Expanded pipeline could grow to one million barrels per day of oil takeaway

Andeavor (ticker: ANDV), formerly known as Tesoro, will be partnering up with Phillips 66 Partners (ticker: PSXCP) and Buckeye Partners, L.P. (ticker: BPL) in two projects that will help transport Permian Basin oil to market.

The first joint venture project, Gray Oak Pipeline, LLC, is owned by Phillips (75%) and Andeavor (25%). The pipeline will provide crude oil transportation from West Texas to destinations in the Corpus Christi, Sweeny and Freeport areas.

Origination stations will be constructed in Reeves, Loving, Winkler and Crane counties in West Texas, as well as from locations in the Eagle Ford area in South Texas. The pipeline is expected to be placed in service by the end of the fourth quarter of 2019 and is backed by long-term, third-party, take-or-pay commitments with primarily investment-grade customers, Andeavor said.

Gray Oak earned second open season

According to Andeavor, Gray Oak has received enough volume commitments in the form of precedent agreements to hold a second binding open season. The overall scope and capacity of the pipeline will depend on the outcome of the open season, Andeavor said. Subject to the results of the second open season, Gray Oak could transport up to 700 MBOPD of crude oil from the Permian Basin to downstream markets.

Assuming the pipeline is fully subscribed, its capacity could ultimately be expanded to approximately 1 MMBOPD of long-haul takeaway.

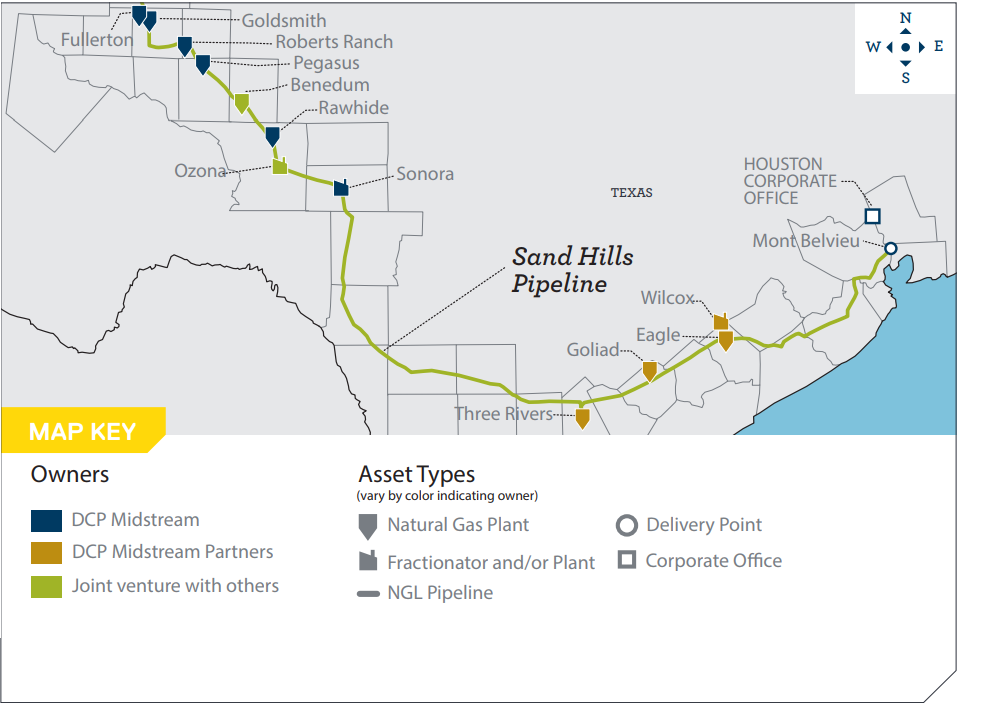

Phillips 66 Partners will construct and operate the pipeline, and a company spokesperson told Oil & Gas 360® that most of the Gray Oak system is expected to follow the same route as the existing Sand Hills pipeline.

Connecting assets

In Corpus Christi, Gray Oak will connect to a new joint venture marine terminal, the South Texas Gateway Terminal, which is under development by Buckeye Partners.

The terminal will be constructed on a 212-acre waterfront parcel at the mouth of Corpus Christi Bay. Buckeye said that two deep-water vessel docks capable of berthing Very Large Crude Carrier (VLCC) petroleum tankers are within the initial scope of construction.

Buckeye will have a 50% interest in the joint venture terminal and will be the operator, while Andeavor and Phillips 66 will each have a 25% ownership interest. The terminal will have an initial storage capacity of 3.4 million barrels and is expected to begin operations by the end of 2019. Buckeye also said that the facility can be expanded to include over 10 million barrels of storage capacity, as well as multiple additional docks and other inbound pipeline connections.

The combined system allows Andeavor to supply crude oil from its Delaware Basin gathering systems, improving commercial capability in the region. This will allow customers to access multiple markets on the U.S. Gulf Coast, as well as other markets through the marine terminal.

“The South Texas Gateway Terminal will serve as a premier open-access deep-water marine terminal in the Port of Corpus Christi,” said Khalid Muslih, EVP of Buckeye and president of Buckeye’s global marine terminals business unit.

“This project expands our presence in the important Corpus Christi market, which we believe offers strong competitive advantages for waterborne shipments of crude oil and other petroleum products from the fast-growing Permian and Eagle Ford shale plays,” Muslih said.

Muslih pointed to improvements at the company’s existing terminal, along the ship channel in the Port of Corpus Christi.

“This combined marine terminal presence in Corpus Christi will provide our customers with advantaged last mile solutions, including unmatched connectivity to two recently announced Permian Basin pipeline expansions,” Muslih said.