On November 8, 2017 Goodrich Petroleum Corporation (ticker: GDP) announced its financial results for third quarter of 2017 and provided an operational update.

According to the companies press release, adjusted EBITDA on a pro forma basis increased to $8.8 million in the quarter and discretionary cash flow (“DCF”), defined as net cash provided by operating activities before changes in working capital, was $8.3 million in the quarter.

Net income was $0.7 million in the quarter, or $0.07 per basic share ($0.05 per fully diluted share) versus a net loss of $1.2 million in the prior quarter, or ($0.13) per basic and diluted share.

Production for the quarter totaled 3.7 Bcfe, with average daily production of approximately 40,000 Mcfe per day (88% natural gas) growing sequentially by 11%, versus 3.3 Bcfe, or an average of approximately 36,000 Mcfe per day in the prior quarter.

Revenues for the quarter totaled $13.2 million, with 74% of our oil and gas revenue attributable to natural gas. The average realized price was $3.54per Mcfe ($2.96 per Mcf of natural gas and $47.85 per barrel of oil) or $3.59 per Mcfe when including cash settled derivatives ($3.01 per Mcf of natural gas and $47.85 per barrel of oil).

Low cost structure of new Haynesville Shale wells drives down operating expenses

Source: Goodrich Petroleum Inc.

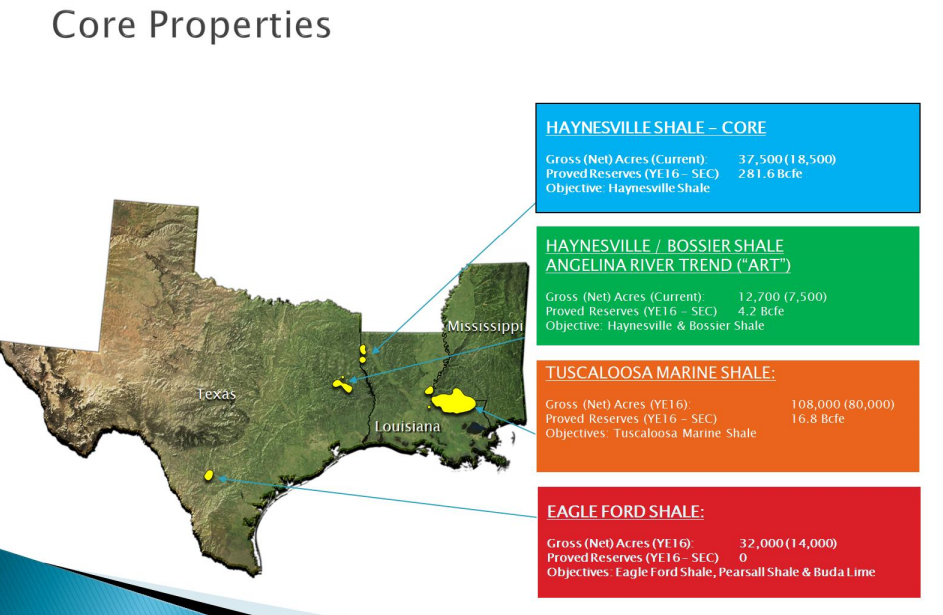

In the quarter GDP announced an acreage swap in the core of its North Louisiana Haynesville Shale acreage. This swap contributes to GDP’s 25.5 Bcf of proved undeveloped reserves.

Source: Goodrich Petroleum Corporation

Lease operating expense (“LOE”) was $2.2 million in the quarter, or $0.60 per Mcfe, versus $3.0 million, or $0.89 per Mcfe in the prior quarter. LOE for the quarter included $0.2 million, or $0.05 per Mcfe, for workovers. Haynesville wells drilled in North Louisiana have severance tax abatement until the earlier of payout or two years, and therefore the Company’s production and other taxes per unit of production is expected to remain low in the near term as new Haynesville wells are added.

Goodrich Petroleum has drilled its Franks 25&24 No. 1 well (69% WI, 50% NRI), which is a 10,000 foot lateral, and is currently drilling its Wurtsbaugh 25&24 Nos. 2 & 3 (55% WI, 39% NRI) wells from the same pad. The Wurtsbaugh 25&24 Nos. 2 & 3 wells are planned as 7,500 foot laterals to optimize the geographic configuration and reserve recovery for the company’s operated acreage, which carries a higher cash margin through lower gathering costs. Completion of the three wells is expected to commence late fourth quarter, which is driving the Company’s end of year or early January production rate guidance of 55,000 – 60,000 Mcfe per day.

The Company’s Haynesville acreage comprises approximately 50,000 gross (26,000 net) acres in Caddo and DeSoto Parishes, Louisiana and Angelina and Nacogdoches Counties, Texas. We estimate approximately 250 gross (100 net) locations prospective for the Haynesville on our core North Louisiana acreage, where the Company is allocating the vast majority of its capital expenditures in 2017.

Source: Goodrich Petroleum Inc.

Q&A from GDP Q3 conference call

Q: Rob, you’ve been real successful on the acreage swaps and trades, I’m just wondering now when you look at the position including the JV with Chesapeake, is there opportunities for more of this in the near term?

Chief Operating Officer, Robert C. Turnham Jr.: Yes Neal. Certainly hope so. It makes a lot of sense for both parties to — in essence get out of each other’s hair and expand the working interest in the wells that you already operate or certainly block off areas where you can add to your long laterals. And for us carry a lower gathering cost from our operated activity. So we’re hopeful, we have a very good dialog with Chesapeake. We continue to discuss how best to develop the acreage and so nothing definitive as we sit here right now, but we’re hopeful.

Q: Sticking with the 2018, I’m not asking for guidance here, but would be hopeful that you can give us a glimpse in just what approach — the general approach will be in 2018. Maybe just give us a look at kind of high level strategy and so objectives that you might have set as you approach next year?

Chairman and CEO, Walter G. Goodrich: Look, we’re delighted with the progress we’ve made so far in 2017. We will be meeting with our Board in December to review and set the preliminary plans for next year. But given the exit rate and the production rates as we enter next year in addition to the margin expansion that both Rob and I’ve mentioned and the enhanced hedge position, our expectation is that we will be able to increase capital expenditures for 2018 over 2017, continue the rate of growth that you’ve seen so far and be able to do all of that with limited to no incremental borrowings under our revolver as we get into 2018. So we’ll set that in December, we’ll put out a press release that kind of outlines our 2018 plans. But you can expect us to be a little bit more aggressive next year than we were this year.

Q: And if I’m looking at slide 12, those two offset Angelina River Trend wells do look thoroughly phenomenal. So you can give us maybe a little bit more color on that, what you saw there, little more profit it looks like, but anything else from the approach of that operator? And then just the logical follow-up there is, is that how you’re thinking about maybe testing your acreage down there in ’18?

Robert C. Turnham Jr.: Yes, the results are pretty phenomenal. We were concerned a little bit early on because the choke sizes were very small, but obviously that operator had a plan to minimize crushing or closures of the fractures, let them heal and then gradually open the choke. You can’t argue with the curve, you do forfeit some cash flow in your first four months or so. Based on how we’re flowing our wells back, our rates are certainly higher than that in the early time. And so we need a little more time to see how that curve shapes out over time just to be able to kind of more accurately portray what the cash flow might look like as well as the EUR. For us, it’s all about returns and generating higher PV10, higher cash flows and you want to obviously be conservative, but what drives the growth of our business, what drives us going forward is generating higher and higher cash flows. So we just need a little bit more time to monitor those results.

As to activity in 2018, all of our acreage in the Angelina River Trend is held by production and would basically becoming the donut hole in the middle of offset activities and all of our plans in 2018 are still going to be centered around North Louisiana. It’s more shallow there. Therefore, we think it’s a couple of million dollars less expensive to drill and complete wells in North Louisiana. So we’re actually mapping that out as Gil said for our December Board meeting. But you can see more of the same with a little more capital intensity.

Q: You mentioned next year moving to more 2-Well pads on more recurring basis, kind of wondering how we should think about cycle times changing as a result of that? I think in your type curves you guys have kind of a 60 days budget sales, I’m just trying to get a better handle on how that evolves with pad drilling?

Walter G. Goodrich: We’ve made no change yet in that. I think the real question is securing the frac crews and completions in order to maximize efficiency as we’ve just done here with these last few wells, could cost things to move around a little bit. But we’ve not made any wholesale change to the overall plan and we are expecting and hoping frankly that we’re going to see a little bit more flexibility and capacity for securing those days out in front of ourselves that should keep that pretty much on schedule.

Robert C. Turnham Jr.: I might just add that obviously you’re drilling two wells instead of one, so in essence, kind of 60 days of drill time for both wells, you got to do it a little bit quicker than that because as Gil described earlier, you’re walking the rig and able to enjoy a lot of efficiencies there. So if you look at 60 days, you’re really looking at 90 to a 100 day spud to completion for two wells instead of 60 days, budget sales over the one.

Q: And then just on these upcoming batch of wells here, and you guys as well as other operators have kind of tweet between it seems like four to five kind of seems to be the honey spot there. Just kind of wondering if you guys are laying in one way or the other, it seems like the shorter lateral 5,000 pound well, you guys had the real strong performers, I just wonder if you guys are kind of narrowing in on either end of that spectrum?

Walter G. Goodrich: We are monitoring that very closely. You probably just saw Chesapeake announced a series of wells in their 3Q earnings that were all 2,600, 2,700 pounds per foot, which is obviously considerably lower than what we’ve seen in the past. The wells that Rob was talking about a second ago at Angelina River are again about 2,700 pounds per foot. So we’re trying to figure out thus perhaps tightening up the spacing a little bit, but backing out the profit, end up saving you a little bit of money and delivering the same type of results. I think it’s still an open question. That being said, we are planning on 4,000 pounds plus on these upcoming wells that we’re going to frac in between now and end of the year.

Q: Slide 17 shows four wells completed — to be completed in 1Q ’18, are those operated or non-op wells and what’s the working interest on those?

Walter G. Goodrich: It’s probably going to be six wells instead of four. We’ve had four non-operated well proposals come in the door over the last 30 days, all of which obviously caused our CapEx budget to go back up by the midpoint of about $5 million. All four of those wells are scheduled to be completed in the first quarter. So basically, call it a half of the net well four gross the half of the net well. But we’re also scheduled the frac — the two Cason and Dickson wells in the first quarter. And that’s, as I said, about 79% working interest, 51% net revenue interest. So I think we should have probably updated this slide 17 to state six additional long lateral wells completed in first quarter.

Q: And I know it’s early for ’18, but do you guys have a general idea of what the non-op program will look like or at least how you think it will all unfold?

Walter G. Goodrich: We are expecting as many as six non-operated gross wells, again our interest will be less than 50% in those wells, and those I think are scheduled kind of mid-year, middle of second quarter alone call it June 1st, and we don’t know about other offset operators for example two of the wells that we just received well proposals are from Covey Park on our kind of southeastern side of our Bethany-Longstreet acreage. So we’re trying to get a handle with all of the offset operators as to what their plans are. But the vast majority of our activity, if we continue to run one rig is going to be operated and so I think if you look at the metrics going forward, that’s why we’re confident that you’re still going to see improvement on our per unit costs across the board, just because of majority of the activity being operated.

Q: So it sounds like we could see some front-end weighted growth for next year, is that right?

Walter G. Goodrich: I think that’s right. In fact, we had a call earlier today by pushing the peak exit rate to right at the end of the year or perhaps slightly into January, that causes those three wells to produce more in the first quarter than they would have had they come online two or three weeks earlier. So clearly you’re just kind of shoving some of that production into the first quarter and then we clearly have four additional wells that weren’t in our original path or budget that are non-operated and can be completed in the first quarter that perhaps needs to be baked in the year modeling.