Political instability in Kurdistan makes future uncertain

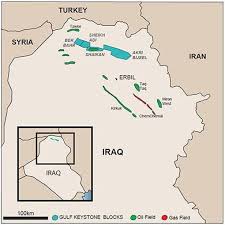

In its fourth quarter results, Gulf Keystone Petroleum (ticker: GKP, GulfKeyston.com), which operates in Iraq’s northern Kurdish region, said it may not be able to make payments to bondholders. Political instability in the region, combined with lower oil prices has left it, along with other operators in the Kurdistan region, without a definite source of income.

The Kurdistan Regional Government committed to regular payments of oil exports last month after disputes with the Iraqi central government, but there is still over $1 billion outstanding owed to Gulf Keystone and other oil companies.

Gulf Keystone reported $93 million in arrears for past sales of crude oil from the Shaikan oil fields and a further $85 million for the KRG’s share of past costs on development in the field.

This disruption to Gulf Keystone’s cash flow has left the company unsure if it can make repayments to its bondholders. The company owes $26.4 million to bondholders due in April and October of this year, as well as $250 million due April 2017 and $325 million due in October of next year.

Gulf Keystone CEO Jon Ferrier said “strenuous efforts are currently underway to strengthen the balance sheet,” but it remains unclear how the company will repay the $601.4 million it owes over the next two years.

The company’s full-year results showed a net loss of $135 million, and GKP CFO Sami Zouari said there was “low likelihood” of an asset transaction in the near future, given the company’s debt burden, current oil prices and geopolitical challenges in Iraq.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.