EQT announces $2.4 Billion CapEx which it expects to fund entirely from cash flow

Earlier this week Pittsburgh-based EQT Corporation (ticker: EQT) turned in line the longest lateral completed to date by any operator in the Marcellus.

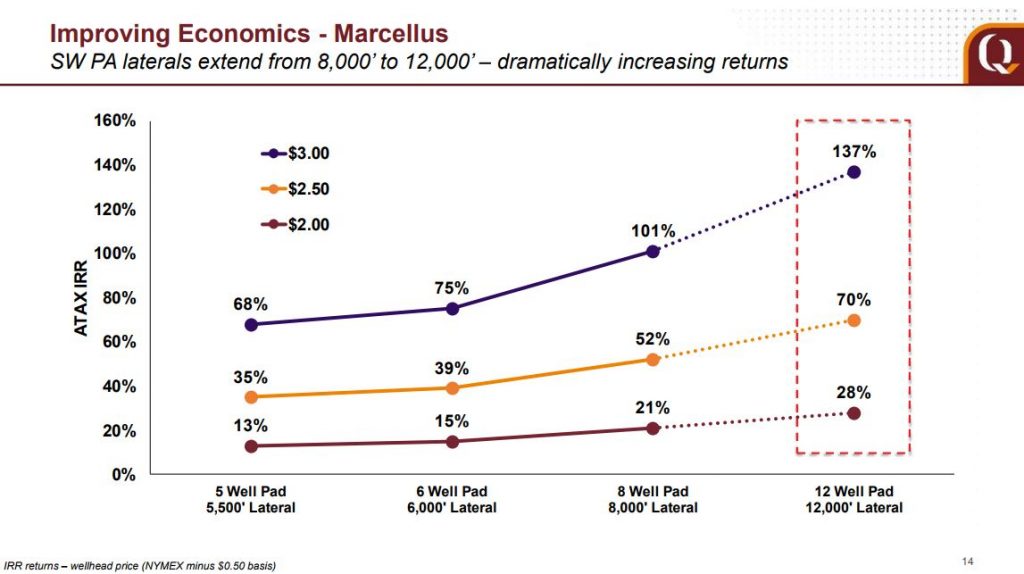

The Haywood H18 well in Washington County, PA has a completed lateral length of 17,400 feet and will develop 42 Bcfe of reserves. Laterals of this length are projected to have development costs of $0.36/Mcfe and will generate an IRR greater than 70% at $3.00 NYMEX.

EQT said it plans to drill 27 Marcellus wells at 17,000 feet or longer in 2018.

CapEx for 2018

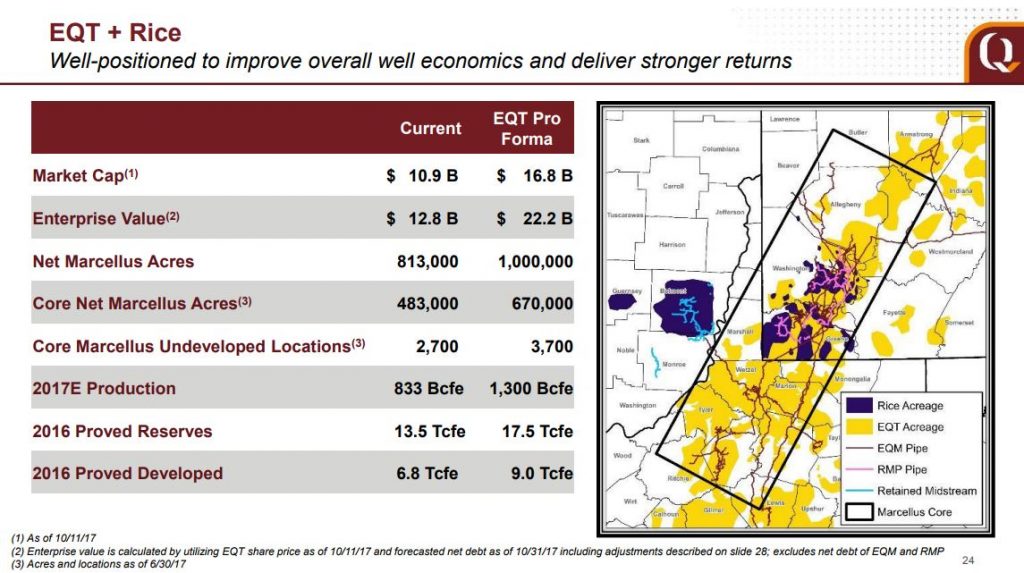

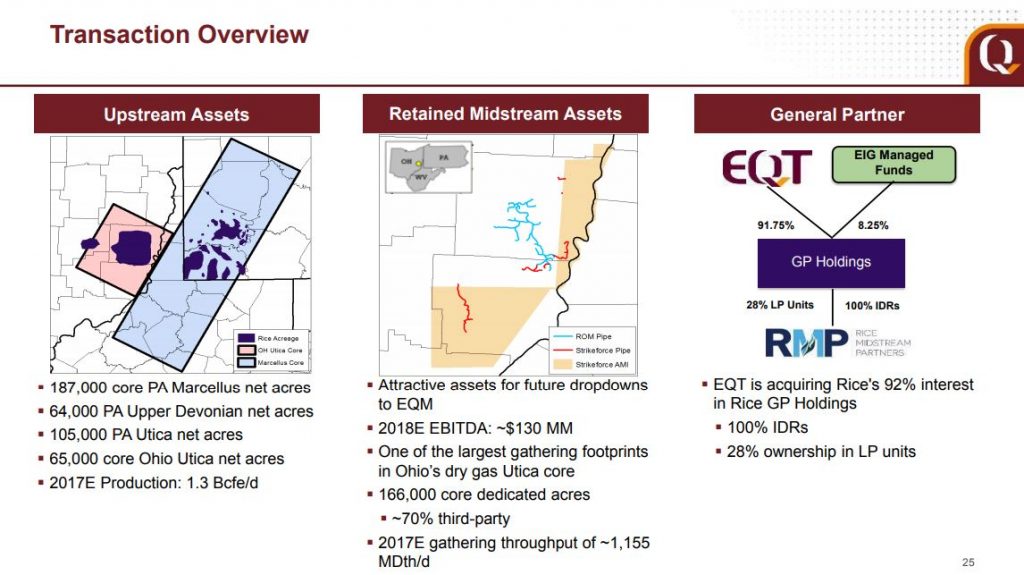

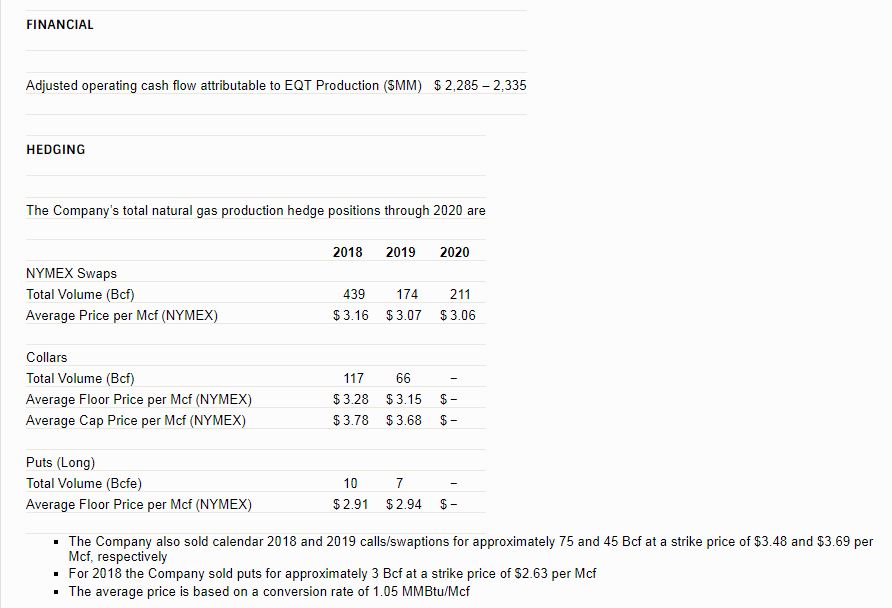

EQT also announced its 2018 capital expenditure forecast of $2.4 billion, which includes $2.2 billion for well development and $150 million for acreage fill-ins and bolt-on leasing. Based on current pricing and synergy capture, the 2018 drilling program is expected to be fully funded through adjusted operating cash flow attributable to EQT.

Rice synergy will deliver $100 million reduction in G&A

“We have already begun to realize synergies associated with completion of the Rice Energy acquisition, which include an estimated $100 million reduction in our projected corporate G&A expenses,” stated Steve Schlotterbeck, EQT’s president and chief executive officer.

Increasing lateral lengths by 50%; 12,600 laterals in Pennsylvania results in 40% reduction in per unit LOE, production SG&A

“Initial development plans for our consolidated acreage target a 50% increase in average lateral lengths, which is exceeded with 12,600 foot laterals projected in Pennsylvania, resulting in a 40% reduction in per unit LOE and production SG&A expenses. These cost structure and capital efficiency improvements support a more compelling investment proposition, as we shift from maximizing volume growth to focusing on capital returns and returning cash to shareholders.”

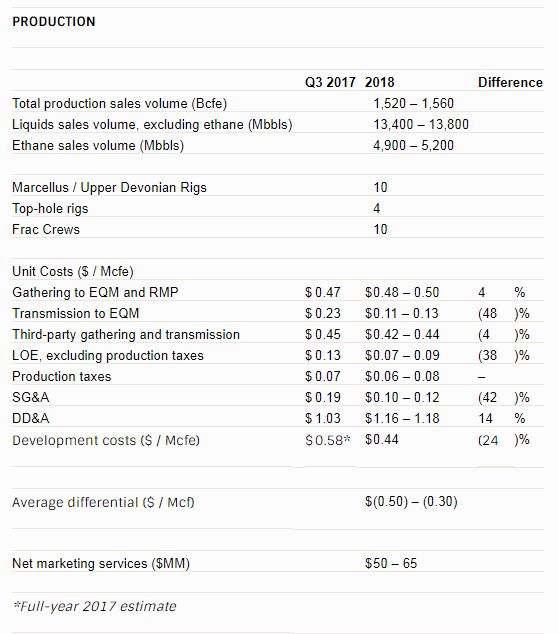

EQT forecasts 2018 production sales volume of 1,520 – 1,560 Bcfe. The 2018 drilling program anticipates a 15% increase in production sales volume in 2019. It is anticipated that the 2019 development plan will be funded entirely by the cash flow provided by EQT Production.

EQT’s 2018 CapEx forecast excludes CapEx for its retained midstream assets, as well as for EQT Midstream Partners, LP (ticker: EQM) and Rice Midstream Partners LP (ticker: RMP), master limited partnerships controlled by EQT Corporation and consolidated in EQT’s financial statements. EQM and RMP announced 2018 CapEx forecasts today in a separate news release, which can be found at www.eqtmidstreampartners.com and www.ricemidstream.com, respectively.

EQT developments

Marcellus

In 2018, the company plans to drill 139 Marcellus wells with an average lateral length of 11,800 feet – all of which will be on multi-well pads to maximize operational efficiency and well economics. The program will focus on the company’s core Marcellus acreage, which is targeting 111 wells in Pennsylvania and 28 wells in West Virginia. During the year, the company plans to turn-in-line (TIL) 160 – 170 Marcellus wells.

Ohio Utica

The company plans to drill 38 gross (25 net) Ohio Utica wells with an average lateral length of 11,300 feet. The company plans to TIL 40 – 50 gross wells during the year.

Upper Devonian

The company plans to drill 19 Upper Devonian wells with an average lateral length of 15,600 feet. These wells will be limited to co-development on Marcellus pads in Pennsylvania. The company plans to TIL 20 – 25 wells during the year.

Haywood H18: record for longest lateral in the Marcellus @ 17,400 feet

The Haywood H18 well in Washington County, PA has a completed lateral length of 17,400 feet and will develop 42 Bcfe of reserves. Laterals of this length are projected to have development costs of $0.36/Mcfe and will generate an IRR greater than 70% at $3.00 NYMEX. The company plans to drill 27 Marcellus wells at 17,000 feet or longer in 2018.

EQT 2018 guidance

Based on current NYMEX natural gas prices, adjusted operating cash flow attributable to EQT is projected to be $2,350 – $2,450 million for 2018, which includes $325 – $375 million from EQT’s interests in EQT GP Holdings, LP (ticker: EQGP) and RMP.

As a result of the replacement of $1.3 billion of Rice senior notes with lower coupon investment grade debt, EQT expects to realize annual interest savings of approximately $45 million.