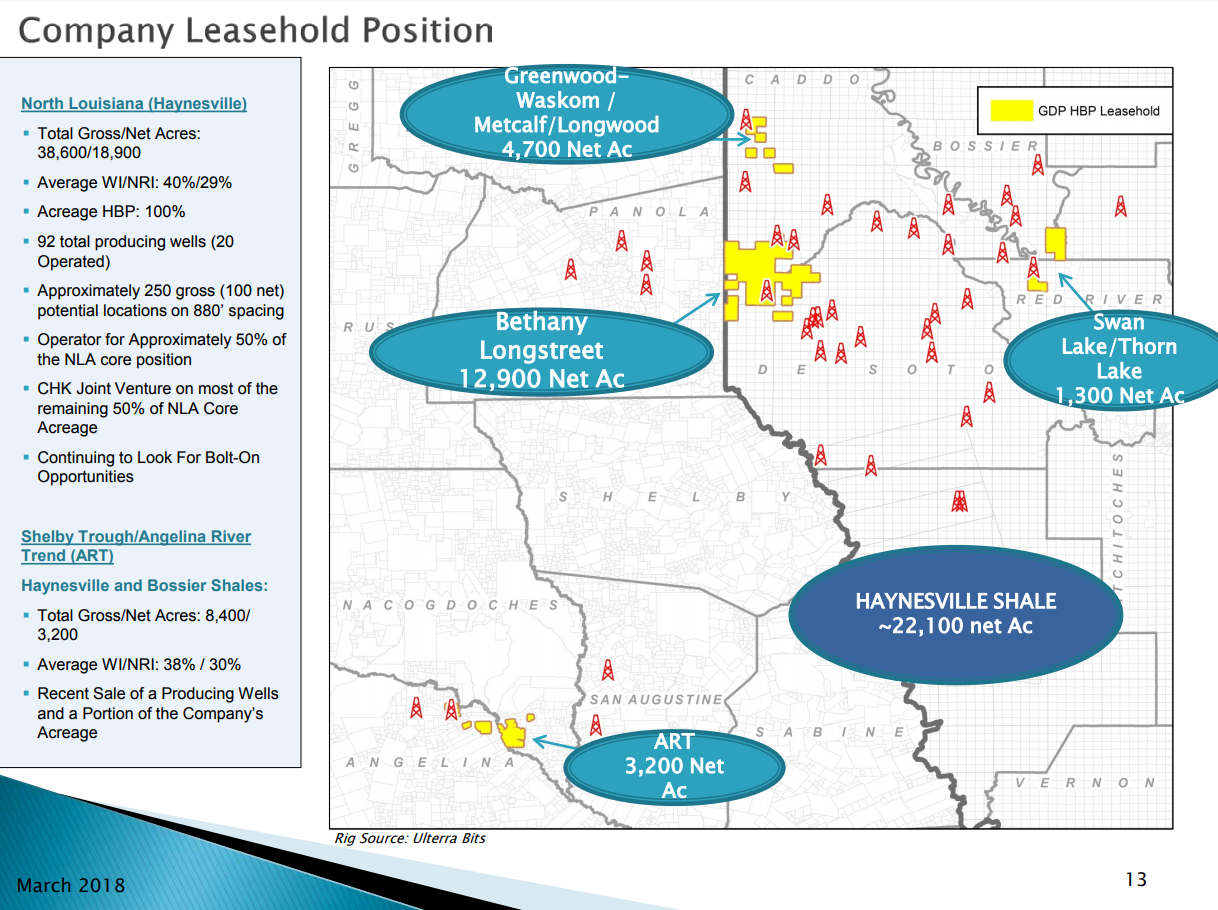

In its Q4/year-end release, Goodrich Petroleum Corporation (ticker: GDP) said it has recently closed on the sale of certain production, facilities, infrastructure and a portion of its acreage in the Angelina River Trend to BP America Production Company. Goodrich said it will use a portion of the proceeds from the sale to pay off its revolver, with plans to accelerate development of its North Louisiana Haynesville asset in the second half of 2018.

Slide three of the March 2018 presentation shows that the asset(s) were to be sold for $23 million.

Brief Haynesville update

- The Wurtsbaugh 25&24-14N-16W 2H (55% WI) well in DeSoto Parish, Louisiana has recorded a 24-hour peak rate to date of approximately 25,000 Mcfe/d from a producing lateral length of 7,249 feet

- The Wurtsbaugh 25&24-14N-16W 3H (55% WI) well in DeSoto Parish, Louisiana has recorded a 24-hour peak rate to date of approximately 30,000 Mcfe/d from a producing lateral length of 7,465 feet

With the completion of these wells, the company is currently producing approximately 60,000 Mcfe/d and expects to commence fracking operations on its next two wells, the Cason-Dickson 14&23 No. 1 & 2 (92% WI) wells in early March.

Reserves grew by 41%, F&D cost of $0.28/Mcfe

Goodrich said that its proved oil and natural gas reserves, as of December 31, 2017, increased by 41% to 428 Bcfe, versus 303 Bcfe at year-end 2016. PV-10 for year-end 2017 proved reserves was $264.2 million. Natural gas reserves comprised 97% of the total.

The company had reserve additions and positive revisions of 138 Bcfe from drilling and completion capital expenditures of $38.7 million, for an organic finding and development cost of $0.28 per Mcfe. However, when taking into account the costs incurred in 2017 associated with wells of new developed reserves from probable, proved undeveloped conversions and workovers, the developed finding and development cost was $0.87 per Mcfe, Goodrich said.

Financial details, CapEx

The company reported a net loss of $1.8 million in the fourth quarter of 2017, or $(0.17) per basic and fully diluted share, versus a net income of $0.7 million in the prior quarter, or $0.07 per basic and $0.05 per fully diluted share. Net loss for 2017 was $8.0 million, or $(0.80) per basic and fully diluted share.

The company exited the fourth quarter of 2017 with $26.0 million of cash and $63.7 million of total principal amount of debt, for net debt of $37.7 million. After ART is sold to BP, the company projects net debt of approximately $15 million.

Capital expenditures, including non-cash accruals, totaled $16.0 million and $41.8 million in the quarter and year ending December 31, 2017, respectively, with the majority of the expenditures being spent on drilling and completion costs for the company’s recent Haynesville operated wells. Net cash used in investing activities was $7.0 million and $28.2 million in the quarter and for the year, respectively.

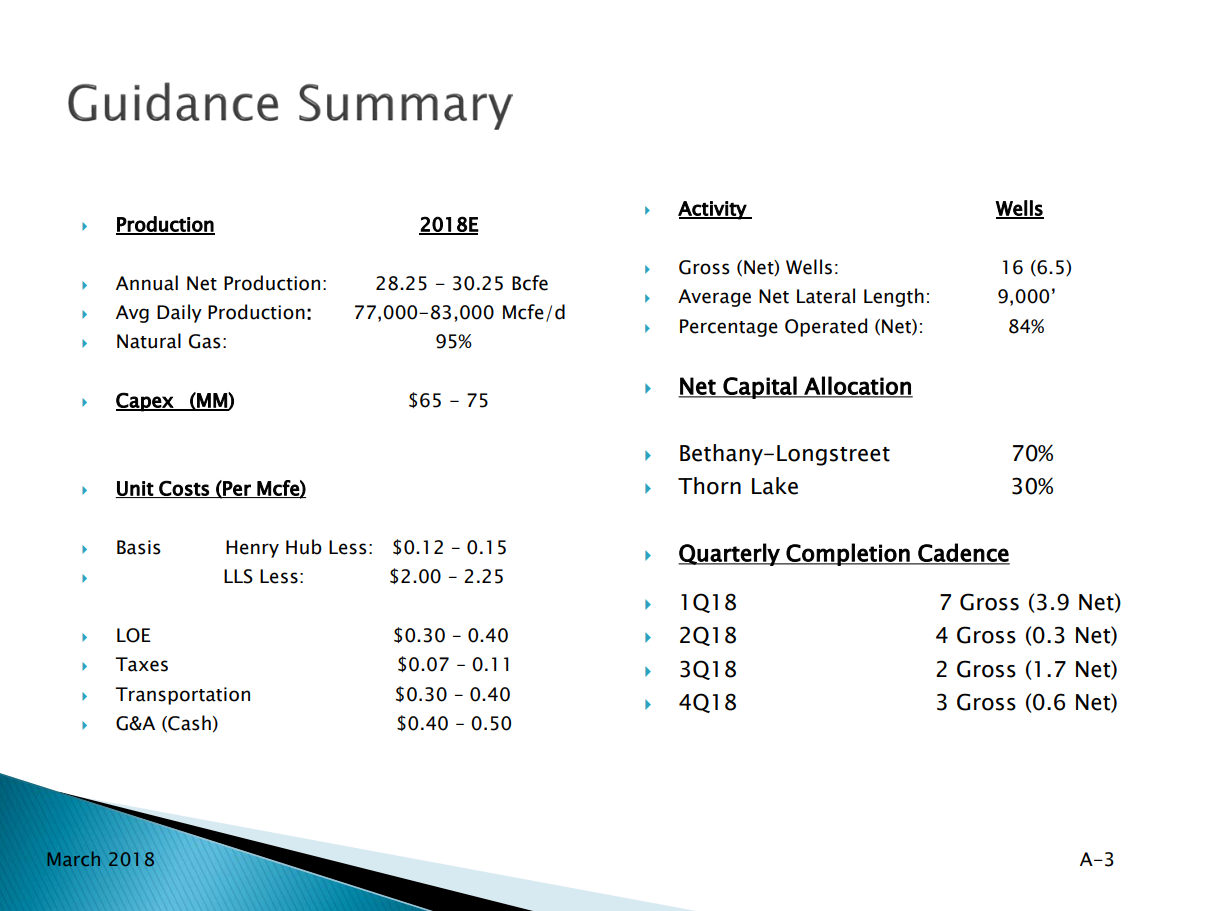

The company said that it is maintaining its capital expenditure guidance for 2018 of $65-$75 million, and plans to accelerate development of its core, North Louisiana Haynesville asset in second half of 2018.

Production, drilling

- No new wells were added in Q4 2017

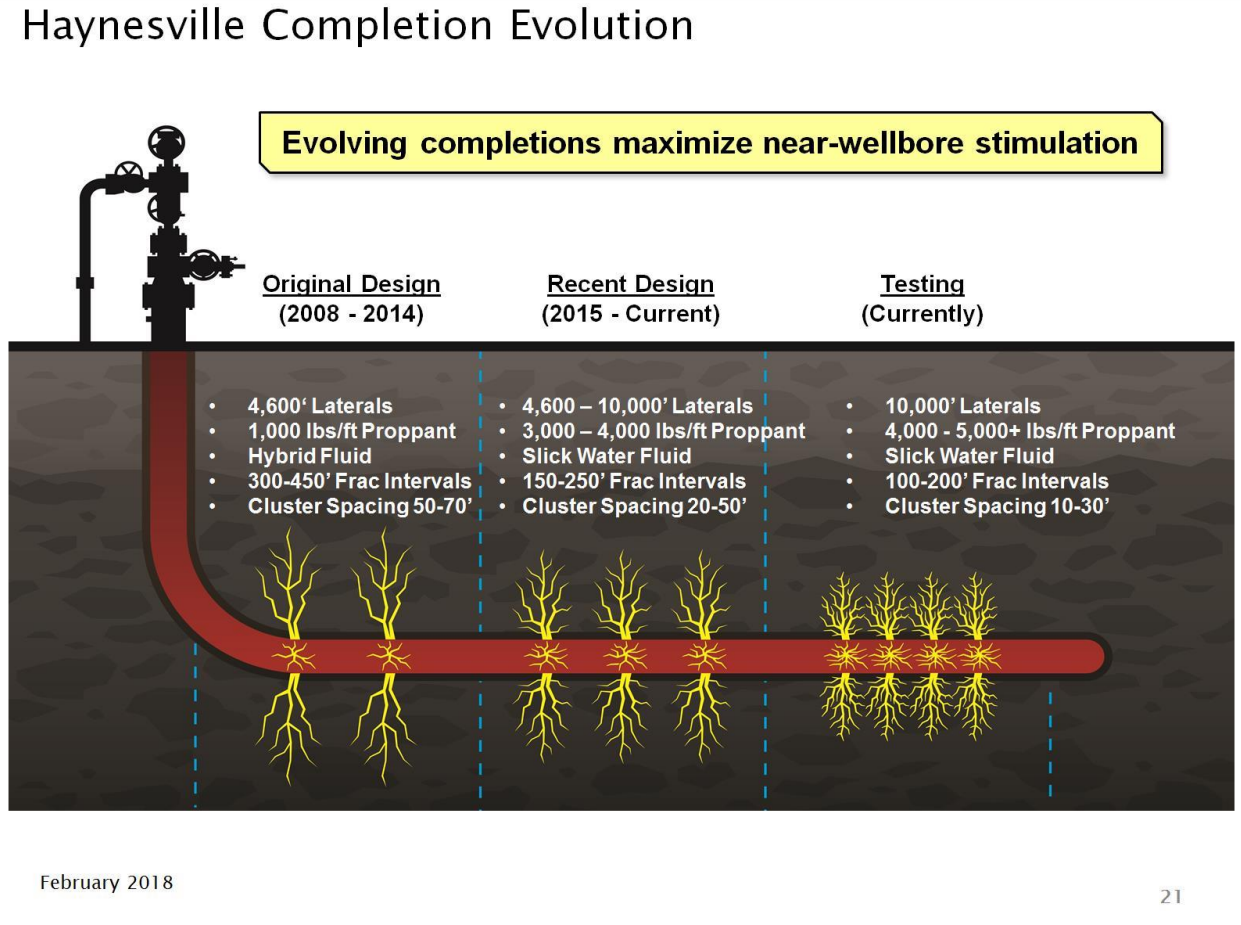

- Goodrich plans to drill approximately 16 gross (6.5 net) wells in 2018, with average lateral lengths of ~9,000 feet

- 2018 guidance of 77,000-83,000 Mcfe/d

Production for the fourth quarter of 2017 totaled 2.9 Bcfe, with average daily production of approximately 31,200 Mcfe/d (86% natural gas). Production was affected by shut-ins during the month of December of an estimated 3,000 Mcfe/d, as offset frac operations were conducted.

Production for the year totaled 12.2 Bcfe, with average daily production of approximately 33,300 Mcfe/d (85% natural gas).

Source: EnerCom Dallas 2018 Presentation