Halcon Resources Corporation (ticker: HK) has recently entered into definitive agreements to acquire 22,617 net acres in Ward County, Texas for approximately $381 million.

The properties are currently producing ~1,325 BOEPD which equates to a purchase price of ~$14,674/acre (after adjusting for production using an estimated value of $35,000 per BOEPD).

West Quito Draw

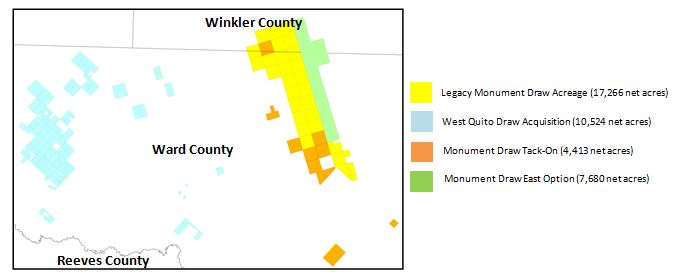

The largest acquisition is comprised of 10,524 net acres in central and western Ward County in an area Halcon calls West Quito Draw. The company expects the acquisition to close in early April 2018. The West Quito Draw acquisition is located in an actively developed area of the Delaware Basin and adds 251 additional gross operated drilling locations in the Wolfcamp and 3rd Bone Spring Sand zones with an average lateral length of ~7,300-feet.

However, Halcon expects that near-term drilling will be predominantly comprised of 10,000-foot laterals. The company estimates that 10,000-foot laterals in the Wolfcamp on this acreage will generate EURs in excess of 1.1 MM barrels of oil and a total EUR of oil and gas (two-stream) of approximately 2.2 MMBoe.

Including additional landing zones (Bone Spring, Avalon, etc.), Halcon estimates there are 383 potential operated horizontal locations within this acreage position. Many of the additional landing zones have been successfully drilled by offset operators in the area. This property is approximately 47% held by production and is 91% operated with an average working interest of 72%. The company is considering bringing an operated rig to this area in the second quarter of 2018.

Monument Draw Tack-On

Halcon also recently closed on the acquisition of 4,413 net acres contiguous to its existing Monument Draw area (the Monument Draw Tack-On). This acquisition increases the company’s Monument Draw base case location inventory by 48 operated locations with an average lateral length of 10,833-feet (assuming two Wolfcamp zones and one Bone Spring zone).

Well results and type curves on this acreage are expected to be consistent with the company’s existing Wolfcamp wells on its Monument Draw acreage (i.e. 1.9 MMBoe two-stream EURs for a 10,000-foot lateral comprised of 80% oil). Including additional target zones (additional Bone Spring, an additional Wolfcamp zone, etc.) Halcon estimates there are 104 potential horizontal operated locations on the Monument Draw Tack-On acreage. The company plans to actively de-risk these targets with its 2018 drilling program. This property is 96% operated with an average working interest of 88%.

Monument Draw East

Halcon also has an option agreement in place to purchase 7,680 net acres on the eastern side of its existing Monument Draw area (the Monument Draw East option). The company has until March 31, 2018 to elect to exercise this option at $10,000/acre.

The Monument Draw East option would increase the company’s Monument Draw base case inventory by 72 operated locations, all with a lateral length of 10,000-feet (assuming one Wolfcamp zone and one Bone Spring zone). Halcon estimates there are more than 144 potential operated horizontal locations on this acreage if other potential landing zones are included.

Well results and type curves on this acreage are expected to be consistent with the company’s existing Monument Draw acreage (i.e. 1.9 MMboe two-stream EURs for a 10,000-foot lateral Wolfcamp well comprised of 80% oil).

This property is 100% operated with an average working interest of 100%. The company recently completed fracing a 10,000-foot horizontal well in the lower Wolfcamp zone on the southern portion of the Monument Draw East option acreage (the Sealy Ranch 5902H well). Halcon ran a horizontal “shuttle log” in this well and expects this well to be productive based on the log results. This well was put online in late January 2018 and is currently flowing back.

In early January 2018, the company exercised the previously disclosed option it had to acquire 8,946 net acres in the northern area of Monument Draw for $108 million ($13,000/acre).

Pro forma for these acquisitions (including the exercise of the Monument Draw East option), Halcon will have acquired ~66,500 net acres in the Delaware Basin over the last year at an average acquisition cost of ~$17,800/acre (after adjusting for production using an estimated value of $35,000 per BOEPD and considering the estimated value of infrastructure acquired).

Q4 2017 production

Halcon estimates fourth quarter 2017 production at approximately 6,300 BOEPD. Fourth quarter production was below the company’s previous guidance range due to fewer wells put online in November and early December than previously forecast.

Fewer wells were put online primarily because of a delay in sourcing a spot frac crew early in the quarter. However, Halcon was able to contract two spot completion crews by mid-December to fully work through the company’s drilled but uncompleted well backlog. As a result, current production is approximately 11,000 BOEPD. The spot frac crews have been released and Halcon is currently operating with three drilling rigs and one completion crew on its Monument and Hackberry Draw acreage.

Halcon expects 2018 full year production to average between 15,000 and 19,000 BOEPD, excluding the impact of the West Quito Draw acquisition. Halcon expects to update its full year 2018 financial guidance in the future to include the impact of the West Quito Draw acquisition and any updates to its rig count.

Over the longer term, the company expects production to grow in excess of 50% annually in 2019 and 2020 assuming five rigs are running in 2019 and beyond.

Stock, Notes offerings

Halcon has priced a public offering of 8,000,000 shares of its common stock for anticipated gross proceeds of approximately $55.2 million, or $6.90 per common share. The underwriters have an option for 30 days to purchase up to an additional 1,200,000 shares of common stock from the company.

The company also intends to offer an additional $200 million in aggregate principal amount of its 6.75% senior unsecured notes due 2025. The additional senior notes are being offered as additional notes to the company’s 6.75% senior notes due 2025, of which approximately $425 million is currently outstanding.

The company intends to use net proceeds from the offerings to fund a portion of the purchase price for its recently announced acquisition of Southern Delaware Basin assets and for general corporate purposes.