Extraction Oil & Gas, Inc. (ticker: XOG) reported a net loss of $52 million for Q1 2018, or $(0.32) per share. First quarter average net sales volumes were 68,874 BOEPD, including 36,052 BPD of crude oil, an increase of 106% year-over-year and 4% sequentially.

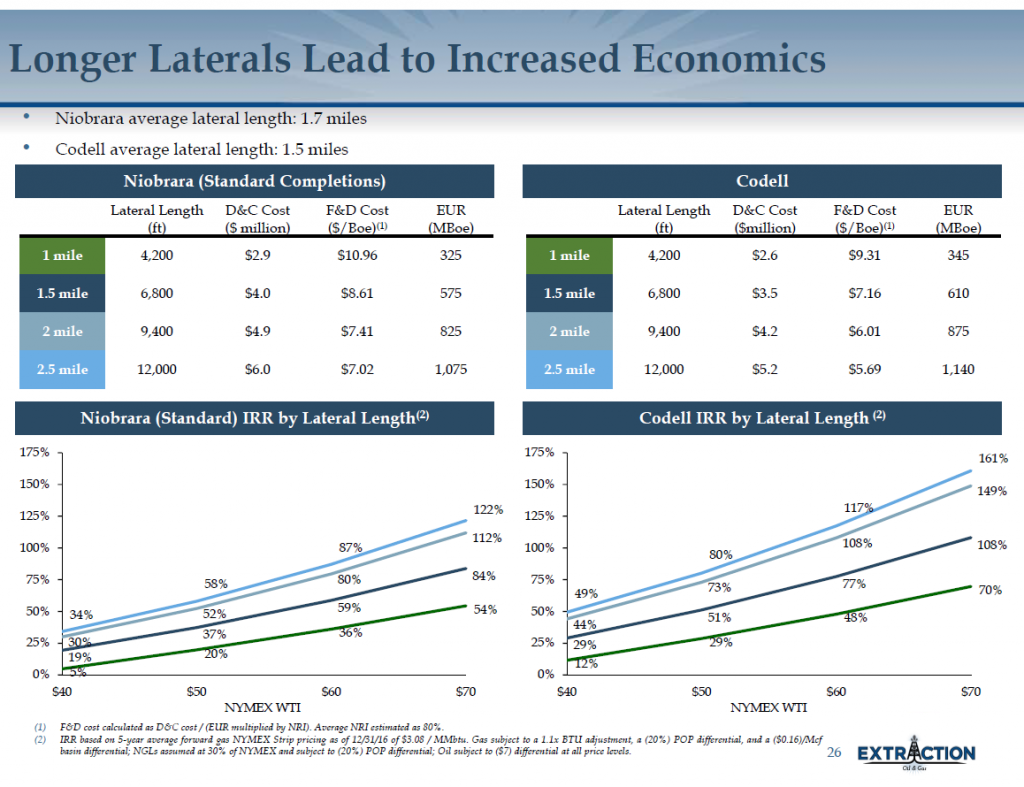

During the quarter, Extraction reached total depth on 41 gross (27 net) wells with an average lateral length of approximately 7,300 feet, completed 49 gross (39 net) wells with laterals of ~8,700 feet and the company turned to sales 31 gross (18 net) wells with laterals of ~9,000 feet.

High line pressures and freeze-offs

Chairman and CEO Mark Erickson said, “We continued our rapid pace of production growth with both our total equivalent production and our crude oil volumes hitting new quarterly records despite facing an extremely difficult midstream operating environment impacted significantly by both high line pressures and freeze-offs on a third-party system.”

Extraction said it estimates that high line pressures and freeze-offs negatively impacted its first quarter net production by approximately 13 MBOEPD, including 8,000 BPD of crude oil. As the first new plant comes on, a significant increase in Extraction’s base production is expected as constraints are lifted.

CapEx, guidance

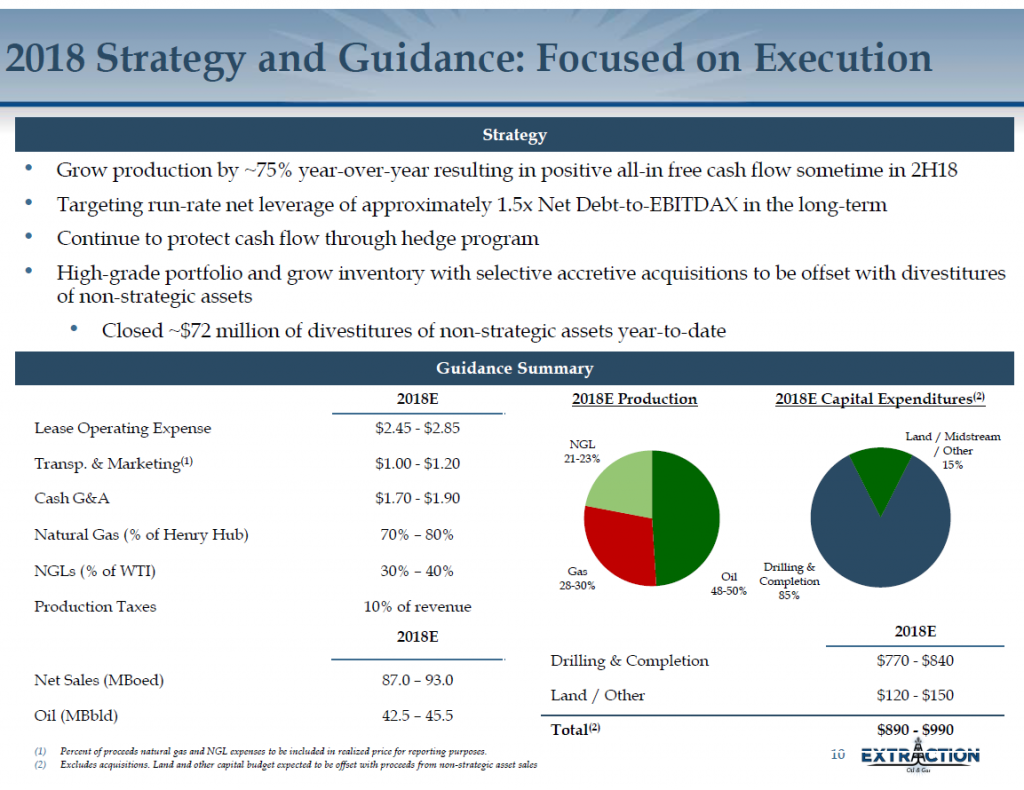

For Q1 2018, Extraction’s capital expenditures totaled ~$248 million – of which, $226 million was for D&C and $22 million for leasehold. In addition, the company incurred $5 million of midstream capital expenditures.

Extraction reaffirmed the previously disclosed 2018 guidance.

Conference call Q&A excerpts

Q: Could you give some color, as you look into the future, on the plant expansions and the build-out?

And in terms of timing, that should be sufficient for managing through the continued growth plan in 2019 that you guys have in your internal plans laid out?

CEO Mark A. Erickson: After DCP comes on early Q3, we expect to see a third-party midstream plant come on. And then as you look forward over the next couple of years, we’re seeing almost a doubling of the existing capacity in the basin.

With our diversified acreage position, our ability to go to multiple plants, we’ll look at systems that may potentially be constrained, we’ll be staging our production into those systems as they get expanded and we’ll be actively developing and targeting systems that have available capacity.

Q: Can we talk a little bit about the two operated pads a little bit north of Denver in the Hawkeye Area?

Erickson: I can give a brief update on what we’ve been doing up in that area. So, we drilled two pads just northwest of Denver, Denver International Airport. If you look on page 17, you can see a circle up there that shows the area of the six new wells that we drilled. One of the pads was on the eastern side of that circle and the other pad was on the western side. We drilled both Codell and Niobrara formations on each one of those pads. We just recently turned those pads on.

And the pad on the eastern side, we’ve got one Codell and one Niobrara there that have been online for roughly 30 days. The Codell has been increasing in production as well as the Niobrara, the Codell is up to about 600 BOE a day with the Niobrara up to 800 BOE a day, normalize the two miles and both are producing at about 85% oil cut.

On the pad on the western side, that pad just recently came on within the last five days, so only two of the wells, one Codell and one Niobrara, have been producing for about five days. Codell is up to 950 barrels of oil equivalent per day, while the Niobrara is up to 725, and those are both also averaging in the mid-80s for a percent oil. So, we’re really encouraged early time with what we’re seeing there, but typically we don’t like to start showing production plots until we’ve got 90 or more days of production.

Q (continued): Fair enough. Do those oil cuts surprise you guys a little bit? That seems pretty high for that area. Am I just missing something there or is that something that was better than what you all had modeled?

Erickson: The way that the oil cuts – that we look at the oil cuts really has to do with the API of the gravity of the oil. And in this particular area, just northwest of the airport there, we’re in the low to mid-40s, which is about the same as Windsor.

So we expected internally for these to come on similarly to the Windsor wells which they are. The Windsor wells, if you remember, last year they all came on about mid-80s on a percent oil as well.

Q: Any update on those Broomfield permits? I think we’re expecting them maybe sometime early summer.

Erickson: Yeah. I think that’s still the timing that we’re looking for. We’ve got the 14 permits that have already been approved and 10 of those have actually already been drilled and are being completed.

The rest of Broomfield has had all of the permits submitted except for half of one pad. So we virtually have about 85% or so of the permits submitted that we wanted to develop our acreage there and they’re all now sitting with the state waiting approval.