Deals: PDC Energy (ticker: PDCE), Whiting Petroleum (ticker: WLL) and Rex Energy (ticker: REXX)

With the holiday season over and the turkey more or less digested, it’s back to deal making in the oil and gas patch.

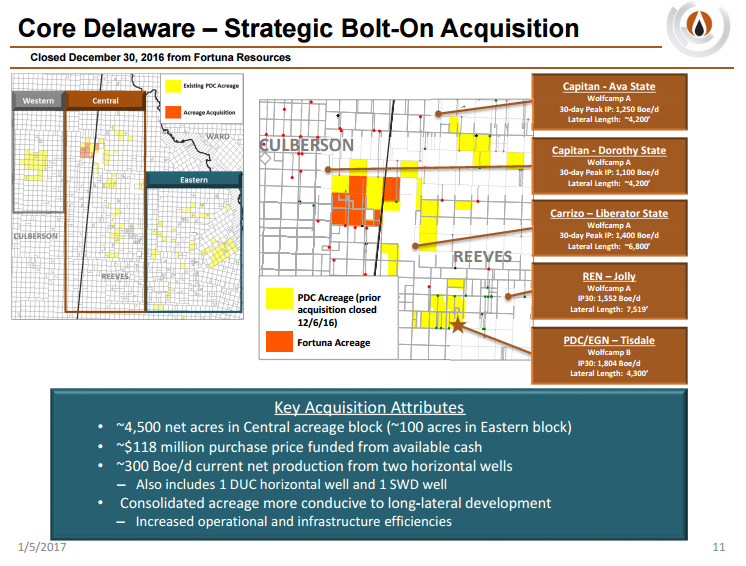

PDC Strengthens Core Delaware Footprint and Wolfcamp Drilling Inventory with Bolt-on

PDC Energy (ticker: PDCE) announced the purchase of 4,500 net acres in West Texas’ Reeves and Culberson Counties for $118 million from private E&P Fortuna Resources. The acreage is contiguous with the company’s 57,000 Delaware net acres and includes 75 gross one-mile drilling locations in the Wolfcamp A, B, and C zones.

The acquisition continues the company’s strategy of expanding and blocking up their Core Delaware Basin position and will increase net acreage, drilling inventory, and estimated reserves potential by 10%, according to President and CEO Bart Brookman.

“By creating a large, continuous acreage block, we have the opportunity to focus on longer lateral development while optimizing our operational efficiencies,” said Brookman.

The price paid of $24,000 per acre is similar to recent deals in the area, including PDC’s acquisition of Arris in August in which it paid $22,000 per acre.

Whiting Closes $375 Million Midstream Sale, Fully Redeems 2018 Senior Notes

Whiting Petroleum (ticker: WLL) closed its sales of two 50% interests in natural gas processing plants and gathering systems in all-cash transactions totaling $375 million.

The assets sold included the Robinson Lake natural gas processing plant and associated natural gas gathering system located in Mountrail County, North Dakota and the Belfield natural gas processing plant and associated natural gas, crude oil, and water gathering systems located in Stark, Billings, and Dunn Counties.

The company also elected to redeem 100% of the principal amount on $275 million in 6.25% Senior Notes due in 2018 with the proceeds from the divestitures. The remaining proceeds are expected to be used to accelerate drilling activity.

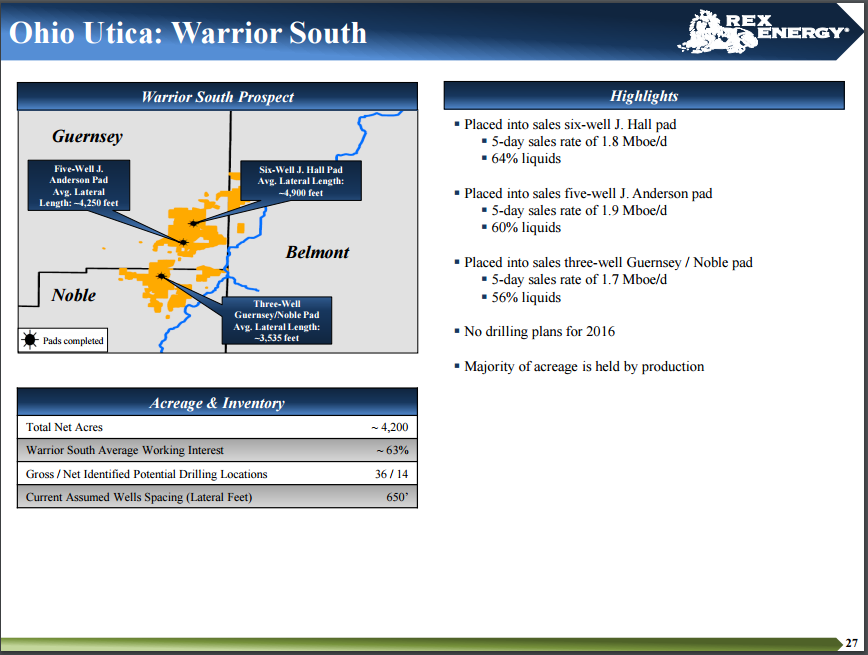

Rex Energy sells non-Core Utica Assets to Antero

Rex Energy (ticker: REXX) announced a purchase and sale agreement with Antero Resources (ticker: AR) for its entire interest in its Ohio Utica assets in the Warrior South Area for $30.0 million. The assets are non-core and were not included in future development plans.

The assets include 4,100 net acres in Guernsey, Noble, and Belmont Counties with 14 gross wells producing 9.0 MMcfe/d, implying a production value of $3,300 per Mcfe/d.

The company will receive net proceeds of $30 million, which will be used to pay down its revolving line of credit and for general corporate purposes, strengthening the balance sheet and improving liquidity. Upon the expected 1Q17 closing of the transaction, bank lenders have agreed to maintain the company’s $190MM borrowing base.