Acquisition adds 500 undeveloped locations expected to have average laterals of 5,600 feet; Opens deep Utica opportunity; Resource Potential of the new acreage is estimated at 9.2 Tcf of Natural Gas

EQT Corporation (ticker: EQT) announced it will acquire 62,500 net acres and 50 MMcfe/day of production from Statoil’s core Marcellus stake for $407 million, subject to customary closing conditions.

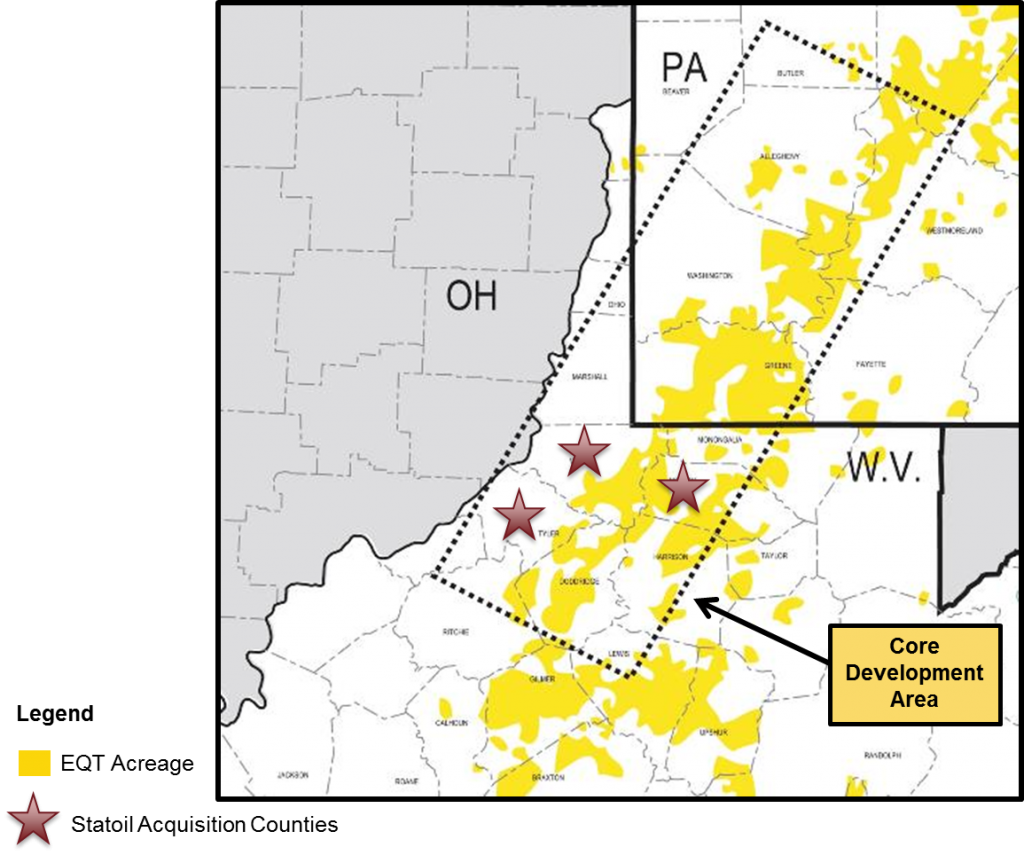

The acreage belonging to Statoil (ticker: STO) USA Onshore Properties, Inc. is primarily in Wetzel, Tyler, and Harrison Counties, West Virginia. Much of the acreage is contiguous with EQT’s existing development area and complements its adjacent operations in Wetzel County. The acquisition increases EQT’s core undeveloped Marcellus acreage by 29% and it includes drilling rights on 53,000 acres that are undeveloped and prospective for the deep Utica.

The acquisition includes:

- 31 Marcellus wells, 24 of which are currently producing – 3 are completed and are not online; 4 are drilled uncompleted

- 87% of the acreage is held by production or has lease expiration terms that extend beyond 2018

- 84% net revenue interest to EQT

Below is a map outlining EQT’s core focus area and counties highlighted with Statoil’s acreage.

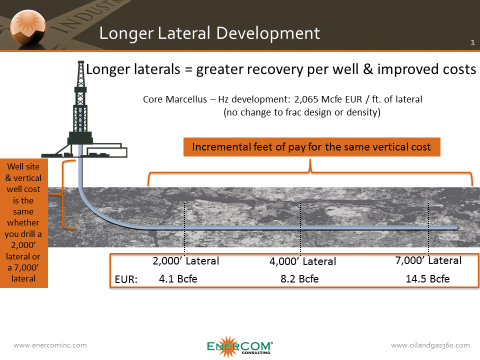

Longer Laterals Lead to Larger EURs

EQT has determined that through the acquisition, 106 of its existing locations can now be extended from 3,000 feet to 6,500 feet. Longer laterals not only extend the incremental feet of pay allowing for increased EURs, wells cost efficiencies are also gained. For every well that is dilled, the well location and vertical well costs are the same whether you drill 2,000 feet laterally or 10,000 feet. In a low commodity price environment like we have today, longer laterals can a key factor in drilling an economic well.

Capital for the Acquisition

EQT concurrently announced a public offering today of 9,500,000 shares of common stock, subject to market conditions. The Company expects to grant the underwriters an option to purchase up to 1,425,000 additional shares of common stock. The company said net proceeds from the offering will be used to fund the announced Statoil acquisition, other potential acquisitions and for general corporate purposes. EQT shares closed today at $69.18. Today’s close is 18.2% higher than their last equity raise done on February 19, 2016, when EQT priced 6,500,000 shares of its common stock at a price to the public of $58.50 per share. The Company used the net proceeds from this offering for general corporate purposes, which included, among other things, repayment of a portion of its outstanding indebtedness.

As of Q1’16, EQT closed the quarter with zero net short-term debt outstanding under EQT’s $1.5 billion unsecured revolver; and about $1.6 billion of cash on the balance sheet, which excludes cash on hand at EQM and EQGP.