Halcon Resources sells operated Williston assets for $1.4 billion

Houston-based Halcon Resources Corp. (ticker: HK) announced Tuesday that the company sold its operated assets in the Willison Basin to an affiliate of Bruin E&P Partners, a portfolio company of Arclight Capital Partners, for $1.4 billion in cash. The company said it will keep its non-operated assets in the basin, although it may monetize them at a future date, according to Halcon’s press release.

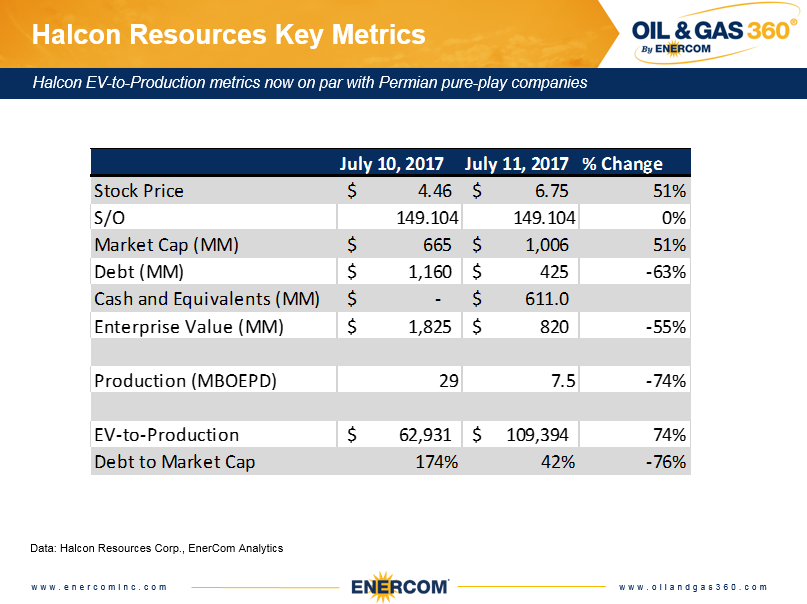

Halcon plans to use the proceeds to pay down roughly two-thirds of the company’s current debt, taking HK’s total debt to $425 million from $1.2 billion. Paying down debt will reduce the company’s debt-to-market cap from 174% to 42% with the company’s market cap of approximately 1.0 billion at market close on Tuesday.

Divestiture turns Halcon into a Delaware basin operator

While Halcon shed the majority of its production in the course of Tuesday’s divestiture, the deal marks a transformation for the company to a Delaware Basin operator. HK’s stock soared 51.4% over the course of the day following the news.

“The sale of our Williston Basin operated assets transforms Halcon into a single-basin company focused on the Delaware Basin where we have more than 41,000 net acres in Ward and Pecos Counties representing decades of highly economic drilling inventory,” said HK Chairman, CEO and President Floyd Wilson. “The cash proceeds from this transaction and related debt reduction provide us with a strong balance sheet and liquidity to execute our growth plans.”

Production associated with the assets being sold is approximately 29 MBOEPD. Pro forma the sale, Halcon’s production is approximately 7.5 MBOPD.

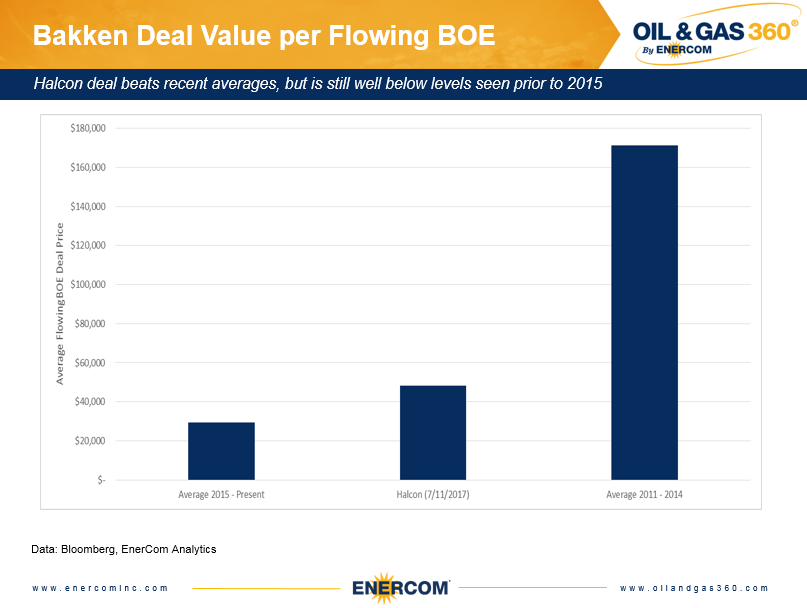

Deal values improving, but still well below levels seen previously

Looking at the metrics around Halcon’s deal Tuesday, the company sold its operated Williston assets for $48,276 per flowing BOE. Looking at deals in the Bakken that included more than 5 MBOE of flowing production since 2015, the average price on a flowing basis was $29,510. The Halcon deal represents a 64% increase over that average but is still well below levels seen prior to the oil price decline in November 2014.

From 2011 through 2014, there were five deals in the basin with more than 5 MBOE of flowing production. These deals had an average per-flowing price of $171,143, 3.5x more than the Halcon deal.

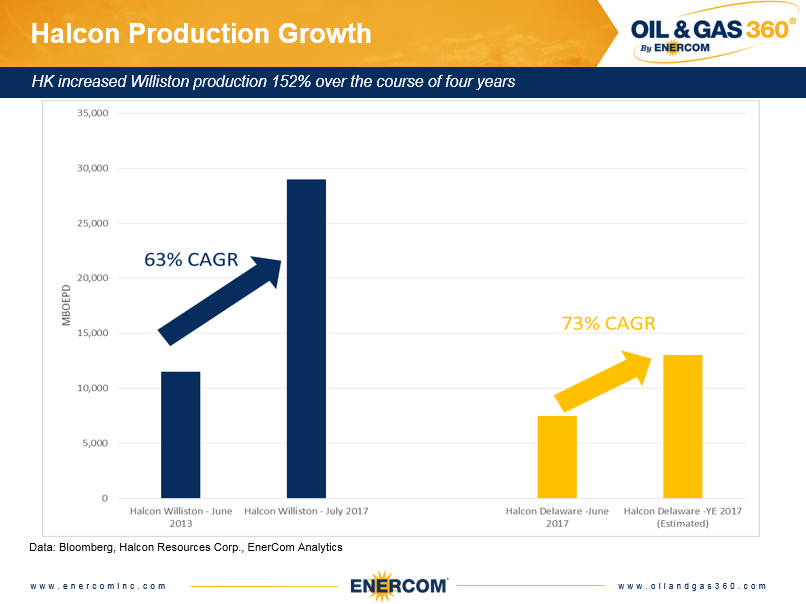

Halcon entered the Bakken in a major way in October of 2012 with a $1.5 billion acquisition from Petro-Hunt, and added on to its acreage with a $75 million deal with Resolute Energy Corp. (ticker: REN) in June of the following year. The two acquisitions, done at an average of $108,688 per flowing BOE, brought Halcon’s production in the play to roughly 11.5 MBOEPD. HK was then able to grow production 152% to 29 MBOEPD before selling it for just shy of its purchase price despite significantly lower oil prices.

Delaware program

Halcon plans to continue running a two rig program on its Delaware assets for the remainder of the year, with expected exit production of 13 MBOEPD, a 73% increase in pro forma production for the remainder of the year. The company is starting with 1.5 MBOEPD of additional production compared to where its operations started in the Bakken and plans to grow at a slightly faster annual growth rate. Halcon was able to grow production in the Bakken by 63% CAGR from 2013 to 2017, 10% less than what HK is projecting for 2017.

Non-op position potentially worth $96.6 million

During a call announcing Tuesday’s divestiture, Halcon’s management said its non-operated position in the Williston is still producing 2,000 barrels net to the company. Assuming the company is able to get a similar value on a flowing BOE basis, HK’s non-op assets are worth approximately $96.6 million.

It is worth noting, however, that other companies have pulled similar divestitures based on large gaps in the bid-ask spread. On May 16, 2017, SM Energy (ticker: SM) announced that it would postpone indefinitely its planned sale of non-operated assets in Divide County, North Dakota as “valuations in the sales process did not reach the company’s threshold to meaningfully reduce its leverage,” according to SM.

The pursuit of a premium valuation

Halcon exited bankruptcy in September 2016 before entering the Delaware Basin in January of this year. The company entered the Delaware with a $705 million purchase at roughly $20,000 per acre, according to Halcon. The property was producing approximately 6 MBOEPD net to HK, putting the deal at $117,500 per flowing barrel. The average price for the seven deals that took place in the Permian during the first month of the year was $235,265, based on Bloomberg data.

Many companies have been entering the Permian – and the Delaware Basin in particular – as they look for the most economic acreage. Despite steep entry costs, acquisitions in the basin have been rewarded by public markets with investors giving premium valuations to companies in the region.

Halcon saw a bump in its stock following the entry into the basin compared to the wider XOI Index. The company’s stock jumped 17% the day following the Delaware acquisition and remained about 12% above the broader index in the following days even as the XOI declined slightly.

Halcon was realizing $62,200 of enterprise value to its trailing twelve-month production ahead of the deal, slightly above its Bakken peers, which average $53,585 of EV-to-TTM production. Halcon’s EV-to-pro forma production based on Tuesday’s closing prices is now trading on par with Permian pure-play companies, which have an EV-to-TTM production of $101,221 per flowing barrel compared to HK’s $109,394 per flowing BOE.

The capital from Tuesday’s deal will leave Halcon with approximately $611 million to develop its Delaware assets. The company plans to spud 16 gross wells through the end of the year and believes it has 2,310 gross operated positions, according to its investor presentation.

HK estimates drilling and completions costs for one of its Wolfcamp wells at roughly $9.4 million, meaning the company will spend approximately $150 million this year on Delaware wells. Even if Halcon doubles the pace of its drilling after this year, it could potentially fund this year and all of next year’s drilling program without needing to any additional capital or new acreage.

Tuesday’s deal sets the table for the company to de-lever and begin growing again in the most active basin in the country. The company’s stock was up approximately 51% Tuesday following the news as Halcon begins to close the valuation gap between Bakken players and Permian players.