‘Second phase’ of the shale gas revolution replaces high-growth models; time to create real value and get that value directly back to shareholders: Schlotterbeck

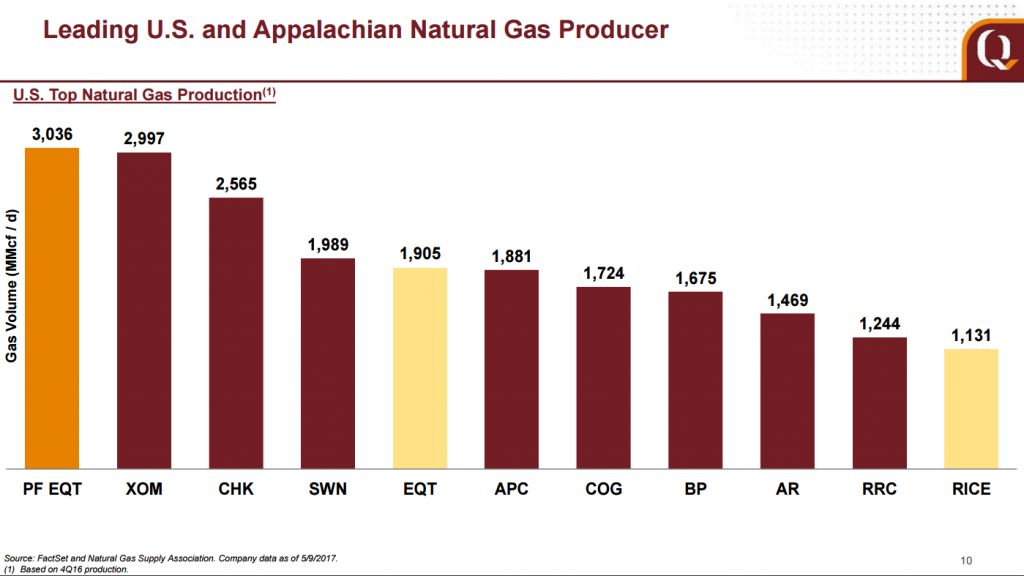

EQT (ticker: EQT) announced today that it will purchase Rice Energy (ticker: RICE) in a deal valued at $6.7 billion. Based on Q4 2016 production, this transaction will make EQT the largest U.S. natural gas producer. Pro Forma, EQT just edges out ExxonMobil (ticker: XOM) as largest U.S. natural gas producer, with 3.036 Bcf/d of production.

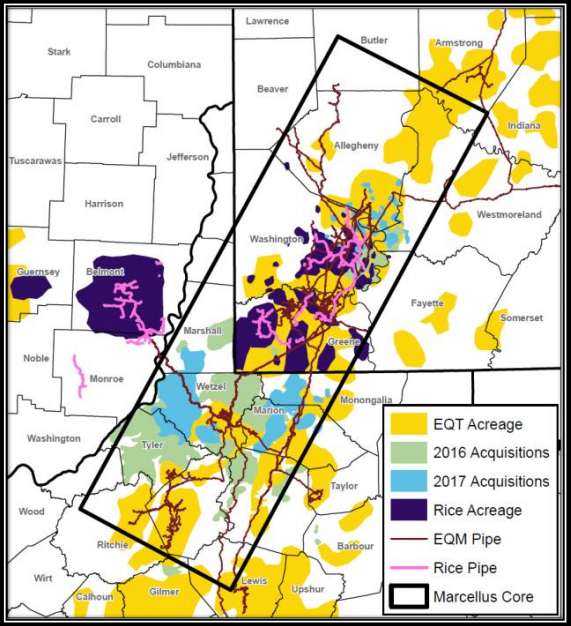

Rice Energy owns about 187,000 net acres in the Marcellus, with 107,000 acres offering stacked Marcellus and Utica pay zones. The company holds an additional 65,000 Utica acres in Ohio. The vast majority of Rice’s Marcellus acreage is directly contiguous with EQT’s existing acreage, allowing significant synergies. Pro Forma for the acquisition, EQT will own about one million total net Marcellus acres.

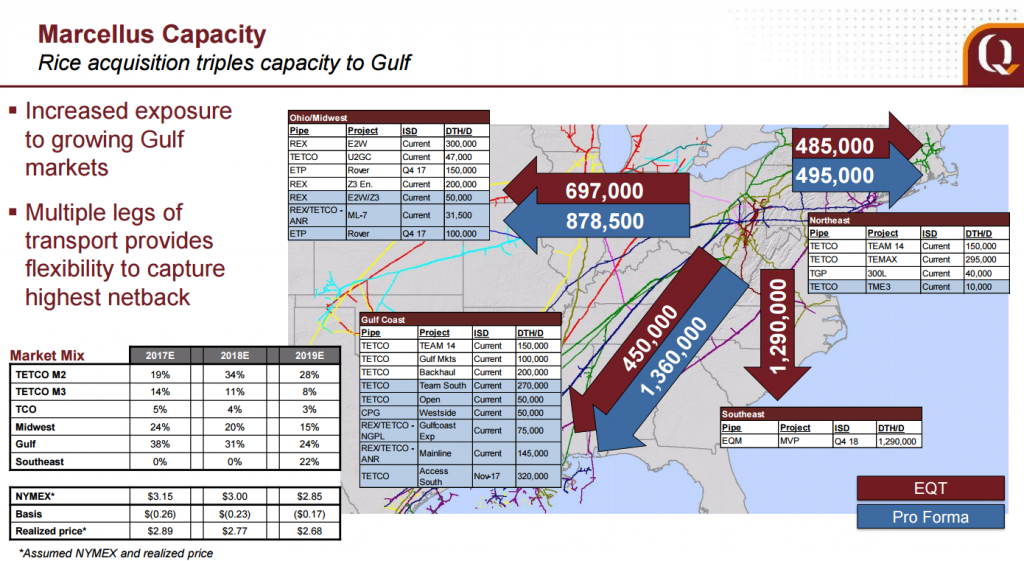

Additional midstream capacity to Gulf Coast

In addition to the acreage, this purchase gives EQT access to Rice’s midstream assets. These include a 92% stake in Rice Midstream GP holdings, which owns 100% of the general partner incentive distribution rights and 28% of the limited partner interests in Rice Midstream Partners LP (ticker: RMP). These assets and takeaway capacity will triple EQT’s transport capacity to the Gulf Coast, from a current 450,000 DTH/d to 1,360,000 DTH/d. In total, EQT’s midstream transport capacity will increase by about 38% due to Rice’s holdings.

The transaction will involve both stock and cash, according to EQT’s news release. EQT will pay $5.30 in cash and 0.37 shares of EQT stock for each share of Rice stock.

Based on Friday’s closing share prices, this gives Rice a premium of 37%. EQT will also assume or refinance $1.5 billion in debt and preferred equity. The boards of directors of both companies have already approved the transaction. Completion of the purchase is subject to approval by Rice and EQT shareholders, and is expected to close in Q4.

Purchase allows longer laterals, better returns

EQT believes that this transaction will allow the company to significantly improve its well returns. Because the two companies’ acreage positions are contiguous, EQT will be able to drill longer laterals in more locations. Before the purchase EQT had 775 undeveloped locations in its core Marcellus acreage with an average of 8,000’ lateral. Adding Rice acreage means the company will have 1,200 undeveloped locations with an average of 12,000’ lateral. EQT reports that increasing the number of wells in a pad from 8 to 12 and increasing the lateral length from 8,000’ to 12,000’ will improve each well’s IRR from 52% to 70% at $2.50 gas.

This is the latest in a series of purchases made by EQT to expand its acreage. In 2016, the company spent about $1 billion in two purchases from Statoil (ticker: STO) and Trans Energy. More recently, EQT spent $527 million buying Stone Energy’s Marcellus and Utica properties as part of Stone’s bankruptcy proceedings.

EQT shifting focus from acquisition of acres to integration, longer laterals

While EQT is always looking for opportunities, EQT CEO Steve Schlotterbeck remarked on a shift in focus. “Since the beginning of 2016, we have added more than 485,000 acres to our development portfolio and have achieved significant scale in the core of the Marcellus. We will now shift our focus from acquisitions to integration as we work to drive higher capital efficiency through longer laterals; reduce per unit operating costs through operational and G&A synergies; improve our sales portfolio by expanding access to premium markets; and deliver increased value to our shareholders.”

Q&A from EQT’s conference call

Q: When you look at EQT going forward, EQT and Rice historically have been both very high-growth companies. As you look and contemplate over what you’re going to do 2019, 2020, and beyond, talking about returning cash to shareholders, how do you think about like long-term growth versus like pulling forward value with EQT and how do you want to achieve returning cash back to shareholders?

Steven Schlotterbeck: I think I can’t give you a full specifics at this time, but I will say that it is my belief that we are in the second phase of the shale gas, I guess, you call, revolution. And the high-growth models of the first phase, I don’t think are going to work in Phase 2. We really need to be focused on creating real value and getting that value directly back to shareholders.

So, I think the way that will play out, particularly, after this acquisition, when we are now the largest producer in the U.S., with a very attractive and concentrated position is, we will have to determine what the appropriate growth rate is, but that growth rate will likely be certainly within cash flow and most likely below our cash flow so that we can return cash to shareholders. And we will have to study what the best method of doing that is, whether it’s share buy backs or re-establishing a meaningful dividend. But I think it’s critically important that we get there really as soon as practical.

And some of the practical implications are, we have firm takeaway commitments and there’s a real PV impact to not filling those fairly quickly. So, we’ll be weighing all of the factors in determining exactly when we get there and how far we go. But, I think it’s important for a company our size and in this phase of the shale gas economy, I guess I’d say, is to start looking at more moderate growth rates generating profits and returning those profits to shareholders. So, that’s over the next several years, that’s clearly where we’re headed.

Q: What are your thoughts on the Utica acres in Ohio?

Steven Schlotterbeck: We like that acreage and I think our view will be when we build our business plan for next year, and looking at our capital allocation, we will be putting our capital work in the highest return areas. I expect that some of that Utica acreage will make it into our development plan for next year. I will say that acreage is already very consolidated. So, we don’t feel compelled to or a real compelling need to go try and consolidate that acreage. We can already drill pretty long laterals over there with the position that Rice already has. So, no plans to go try and build on that position, but I do think it’s – the returns will stack up fairly competitively and have a place in our capital plan next year.