Q3 highlights

- Average net sales volumes of 62,884 BOEPD including 34,607 barrels per day (Bbl/d) of oil

- Net loss of $29.8 million, or ($0.20) per basic and diluted share

- Turned to sales 30 gross (27 net) operated wells with an average lateral length of approximately 7,900 feet, and completed 51 gross (34 net) wells with an average lateral length of approximately 10,300 feet

- Completed 3,053 total stages, pumping approximately 965 million pounds of proppant

- Midstream CapEx totaled approximately $302 million

Extraction Oil & Gas (ticker: XOG) Chairman and CEO Mark Erickson said, “Our drilling and completion capital expenditures increased relative to our initial expectations driven largely by our decision to utilize a fourth completion crew to reduce the cycle time on our 22-well, 2.5-mile lateral Triple Creek pad in Greeley. Increased efficiencies on the drilling side resulted in spudding an additional 14 net wells compared to our initial budget. While neither of these activities impacted our production during the third quarter, they will both contribute significantly to our 2018 growth.”

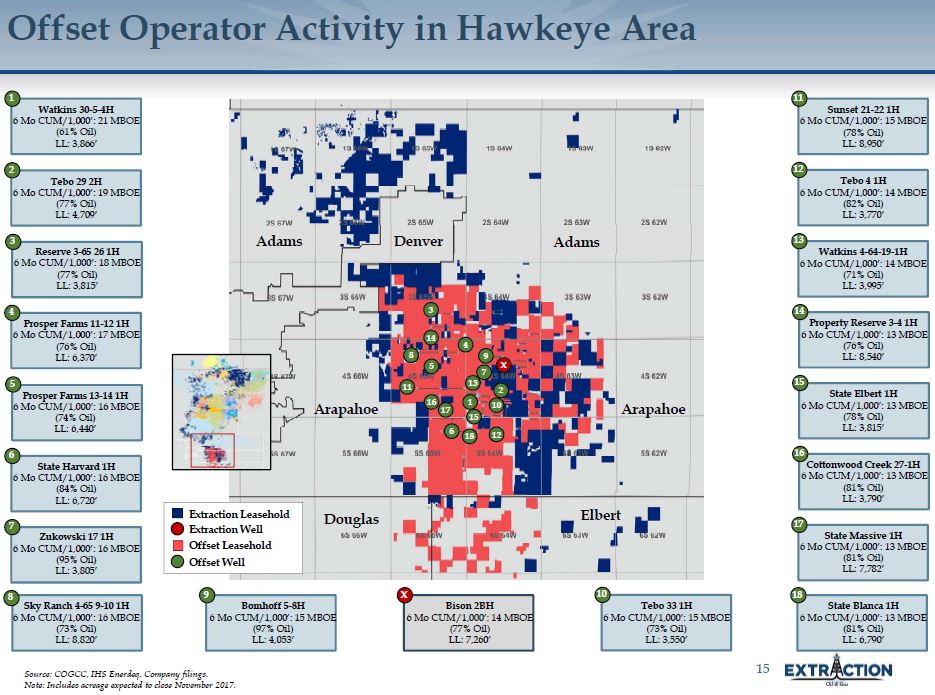

Hawkeye Area

Extraction Oil & Gas has acquired acreage in its New Acquisition Area, now referred to as the Hawkeye Area, located predominately in Arapahoe and Adams Counties in the Southern DJ Basin. This brings Extraction’s expected total investment in its Hawkeye Area to approximately $450 million for roughly 60,000 net acres with approximately 77 percent working interest.

To date, over 30 wells have been drilled in this area, and many of which have exhibited some of the highest oil production rates in the DJ Basin. Extraction believes this acreage is very comparable with core Wattenberg in terms of Niobrara thickness and expects to develop 12-16 wells per section.

The Hawkeye Area is some of Extraction’s most rural acreage, and as such, has allowed the company to quickly secure permits. Extraction currently has over 100 permits approved and over 110 more in process. Extraction is currently negotiating with third parties to maintain competitive rates similar to other operating areas.

Extraction said, “We have assembled a large, high-quality, majority operated drilling inventory of over 1,000 gross locations with an average lateral length of 8,800 feet. With the inclusion of the Hawkeye Area, Extraction now has approximately 160,000 net acres in the core of the DJ Basin and 155,000 net acres in the Northern Extension.”

Broomfield

Broomfield City Council approved the operator agreement with Extraction in Oct. The agreement allows development of a 12,000 gross acre block. With the approval of Extraction’s Broomfield operator agreement, the company now has a clear pathway to completing the spacing and permitting process for the remainder of its Broomfield leasehold. Extraction still plans to spud its initial Broomfield wells from the Coyote Trails pad by the end of 2017.

Operating in Broomfield may require additional equipment to satisfy residents. Extraction Senior Vice President of Operations Eric Jacobsen said, “Extraction has shown a desire to work with communities and to create innovations that minimize inconveniences in the areas where we work. Our introduction of electric drilling and sound walls to this basin, and our role in the creation of quiet completions fleet technology, have all demonstrated this commitment.”

The COGCC approved 10 of Extraction’s spacing unit applications for the Broomfield area development program.

Conference call Q&A

Q: How does the depth and pressure differ at Hawkeye, compared to the southern area and Greeley, and with it, the D&C costs?

Extraction Oil & Gas President Matthew R. Owens: In the Hawkeye Area, the depth is roughly the same. It’s within a few hundred feet of what we’ve been drilling up in Windsor or Greeley. The pressures are probably a little bit less than Greeley, but very comparable to what we’ve had in Windsor.

So, the wells that we’ve drilled so far, the drill times and the completion times have been very similar to what we’ve seen up in the Wattenberg part of the field. So, we don’t expect there to be a material change in well price as we move development down to the Hawkeye Area.

Q: What have you guys seen from Conoco in the A and the C zones?

President Owens: So, what we’ve been able to tell from the public data on the wells Conoco has drilled, they’ve mostly targeted the B-bench, but they have also drilled the A-bench wells and C-bench wells. So, of all their wells, I’d say probably 80% were in the B-bench.

They’ve tested at least one Nio A and then they’ve done, I believe, three Nio Cs with very similar results across all three benches. And all three benches in this area are well developed. They show very well on the logs on resistivity and porosity, and they’ve shown very similar results for the wells that Conoco has drilled.

Q: Obviously, the offset operator oil barrels are outperforming kind of the standard Nio and Codell type curves. Just curious if kind of you can give us a sense of maybe what the completion design is like for those well-enhanced completions work down as you move into Broomfield.

President Owens: Yes. So, the wells that are public, that we have on this slide, what we can tell from the completion data is they’ve been slick water or a linear gel type wells with anywhere from 750 to about 1,200 pounds per foot of proppant depending on whether it was a Codell or a Niobrara.

As far as enhanced completions go, we really look at enhanced completions based off the oil API being produced, and we think that this area is going to be in that mid to upper 40s, which we think is going to be conducive for enhanced completions because that’s how some of our eastern Windsor acreage has been as far as API gravities go, and we’ve seen pretty good results up there.

So, we have a good base, standard 1,000 pound per foot completion production results from the offset operators. And when we go down there, we well be testing what enhanced we’ll do in the area.

Q: Pressing on the Hawkeye Area, you have a couple of hundred permits in hand and you comment that you believe that it’ll compete with the upper 20% of your inventory. How quickly is this folded into your development and, I guess, squaring that with the commentary around being sort of free cash neutral on the back half of 2018?

President Owens: Yes. So, the Hawkeye Area, we do, we have several hundred permits in process of which over 50% of those are approved. What we’re working on right now is completing the second well that we have drilled, which is near the first Bison well that we have drilled. And we’re also in negotiations with several other parties on what the midstream offtake is going to be in this area.

So, for 2018, we will continue development down here, mostly testing spacing for the – whatever we’re going to end up at the 12 to 16 wells per section in the Niobrara. But we’ll also be really focused on getting the midstream implemented for 2019 full development.

Our 2018 program, remember, is pretty set in stone with the permits that we’ve gotten. And we plan to spend a lot of time developing our Greeley acreage, which is still the top acreage that we have in the company’s portfolio and will really help us hit that cash flow neutrality in the second half.

Q: And the midstream plans, I guess, on the asset, do you envision this as requiring any of Extraction’s capital for a build-out?

Extraction Oil & Gas Chairman and CEO Mark Erickson: No, we don’t anticipate that. Actually, it’s a very competitive area. There’s a new PE firm out that’s expanding the system out there. We’ve got Western Gas Resources, which has one of the most robust systems in the area. We’re in deep discussions with both of them on the gas side.

Additionally, on crude oil side, there are multiple parties within the basin that are doing crude gathering. So, we anticipate kind of utilizing relationships and joint ventures to move forward with the midstream and don’t anticipate really any CapEx spend from our side.

Q: Can you talk more about your position and strategy for Hawkeye?

CEO Erickson: Sure. I’ll add some points here. We follow a similar strategy to what we’ve done in the past. We really like this area because it has enough vertical wells to give us really solid geological control, but not so that we would have to worry about the mechanical risks of drilling around verticals or depletion.

The other thing we like about this area is it’s an area that really is, from the DJ Basin perspective, it’s very oily, which, when you look at our revenues, it’s like 70-plus-percent of our revenues are derived from oil, even though only roughly 50% of our production is oil weighted. So, we targeted that for superior economics.

We felt it was very good from results that Conoco has had. Actually, some of the very best oily wells in the whole basin, as exhibited by our initial well, are out here.

So, I think the reason we are able to get the acreage position we did is there was a very, very significant perception in the basin that this area was 100% controlled by Conoco. And Conoco obviously had – there were some holes that developed in their acreage. We discovered that opportunity and we’ve spent a couple of years out here kind of really getting a toehold and – that actually grew into a very significant position for us.