Latin American E&P operator GeoPark Limited (ticker: GPRK) released a production update today, noting that current production is currently at 35 MBOEPD. This figure includes production from the recent Argentina acquisition.

- Oil production increased by 33% to 27,345 BOPD (up 8% compared to Q4 2017)

- Colombian oil production increased by 37% to 26,303 BOPD (up 8% compared to Q4 2017)

- Gas production increased by 3% to 29.1 MMcf/d (down 9% compared to Q4 2017)

- Oil production increased by 33% to 27,345 BOPD (up 8% compared to Q4 2017)

- Colombian oil production increased by 37% to 26,303 BOPD (up 8% compared to Q4 2017)

- Gas production increased by 3% to 29.1 MMcf/d (down 9% compared to Q4 2017)

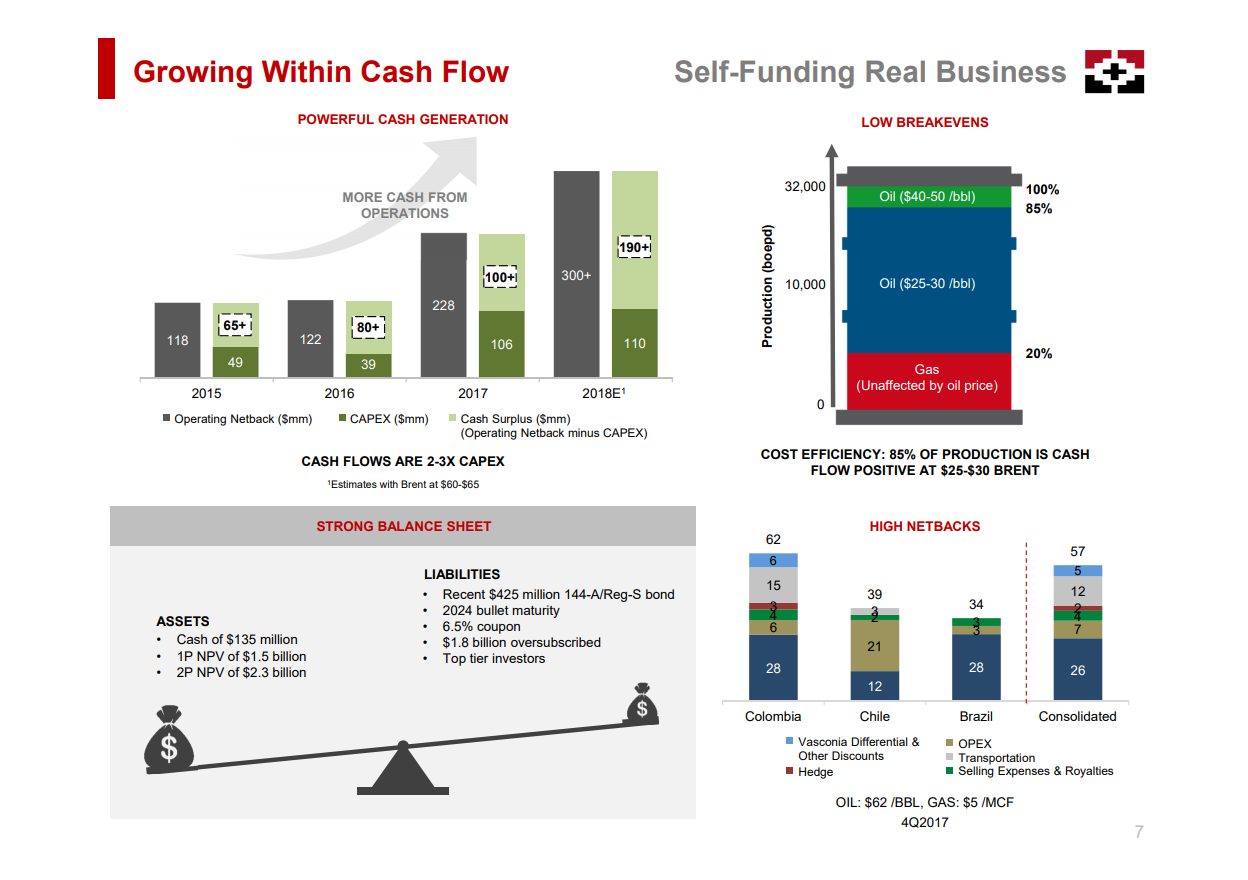

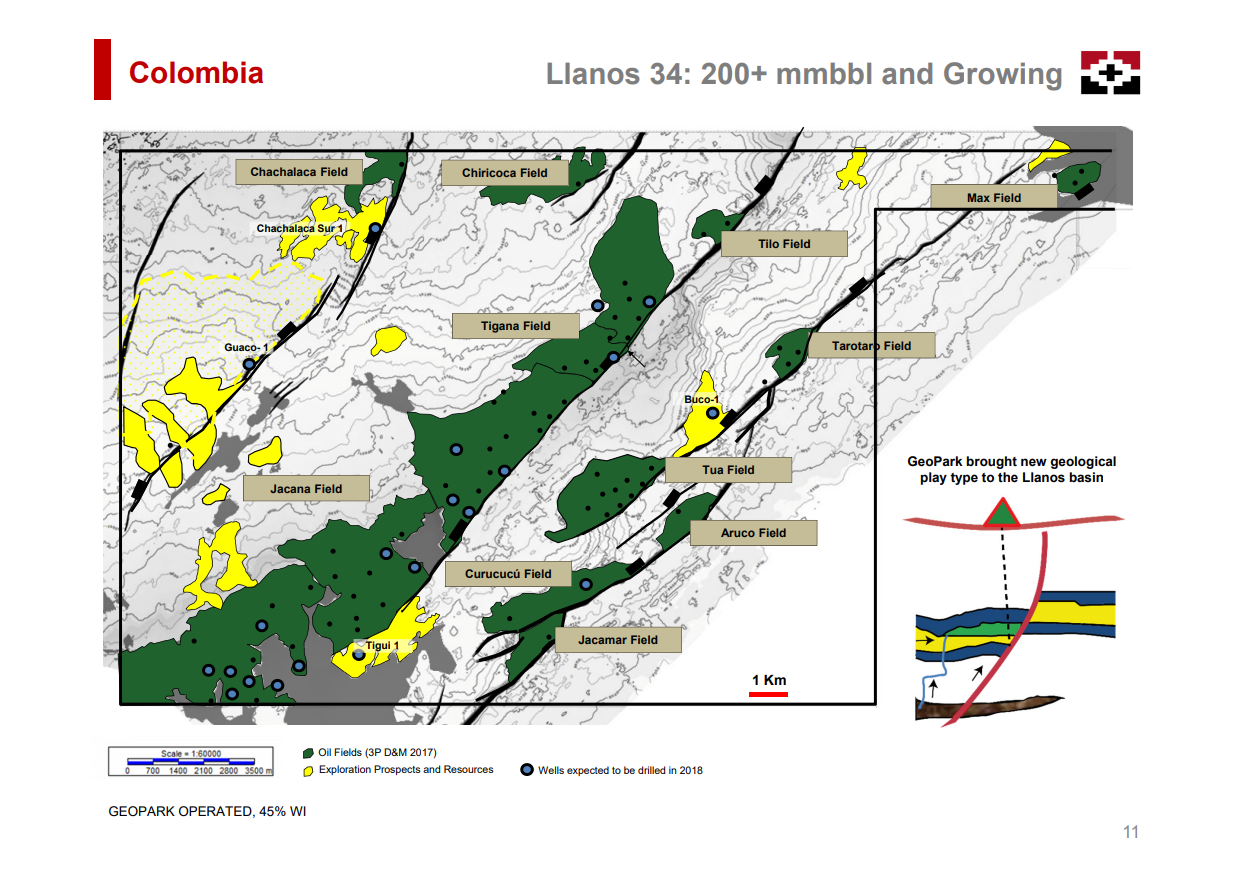

In Columbia, the Tigana Norte 6, Tigana Norte 7 and Jacana 20 development wells have been drilled, tested and put on production, adding approximately 3,000 BOPD gross in the Llanos 34 block (GeoPark operated, 45% WI). This brings current gross production to 58,000 BOPD.

Four other wells were drilled and are currently undergoing testing in Columbia, GeoPark said. The company plans to drill seven new wells – six will be in the Llanos 34 block, and one new exploration well in the Tiple acreage.

Additionally, Chile’s Uaken 1 exploration well has been tested and put on production from a new shallow gas play in the El Salto formation.

Argentina acquisition

On March 27, 2018 GeoPark closed its acquisition in the Neuquen Basin to acquire a 100% working interest and operatorship of the Aguada Baguales, El Porvenir and Puesto Touquet blocks. The blocks include current oil and gas production of 2,400-2,500 BOEPD (65-70% light oil and 30-35% gas) and 2P reserves of 12-14 MMBOE. The company reports that it now has 137,000 acres in the Neuquen Basin.

The agreed purchase price was $52 million, of which $15.6 million was paid in December 2017 and the remaining $36.5 million on March 27, 2018. According to the terms of the agreement, GeoPark will receive net cash generated from the blocks between the execution of the agreement on December 18, 2017 to closing date on March 27, 2018, in the amount of approximately $2-$3 million.