Halcon Resources announced on May 18, 2016, the company reached an agreement with shareholders and bondholders to enter into a pre-packaged Chapter 11 filing.

“The restructuring plan, if implemented, will result in the elimination of approximately $1.8 billion of debt and approximately $222 million of Preferred Equity, and will reduce the company’s ongoing annual interest burden by more than $200 million,” the company said in a statement.

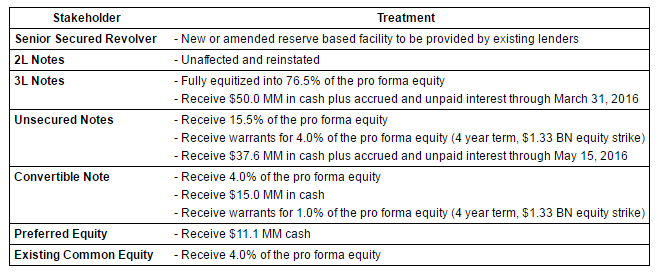

The Houston oil producer, which drills in North Dakota and Texas, said its prepackaged deal with creditors would convert some junior debt tranches into equity and provide cash to preferred equity holders. The company had $2.88 billion in long-term debt as of the first quarter 3/31/2016 filing. Halcon becomes the latest midsized U.S. driller to declare bankruptcy amid the toughest oil downturn in decades.

AS of May 13, 2016, Halcon had market cap of $125 million, a debt to market cap of 2301%, and a net debt to EBITDA ratio of 4.6 times. Halcon has long been saddled by high costs and debt, as evidenced by a cash margin of -$1.91/barrel. The largest cost in the cash margin calculation is interest, nad during the most recent quarter Halcon had an interest expense of $47.8 million compared to oil and gas revenue of $80.6 million.

Debtholders will hold most of Halcon’s shares after it emerges from bankruptcy protection, the company said in a statement, with existing common shareholders getting 4% of the pro forma equity and existing preferred shareholders receiving $11.1 million in cash.