Ethanol’s Last Stand

U.S. ethanol producers are on the cusp of calamity, but hopes are growing for policy-driven longevity.

Summary:

- Ethanol Producers’ Last Stand: Declining gasoline demand forecasts present a catastrophic risk to an industry born out of the EPA’s renewable fuel standards, which mandate ethanol blending in fuels.

- The industry’s lobbying could pay off, however, as the Biden administration plans to grant year-round gasoline sales with 15% ethanol.

- Ethanol producers have their eyes set on the lucrative tax credits for sustainable aviation fuel offered in Biden’s Inflation Reduction Act.

- If year-round sales of E15 are approved, likely consequences include increased demand for tradable D6 RINs, upstream support for ags, and headwinds for beleaguered gasoline cracks.

Ethanol’s Last Stand:

After 18 years of policy-driven demand for biofuel blending components in finished motor gasoline, the ethanol industry could be on the brink of extinction.

As gasoline consumption plateaus and E10 (10% ethanol) already fuels more than 95% of gasoline-powered vehicles, producers are again looking to policymakers to expand the market for corn-based fuel.

They have two targets:

- The Biden administration’s Inflation Reduction Act, which includes a $1.25/gallon tax credit for producers of sustainable aviation fuel (SAF)

- Overturning a summer-time ban on gasoline with ethanol blends above 10%

According to Reuters sources, the Biden administration plans to grant the second request in March while punting the start date from May 2024 to 2025.

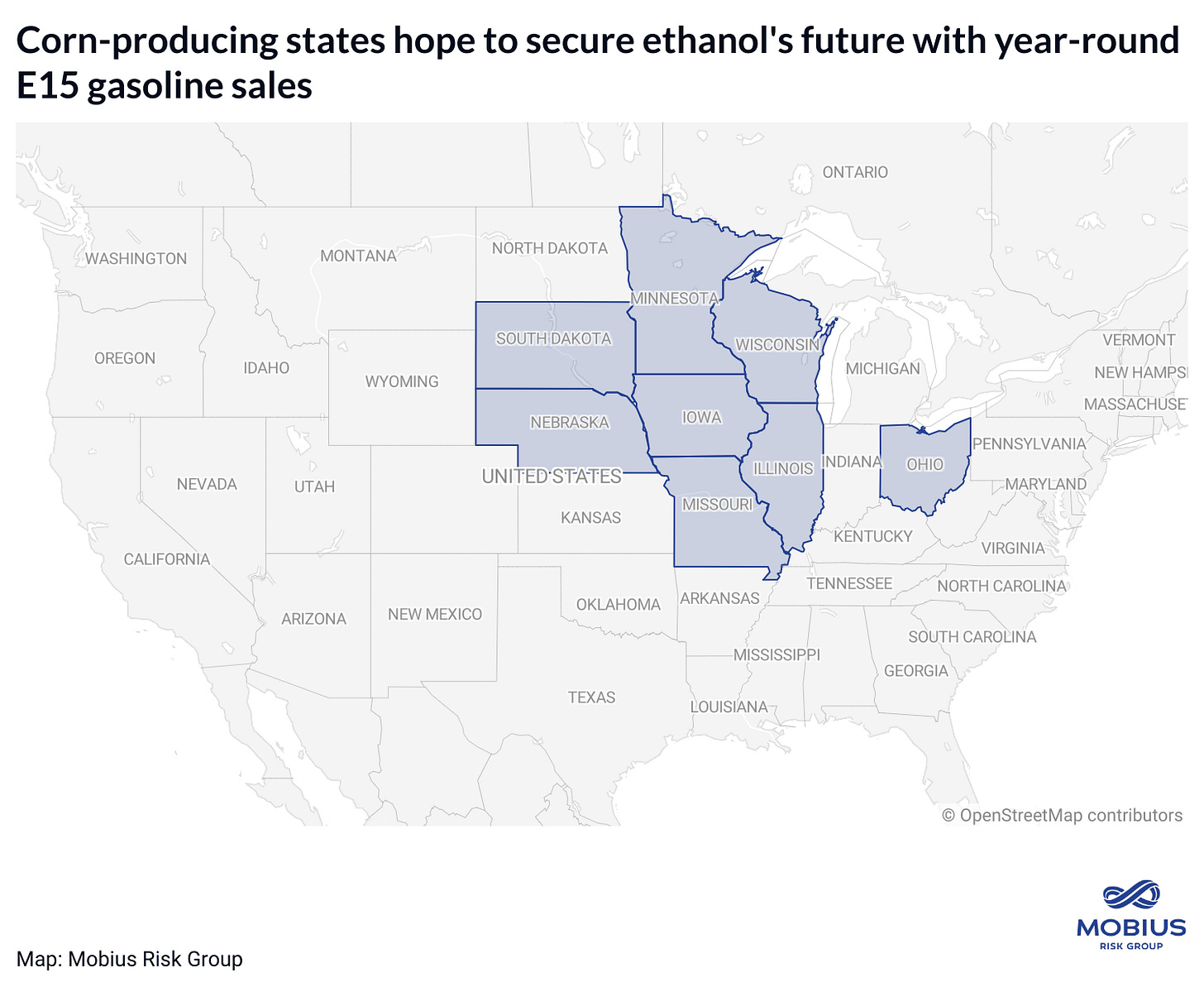

Initial reports suggested that the administration would allow just eight midwestern states to sell E15 gasoline year-round, but subsequent commentary from USDA Secretary Tom Vilsack suggested the change would expand year-round E15 sales across all states in 2025.

Vilsack added that the Biden administration/EPA would likely grant temporary waivers to certain states this summer to allow gasoline with 15% ethanol.

Potential Consequences for Energy Markets:

Upstream Support for Ags

Expanding year-round gasoline sales with 15% ethanol would support demand for feedstocks like corn and sugarcane. Corn-based fuels have the highest volume mandate in the EPA’s annual volume standards.

Higher Infrastructure Spending

Gasoline blends with higher ethanol content require specialized fueling infrastructure. A nationwide rollout of year-round E15 would likely include investments in new storage tanks and fuel-dispensing equipment.

Less Energy Content Per Gallon

A gallon of pure ethanol contains roughly 33% less energy than a gallon of pure gasoline. As ethanol content in gasoline increases, fuel efficiency decreases.

97% of gasoline-powered vehicles accept fuel with 15% ethanol. Mercedes-Benz and Volvo do not.

Headwinds for Gasoline Cracks

Increasing the share of corn-based ethanol inherently reduces the ratio of petroleum-derived blending components, adding headwinds to refiners’ margins on gasoline.

More Demand for D6 RINs

When Congress expanded the Renewable Fuel Standard (RFS) as part of the Energy Independence and Security Act in 2007, it effectively birthed the market for corn-based ethanol and a new tradable credit called a Renewable Identification Number (RIN).

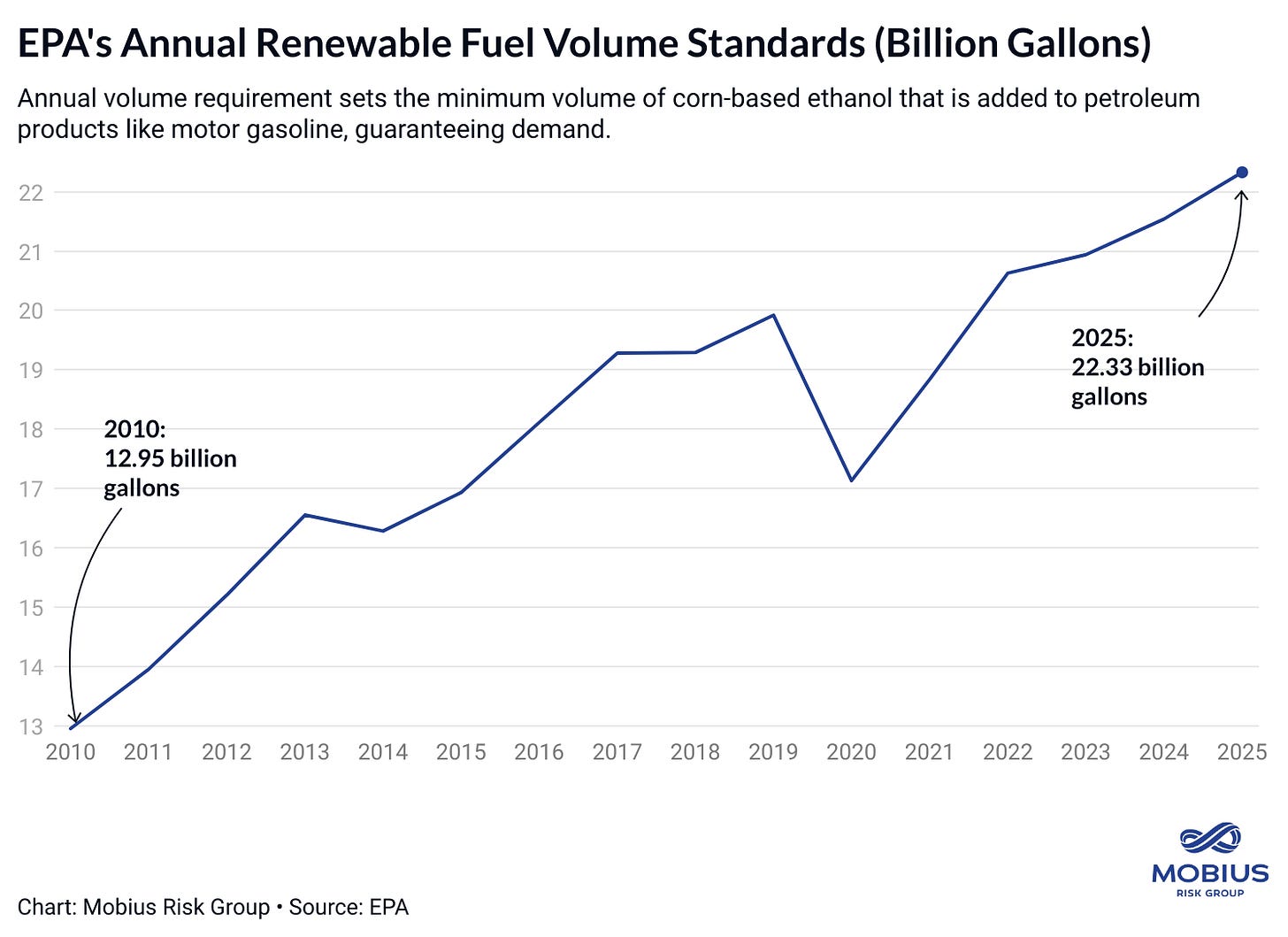

Each year, the EPA releases volume standards that mandate how much ‘renewable’ fuel must be used to replace petroleum-based products.

Refiners and importers of petroleum-based fuels (“obligated parties”) generate Renewable Volume Obligations (RVOs), which can only be retired when blenders add biofuels like corn-based ethanol to create the finished blended fuel.

Obligated parties must buy RINs (typically from blenders) based on the volume of refined products they supplied to the U.S. market that year. Refiners and fuel importers must then prove to the EPA that they offset their RVOs.

Renewable fuel RINs (D6 RINs) are generated by blending corn-based ethanol into gasoline. If the Biden administration increases renewable fuel volume standards after 2025 while expanding year-round gasoline sales with 15% ethanol, demand for D6 RINs will likely increase as obligated parties offset RVOs.

Demand for D6 RINs is capped by 1) overall gasoline consumption forecasts and 2) the EPA’s volume standards.

All of Mobius’ market commentary, including the entire Energy Shots archive, can be found here: https://insights.mobiusriskgroup.com/

Who’s it for:

Industry stakeholders who want to know the second-order effects of topics like energy policy, geopolitics, and global structural supply and demand updates.