Stated target value to eliminate Incentive Distribution Rights (IDRs) is in question: Fox says that Marathon Petroleum’s 15x – 20x multiple for elimination of IDRs will damage MPLX unitholders, including MPC, the largest MPLX unitholder

John M. Fox, co-founder and former chairman, president and CEO of MarkWest Energy Partners, yesterday published two letters directed towards the MPLX GP LLC Conflicts Committee and the Board of Directors of Marathon Petroleum Corporation (ticker: MPC).

Fox’s former company MarkWest Hydrocarbon was acquired by Marathon Petroleum’s Ohio-based master limited partnership—MPLX (ticker: MPLX)—in 2015, a transaction that created the nation’s fourth largest MLP. MPLX provides midstream gathering, processing and transportation of crude oil, natural gas and natural gas liquids in the U.S.

To the MPLX GP LLC Conflicts Committee: the multiple should be 12x – 14x

In his letters published yesterday, Fox wrote, “I support Marathon Petroleum Corporation’s (MPC) decision to eliminate the Incentive Distribution Rights (IDRs) burden on MPLX. It is my belief, however, that MPC’s stated target of a 15x – 20x multiple for the elimination of pro forma IDRs is in direct opposition to the interests of the unitholders of MPLX and will ultimately damage both MPC (the largest holder of units) and MPLX in the long-run.”

Fox says Marathon is valuing the IDRs far above established levels

Fox said that an IDR transaction range of 15x-20x was far above established levels for this type of deal. He then compared it to recent transactions, such as the Plains All American Pipeline (11.6X), Andeavor Logistics (13.1X), and HollyFrontier (14.1X). After giving the three examples, he said that there was a clear precedent for a 12x-14x multiple.

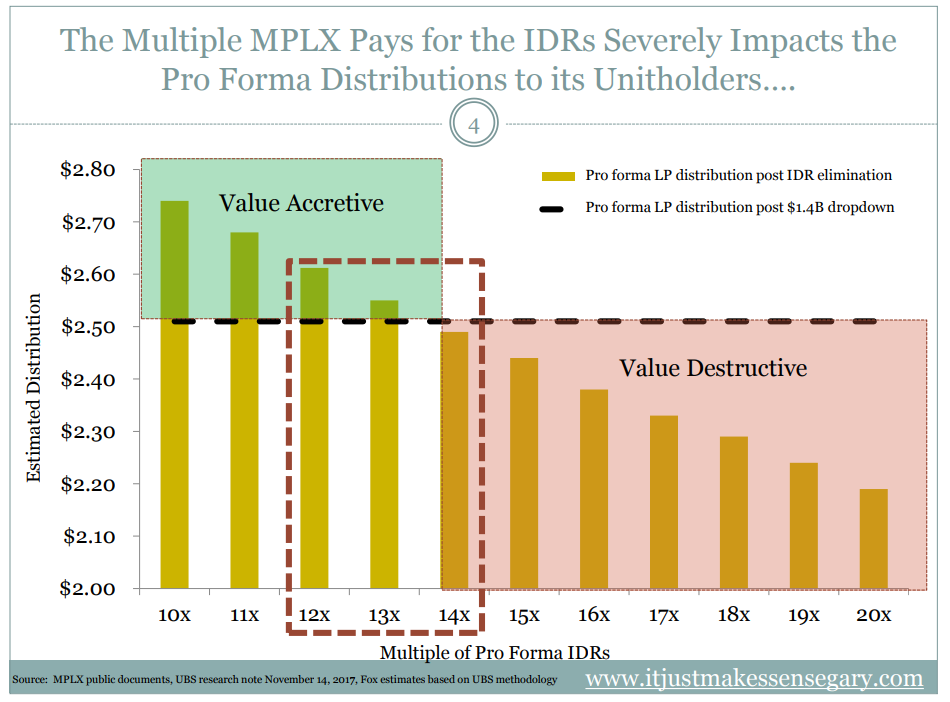

“Additionally, based on my analysis, at any valuation above 13.7x, pro forma MPLX future distributions will need to be cut and value destroyed,” wrote Fox. “Every new share that MPLX issues as a result of an inflated IDR valuation puts pressure on current distribution and future growth potential,” he added.

“As MPC will remain MPLX’s largest long-term holder, it is imperative to approach valuation of the IDR elimination with value creation in mind. I urge you to not to agree to this transaction at an unjustified multiple, and to ensure that the transaction is completed at a price that is fair and reasonable to the Partnership.”

Additional letter highlights

- “I strongly disagree on the valuation MPC management is placing on MPLX’s GP. As MPLX’s largest holder, I am concerned that such a valuation will destroy long-term value for both MPLX and MPC.”

- “The valuation of the IDR transaction has material impacts on MPC’s long-term value, and could vastly diminish growth prospects at MPLX ultimately raising the cost of capital and destroying value for both companies.”

- “It is really very simple, every new share that MPLX issues as a result of an inflated IDR valuation puts pressure on current distribution and future growth potential.”

Original letters

Fox remains active in looking for ways to create value at MPLX

Fox issued a press release on Jan. 30, 2017 reaffirming his stance against Marathon Petroleum’s proposed January 3, 2017 plan.

Fox said at that time that his own proposal to eliminate Incentive Distribution Rights (IDRs) would provide immediate uplift in value for MPC shareholders. Fox said that his former company, MarkWest, generated a 143.3% total return and grew from a $1.2 billion market cap to an $8.6 billion market cap for the period of September 5, 2007, when the IDRs were eliminated at MarkWest, to December 4, 2015, when MarkWest merged with MPLX.

“Don’t put MPLX in the penalty box,” Fox said in the January press release. “Our simple and less risky plan puts us on a growth path to value creation. If managed properly, MPLX has years of double digit organic growth ahead with high rate of return projects built on its substantial core infrastructure.”

In his letters dated Dec. 5, 2017, Fox reports that he is the beneficial owner of 1,544,172 MPLX common units, and 20,900 shares of Marathon Petroleum Company, through its merger with MarkWest in 2015 and from follow-on investments. Fox has posted his letters and a slide presentation on his website.