The story surrounding Freeport-McMoRan’s (ticker: FCX) oil and gas assets continues to unfold as the mining giant announced last week that it would withdraw its registration to sell shares in the unit.

“At this time the company has determined not to proceed with the initial public offering contemplated by the registration statement,” the company said in a filing. FCX initially filed its registration statement on June 23, 2015.

The company initially purchased the assets in 2012 for $19.6 billion, including the assumption of debt. At the time, the purchase made sense, but when oil prices cratered at the end of 2014, the Freeport was suddenly saddled with more than $20 billion in debt, largely from the acquisition.

“You should not be this leveraged,” said FCX’s Vice Chairman, President and CEO Richard Adkerson during the company’s most recent conference call. When prices decline as part of commodity downturn, “having this kind of debt is a killer,” he said.

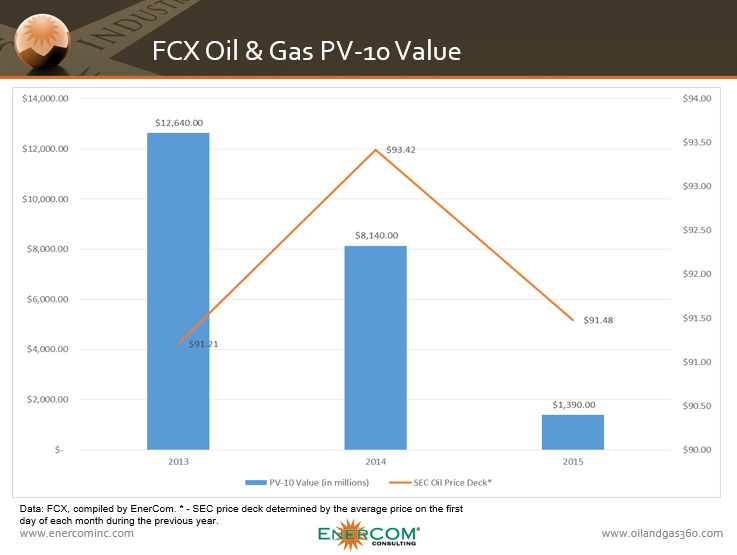

The PV-10 value of the oil and gas assets has decreased dramatically since the company bought them in 2012. In its 2013 year-end filings, FCX reported the value of the assets at $12.6 billion. Just two years later, that number fell nearly 90% to just $1.4 billion.

With oil prices still well below the highs seen when Freeport originally bought the assets, it remains to be see who might buy its substantial oil and gas portfolio. Sources who spoke with Oil & Gas 360® thought the former-CEO of FCX’s oil and gas arm, Jim Flores, might be the potential buyer, but no purchaser, Flores or otherwise, has yet to step forward.