Novatek struggles to fund its 16.5 million ton per annum Yamal LNG project

Efforts to finalizing financing on the only liquefied natural gas (LNG) project currently under development in Russia have stalled. Tarko-Sale, Russia-based Novatek (ticker: NVTK), the lead company on the project and Russia’s largest privately-owned natural gas producer, may continue looking for financing into next year, reports Reuters.

The company has already invested roughly $10 billion into the project, which it expects to cost about $27 billion, but is looking for new sources of financing as those from China remain unattractive, two Russian banking sources said.

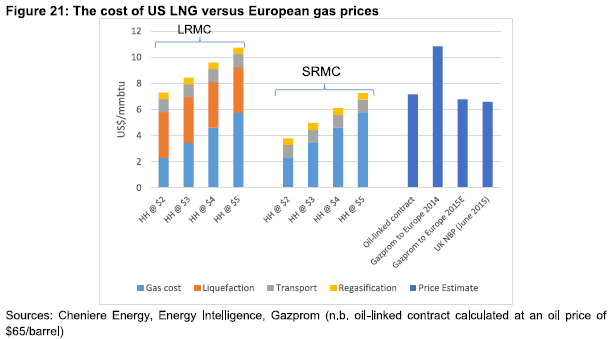

“Chinese money is expensive, so Novatek and Total would like European banks to take on the larger share of financing which is complicated by sanctions,” the source said.

“There is no movement at the moment,” another source said. “Of course, everything could be done in the course of one night … but so far it looks unlikely that there will be anything before the year-end.”

Novatek has a 50.1% stake in what will be only Russia’s second LNG plant. France’s Total and China’s CNPC hold 20% each. And last month, Novatek agreed to sell a 9.9% stake to the China Silk Road Fund for an undisclosed amount.

Russia’s state development bank VEB has pledged $3 billion in banking guarantees, while the country’s Sberbank and Gazprombank preliminarily agreed to provide $3 billion and $1 billion in loans, respectively.

In written comments, Sberbank said it still planned to provide the ruble equivalent of $3 billion as part of a wider syndication loan.

“The process of arranging such financing is complex and assumes the participation of many lenders so it is hard to predict when it will be completed,” Sberbank said.

Project financing for Yamal LNG has been particularly difficult, as Novatek is under direct sanctions from the U.S. and Europe as part of the regime put in place following Russia’s actions in Crimea.

“The delay in announcing project financing for Yamal LNG also raises concerns about the project’s timing and possible increased equity investment in the project,” Goldman Sachs said in a research note on Monday.

Sberbank last week offered Novatek a credit line capped at 50 billion rubles ($805 million) which could be used for Yamal as well, the bank said in emailed comments.

Novatek has secured 150 billion rubles from Russia’s rainy-day National Wealth Fund and Total (ticker: TOT) CEO Patrick Pouyanne said last week that financing for the Yamal LNG project was “on track”.

A “huge change in the Russian export strategy”

Russian natural gas producers have been looking towards LNG as a new avenue of exports for more than a decade, Dr. James Henderson and Dr. Tatiana Mitrova, experts on the Russian oil and gas industry, told Oil & Gas 360®. Sanctions cutting Russian companies off from Western financial markets have cut the capital-intensive projects off from a much need lifeline, however.

In 2013, the Russian government granted permission for projects operated by Novatek and Rosneft to sell LNG to overseas markets while Gazprom was trying to expand its existing project on the island of Sakhalin and build a new plant at Vladivostok.

“All three companies’ plans have been set back to varying degrees by a combination of political and commercial issues,” said Henderson and Mitrova in their report. “The impact of U.S. and E.U. sanction, in particular on the ability of Russian companies to raise long-term finance, and the fall in oil (and as a result gas) price in Asia have undermined Russia’s prospective LNG projects,” said Henderson

“At one point, it looked like there were projects that could have seen upwards of 50-70 million tons of Russian LNG in the market sometime in the 2020s,” Henderson told OAG360®. “Now it’s looking like a total number closer to 25 million tons by the early 2020s and we’ll see what happens after that.”

“[Projects other than Yamal] seem to be postponed past 2020,” added Mitrova. “That’s a huge change in the Russian export strategy. LNG is becoming unavailable for a period of time.”