As competition in Asia increases, Saudi Arabia turns to European Buyers

As competition in Asia has become increasingly fierce as producers look to gain the largest possible foothold in the world’s fast growing markets. The fight for market share is so intense that the world’s largest crude oil exporter, Saudi Arabia, has been forced to reduce supplies to Asian markets in the face of growing deliveries from Russia, Kuwait and Angola, Seth Kleinman, head of energy research at Citigroup, told Reuters.

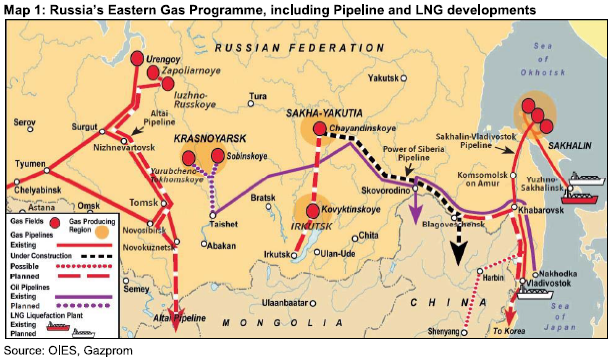

Russia, in particular, has been looking to increase its exports to Asian markets as worsening political ties encourage buyers in its traditional European markets to explore new options. Interestingly, as Saudi Arabia loses supply to Russia in Asia, OPEC’s largest producer has been putting increasing commercial pressure on Russia in Europe.

Trading sources told Reuters that majors such as Eni (ticker: E), ExxonMobil (ticker: XOM), Royal Dutch Shell (ticker: RDSA) and Total (ticker: TOT) have been buying more Saudi oil for their refineries in Western Europe and the Mediterranean in the past few months.

Even refiners like PKN ORLEN (ticker: WSE: PKN) and Lotos (ticker: WSE: LTS) in Poland have been increasingly turning to Saudi Arabia as the kingdom offers more competitively priced oil. Trading sources said at least one cargo reached the Polish port of Gdansk in September and two more could come in October. The crude oil being stored in Gdansk can supply eastern European customers or be sent to Germany to compete with Russian crude sent down the Soviet-built Druzhba pipeline.

“I’m buying less and less Russian crude for my refineries in Europe simply because Saudi barrels are looking more attractive,” said a trading source with a one major, who asked not to be named because he is not allowed to speak to the media. “It is a no brainer for me as Saudi crude is just cheaper.”

Trading markets

Saudi Arabia’s aggressive price discounting in Europe will only add to the pressure Russia is feeling in what has been its primary market traditionally. Russia has been pushing to export more of its production to China, but the Chinese market has been extremely cautious about becoming too entangled with Russia.

As China’s concerns become more apparent, Russia is beginning to realize that the turn to Asia may not be as substantial as it had originally thought, experts told Oil & Gas 360®. “Russia is realizing the situation, and having to adapt their strategy in Europe from one where they can almost threaten the Europeans with ‘we’ll send our gas to Asia if you don’t want to buy it,’ to ‘oh dear, we don’t really seem to have an Asian market, we better make sure the Europeans actually want to buy our gas,’” Dr. James Henderson of the Oxford Institute for Energy Studies said.

Russia may find returning to European markets even more difficult in the months to come as Iran looks to bring its production back online. Iran supplied five to ten percent of Europe’s crude before 2012, and with plans to ramp up production to 5 million barrels per day, competition will only become stiffer.

This could color discussion between the two oil export giants as they prepare to discuss oil markets at the upcoming OPEC meeting on October 21. The meeting will include seven to eight non-OPEC members, according to OPEC Secretary General Abdalla Salem el-Badri. The additional countries have not been official confirmed by OPEC, but it appears that Russia’s Minister of Energy Alexander Novak will be among those attending.

A statement from Venezuela’s Minister of Oil and Mining and President of state-run PDVSA Eulogia del Pino confirmed that Pino had spoked with his Russian counterpart about topics including “cooperation among members of the Organization of Petroleum Exporting Countries and other non-OPEC oil-producing countries,” reports NDTV.

When Russia was called on to cooperate with OPEC in November of last year, the country said that it would maintain its production as it looked to defend its market share in much the same OPEC sought to do. A statement from Novak on October 3 signaled a change for Russia, however, with the energy minister saying, “If such consultations are to happen we are ready to take part.”

Tensions are high between Moscow and Riyadh as Russia uses its military to back Syrian President Bashar al-Assad, an enemy of Saudi Arabia. Trying to undercut one another in export markets may only further exacerbate political ill-will ahead of the next OPEC meeting.