Thomas Hill said in a court filing Tuesday, reports Bloomberg.

The vote forced Hovensa “to restart its marketing and sale process,” eventually leading to the bankruptcy filing, Hill said. The company said it now plans to sell its assets at an auction overseen by a federal court.

Hovensa listed more than $1 billion in debt, including an unknown amount demanded by environmental regulators in the U.S., the Virgin Islands, and Puerto Rico for ongoing environmental issues. Bondholders are also owed about $1.86 billion on notes that matured in 2013 and are not backed by collateral.

The lawsuit filed this week also alleges that Hess and PDVSA, its partner in the refinery, entered into contracts that artificially boosted the cost of the Venezuelan crude it purchased and suppressed the cost of petroleum products the refinery sent to Hess gas stations along the East Coast. Meanwhile, the lawsuit claims Hess management overseeing the facility overloaded the refinery with debt.

A history of litigation in the Virgin Islands

The current lawsuit represents just the latest in a long series of legal battles between Hess and the Virgin Islands. In 2005, environmental regulators sued the company, accusing it of contaminating drinking water and damaging wildlife and marine environment. The company settled by promising to pay $43.5 million.

In 2011, the U.S. Environmental Protection Agency (EPA) reached a settlement with the refinery that required it to pay $700 million to upgrade its equipment to improve safety and reduce pollution. There has also been an ongoing effort to remove leaked oil from beneath the refinery that affects the island’s groundwater. So far, the project has recovered more than 43 million gallons of oil, according to the EPA.

On January 3, 2015, Hovensa’s owners filed separate lawsuits in federal court, seeking more than $236 million from the Virgin Islands government for money the company claimed it was owed in tax refunds. Hess Oil Virgin Islands Corp (HOVIC), first filed suit in federal court in the Southern District of New York seeking $83.6 million for money it claimed it was owed for the 2006 and 2007 tax years. PDVSA likewise filed for $152.6 million for the 2006, 2007 and 2008 tax years, according to Virgin Island Daily News.

Thirteen days later, Gov. Mapp directed the government of the Virgin Islands’ legal counsel to proceed with foreclosing on the Hovensa property and to reopen the natural resources case in which the company had agreed to pay $43.5 million.

It is unclear how the latest bout in this continued legal battle will turn out, but under a proposal that requires court approval, an affiliate of ArcLight Capital Partners agreed to make a $184 million bid at auction for Hovensa’s assets. Should no other offers come in, ArcLight would buy the assets.