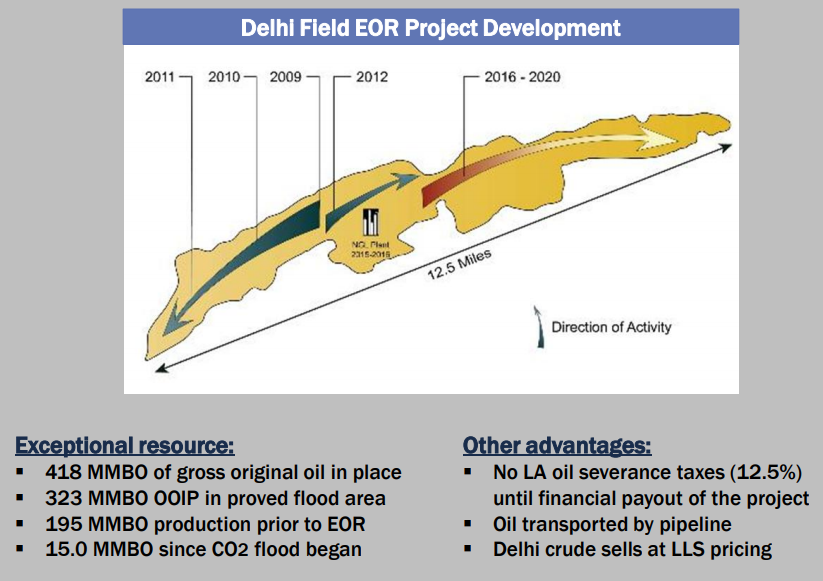

Evolution Petroleum Corporation (ticker: EPM), with headquarters in Houston, Texas is in the business of development and production of natural gas and oil reserves concentrated in the Delhi Field in Louisiana.

One of the key principal assets for Evolution Petroleum include interests in a CO2-EOR project in the Delhi Field. EPM sources CO2 for its EOR operations from Jackson Dome in Mississippi.

Evolution Petroleum recently announced the results for the fiscal 2018 first quarter ended September 30, 2017.

Production

Gross production at Delhi averaged 7,959 BOEPD during the quarter, a 7.0% decrease from the prior quarter and an increase of 7.9% from the year-ago quarter. Gross NGL sales for the quarter of production were 1,047 barrels per day, up slightly from the prior quarter. Results from the NGL plant after completion of this project have been positive, with the plant operating at or near maximum capacity and efficiency.

Production costs in the Delhi field were $2.9 million in the current quarter, down 15% from $3.4 million in the prior quarter and 23% higher than $2.3 million in the year ago quarter. The current quarter includes approximately $0.5 million of incremental operating costs from the NGL plant. Purchased CO2 volumes were 69.3 million cubic feet (MMcf) per day, down significantly from 85.1 MMCF in the prior quarter, and our total CO2 costs were lower by approximately $0.2 million from the prior quarter.

During the quarter, EPM spent approximately $0.6 million on capital workover projects, including $0.3 million for successful capital upgrades to the recycle plant to improve performance of the NGL plant and $0.3 million for conformance operations in the Delhi field. Current expectations for capital spending for the remainder of the fiscal year ended June 30, 2018 include $3.2 million for EPM’s share of an eight-well infill drilling program to enhance production in the developed area of the flood. In a recent press release, EPM said that it is possible, based on available capital and economics, that the program will be restored to its original plan for twelve wells at a total cost of $4.8 million net to us. This program will target productive oil zones which are not being swept effectively by the current CO2 flood.

Liquidity

Working capital increased by $1.0 million from the prior quarter, despite paying $2.5 million in common stock dividends during the quarter, and the company ended the quarter with $24.4 million in working capital with nothing drawn on its reserve-based credit facility.

EnerCom Dallas Conference

Evolution Petroleum Corporation will present at the EnerCom Dallas oil and gas investment conference February 21-22, 2018 at the Tower Club in downtown Dallas. The conference is focused on bringing together publicly traded E&Ps and oilfield service companies with institutional investors.

Buyside professionals and oil and gas company executives may register for the event through the conference website.