2018 – positive sentiment from the industry and economists

There were 31 presentations during the two days of the EnerCom Dallas oil and gas investment conference last week and the overall vibe at the conference was highly positive for 2018 in the oil patch.

The conference featured public and private oil and gas producers and service companies, technology providers, energy economists and other energy experts from the U.S. and Canada. The mix of companies included Canadian and U.S. producers along with Latin American and other international operators and service providers.

Some notable comments from a sample of presenters, energy economists and other experts on site at the Tower Club for the EnerCom event are mentioned below.

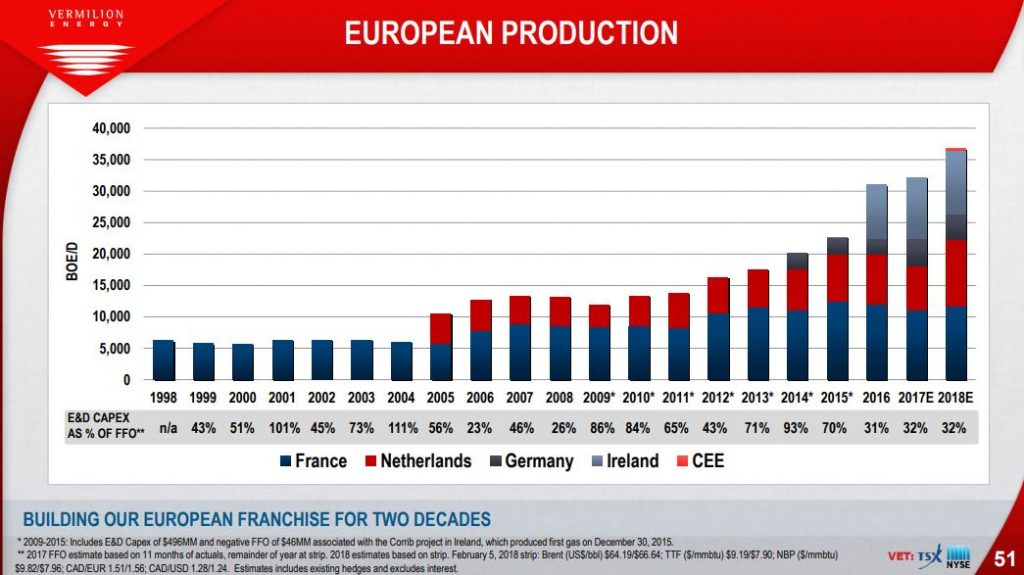

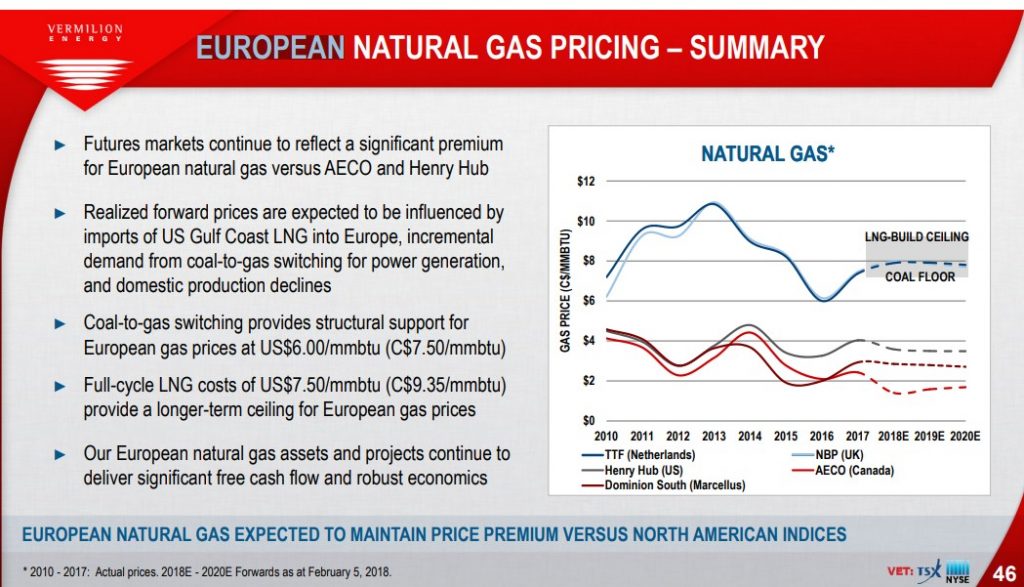

Vermilion Energy

Calgary’s Vermilion Energy (ticker: VET) has operations diversified across North America, Europe and Australia. Vermilion Director of Investor Relations Kyle Preston said his company’s strong European natural gas assets deliver significant free cash flow and positive economics and have the ability to fund the company’s CapEx.

Earthstone Energy

Earthstone Energy (ticker: ESTE) EVP Corporate Development and Engineering Robert J. Anderson gave the presentation at EnerCom Dallas. Anderson took the audience through the company’s history of its executives founding other companies and growing them along with Earthstone’s current production profile.

“Normally we’re selling a company at ten-thousand BOE per day, but with this company we’re just getting started,” Anderson said.

Earthstone said its 2018 capital budget currently assumes a one-rig program for its operated acreage in the Midland Basin and a 10 well program for its operated Eagle Ford acreage. Production guidance for 2018 is 12,000 BOEPD – 12,500 BOEPD. “We really like the economics in Regan County,” Anderson said.

Goodrich Petroleum

Less than a week after ringing the bell at the NYSE to celebrate the anniversary of his company’s listing, Goodrich Petroleum Chairman and CEO Gil Goodrich presented the company at EnerCom Dallas. Goodrich discussed how completion technology “has really changed the Haynesville.” Goodrich said that because of this his company has almost doubled its Haynesville recoveries.

“Per million dollars of CapEx, we are one of the fastest growing companies,” Goodrich said.

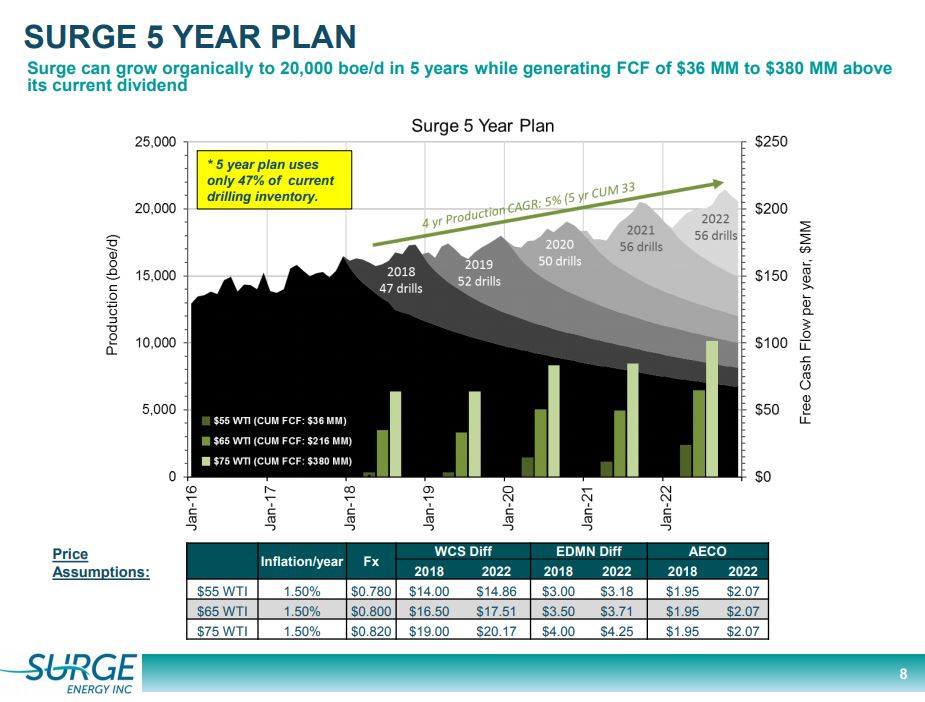

Surge Energy

Calgary-based Surge Energy (ticker: SGY) President & CEO Paul Colborne discussed his company’s strong performance record. “With crude oil prices up over 100% in the last 24 months, it’s one of the most exciting times in our company’s history – for Surge and for our shareholders,” Colborne said. He said that Surge management had positioned the company during the downturn to outperform its peers.

“We focused the company’s assets into three core areas with high-quality large original oil in place per section reservoirs – light/medium gravity, conventional crude oil reservoirs. We have very low declines and we backfill with waterflood.

“We think we are one of the select few companies in Canada that can actually say it and do it: we can actually go in and deliver solid quarterly growth and reserves, production, cash flow per share cost effectively, together with prudent increases in our company’s dividend, while maintaining one of the lowest payout ratios in Canada. … We’ve put six really exciting quarters together and our Q4 is going to be more of the same,” Colborne said.

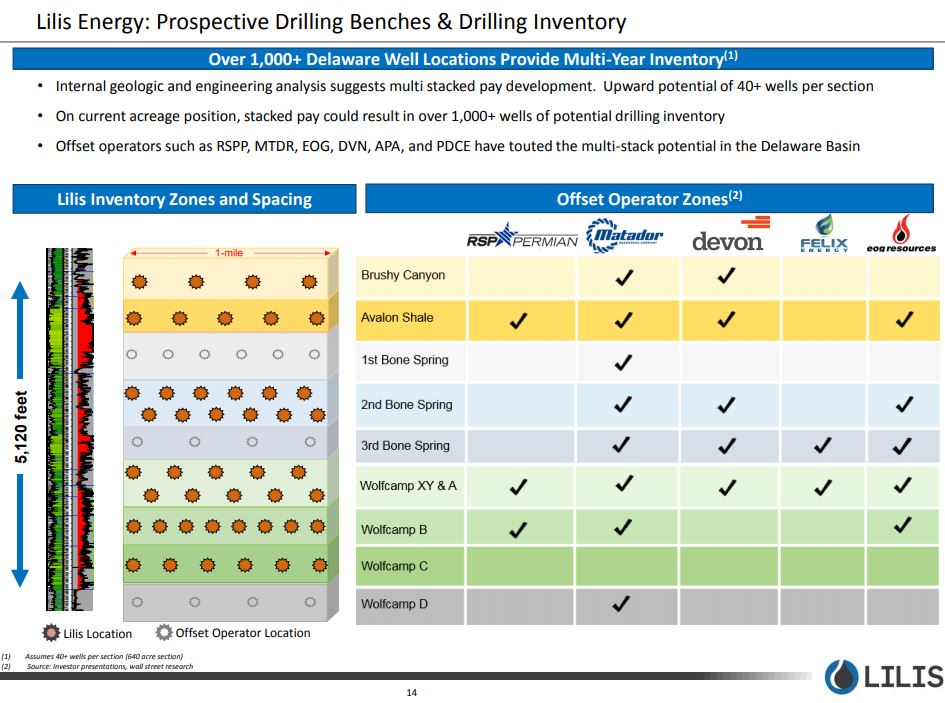

Lilis Energy

Lilis Energy’s EVP, CFO and Treasurer Joe Daches said of his company’s Delaware Basin assets, “we like where we are, we like our position and now we’re going to focus on the drill bit this year.”

“We lead everything with science. We have the geology, we have the logs, the cores. We started off having 19 vertical wells, so we have a really good feel for everything that’s in our position throughout Winkler, Loving and Lee Counties.

“The capital we just raised was in two tranches and it was specifically focused to put us in position to not have to worry about raising capital at all—basically into perpetuity. We’ll have cash flow neutrality in the second quarter of 2019. … The plan today is two rigs in ’18, two rigs in ’19,” Daches said.

“We have 14 wells coming out this year—three are one and a half mile and the balance are all one mile” laterals. Daches said people ask why don’t they drill all one and a half mile laterals and he said being a small, microcap company with limited resources steers them toward the one-mile length because the wells are faster from spud to first oil which puts the company’s arrival at cash flow neutrality in the first half of 2019 time frame, compared to needing more CapEx or the need to possibly run up debt or additional equity to the end of 2019 or into 2020 in order to fund the drilling of a program of entirely one and a half mile laterals. Instead Daches said the company wants to be “D&C funded—again, into perpetuity.”

RS Energy Group

RS Energy Group is a data-driven company with strong tools, forensic research and serious analytics for people making energy investment decisions and operating decisions. RS Energy’s Research and Market Strategist Oma Wilkie spoke plainly about the industry at EnerCom Dallas.

“To really understand the Permian, you have to peer under the hood to see what operators are doing,” Wilkie told the crowd on Thursday morning. “How much of the well performance improvement is a result of high-grading?” Wilkie said a mistake from the industry is “the over-focus on type curves.”

Wilkie looked at how operators are using tech. He said there were early adopters; he used EOG Resources (ticker: EOG) as an example. “A hundred people on its tech team are focused on increasing operational efficiency,” he said.

He looked at a measure of success being breakevens as seen in the Eagle Ford, Midland, SCOOP, STACK, Bakken and Delaware basins. “Most have dropped by half,” Wilkie pointed out.

Based on RS Energy’s analysis, there is a significant amount of oil and gas left in U.S. shale waiting to be produced. Wilkie said his company estimates existing plays like the Permian and Bakken have a total of 200 billion barrels of oil still recoverable. He said it could be as high as 140 billion barrels in the Delaware Basin. He said they estimate 94 billion barrels of the remaining oil are economic with an oil price under $40.

The Marcellus, Haynesville and other major gas plays have even more impressive volumes of gas remaining. For gas remaining, the measure goes up by six additional zeros. Wilkie said that RS Energy calculates that U.S. gas plays will produce an additional 2 Qcf in the future. That is 2,000 Tcf, or two quadrillion cubic feet. That’s a lot of global LNG shipments.

Wilkie said the fast growth of energy exports from the U.S. “will make the U.S. more contentious.”

Flotek

Flotek (ticker: FTK) is an innovative 21st century-style, technology-driven company that is led by an executive with a strong vision. At the EnerCom Dallas conference, Flotek’s Chairman, President and CEO John Chisholm talked about the company reshaping itself from a traditional oilfield services firm supplying wellbore equipment and services to a purely chemical company. “We divested over half the company.” Chisholm said the company divested the downhole tools in May of 2017. “We are laser-focused on energy chemistry,” he said.

Energy chemistry provides 75% of Flotek’s revenue. The remaining 25% comes from selling chemistries and related products and ingredients for the consumer and industrials sector, and specifically for the food and beverage industries. “We are the Western Hemisphere’s largest refiner of citrus oil,” Chisholm said.

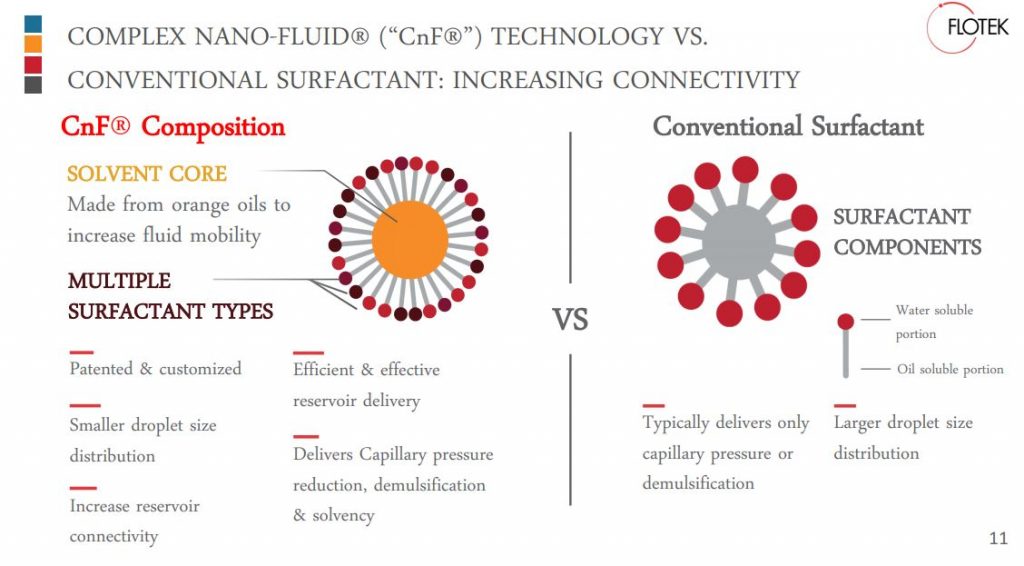

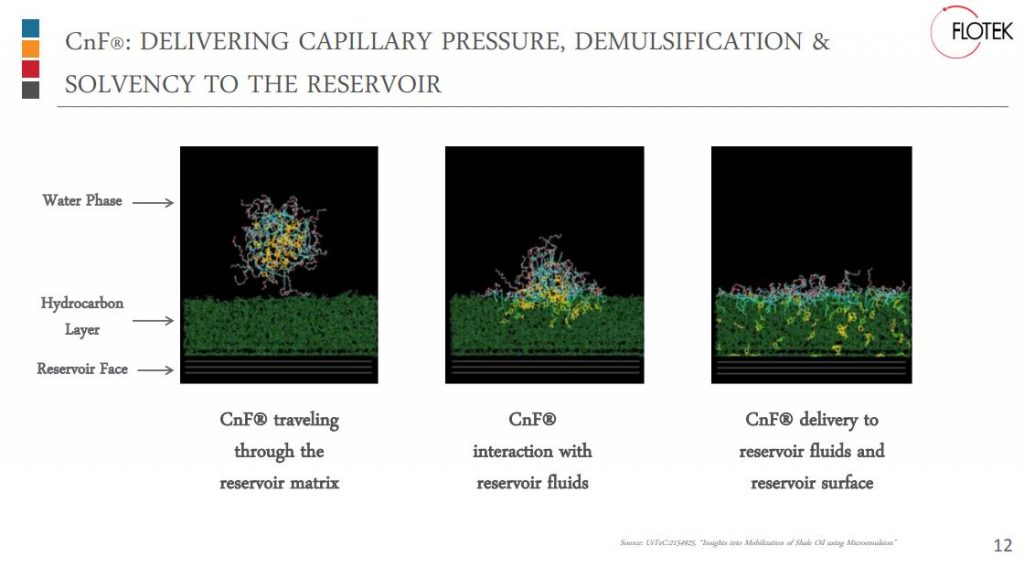

On the energy side, Chisholm said he believes the oil and gas industry has reached the limit on improvements in drilling and coming up with better frac designs. “We believe there is only one thing left and that’s chemistry.” Chisholm talked about his company’s product line of what it calls complex nanofluids (CnF), which oil and gas companies are adopting to reduce surface tension and aid flowback of water-based frac fluids, among other things. The chemistry was developed from Flotek’s research with orange oils.

He said their CnF product makes the frac fluid move easier. He said that Flotek isolated d-Limonene, which is the solvent that goes into the microscopic pore throats in a shale formation and puts more of the frac fluid and proppant in touch with much more of the reservoir surface, giving access to a larger percentage of hydrocarbons in the formation.

Canadian Consul

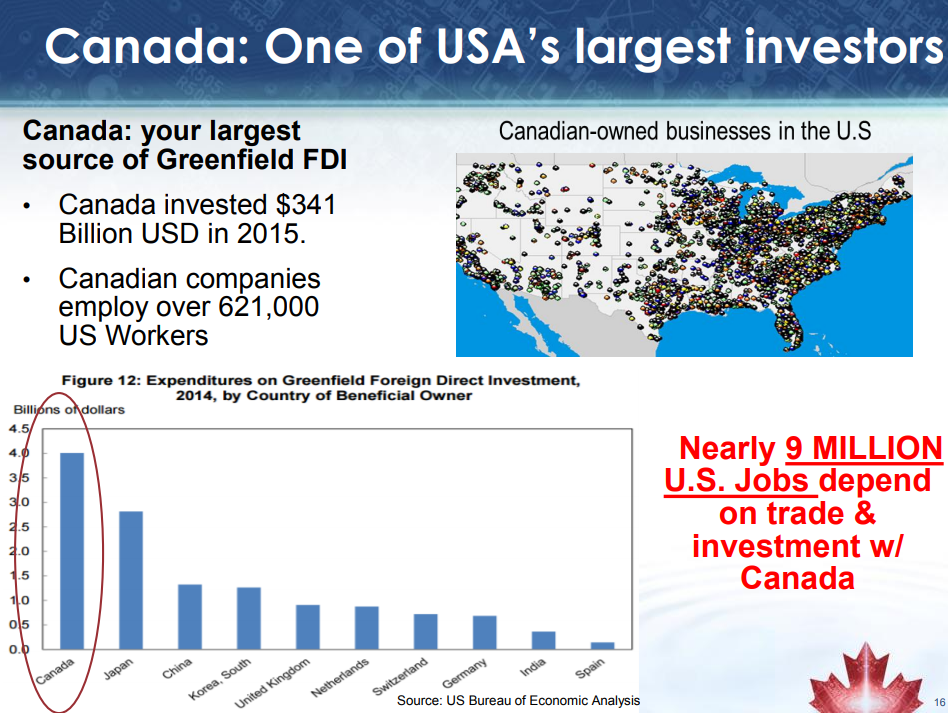

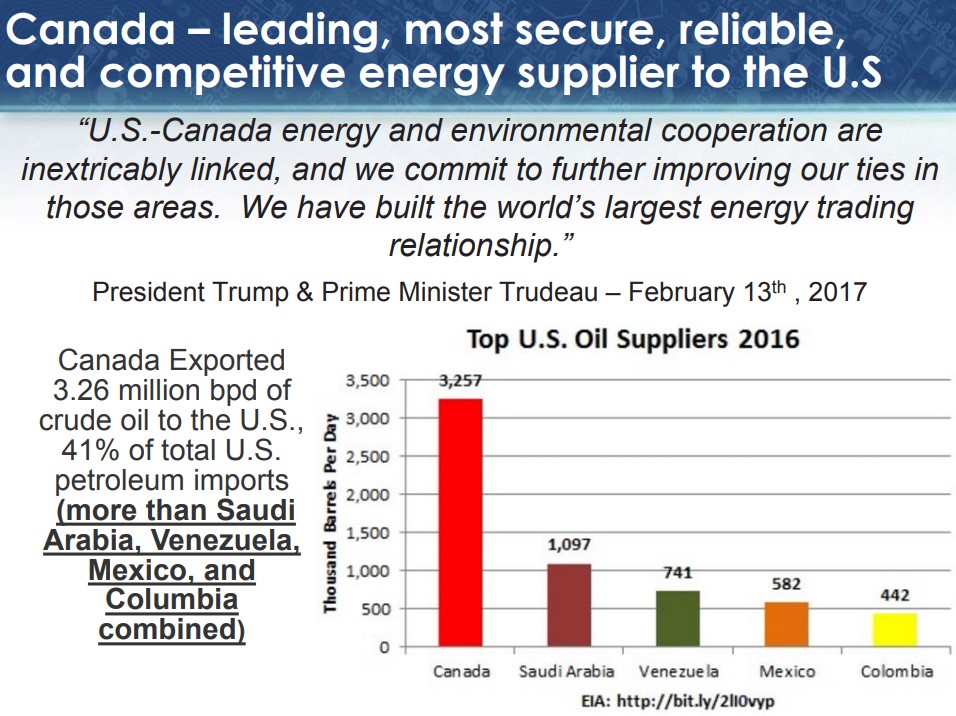

Delon Chan, the Canadian Consul based in Dallas, gave a presentation about the U.S. and Canada’s energy partnership over the years. “We’re your best customer,” Chan said.

He talked about the ease of doing business in Canada as well. “You can establish a business in Canada in less than five days.”

Chan said nine million U.S. jobs depend on trade investment in Canada. “Over 65% of all Canadian imports are from the U.S. and Texas has a $4.75 billion trade surplus with Canada.”

Chan said getting Canada’s energy to market is a priority of the Canadian government.

EnerCom had asked Chan to address the ongoing NAFTA renegotiations. Chan said that there was US$1 trillion in tri-lateral trade in 2016 and that it had tripled since the U.S., Canada and Mexico entered NAFTA in 1993. Chan said 7% of the world’s population and 28% of global GDP are represented by the three countries in NAFTA.

Chan pointed out that the American Petroleum Institute, the Canadian Association of Petroleum Producers and Mexico signed a joint statement in support of NAFTA.

Without NAFTA the countries would experience logistical inefficiencies and likely revert to high tariffs, Chan said. Round 7 of NAFTA renegotiation talks between the three countries is taking place this week in Mexico City.

PetroQuest: worth repeating

PetroQuest Energy Chairman, President and CEO Charlie Goodson made an insightful comment during his presentation: “We can’t drill any uneconomic wells – you can’t undrill those wells.”

PetroQuest Energy Chairman, President and CEO Charlie Goodson made an insightful comment during his presentation: “We can’t drill any uneconomic wells – you can’t undrill those wells.”

Links to conference presentations

Links to the available archived webcasts from EnerCom Dallas are available here.

Downloads of available company presentation slide decks are here.