U.S. Shale Gas Needs More Pipelines to Move the Gas to Market, but Anti-Fossil Fuel Groups are Out to Stop Pipelines

In the past ten years, the shale revolution has changed the U.S. energy landscape. The economic extraction of oil and gas from shale deposits has opened new oil and natural gas supplies in North America, presented new opportunities for customers to benefit from energy development and created thousands of jobs to support shale’s development boom. But not everyone is happy about that.

With the growth of oil and gas extraction from shale, numerous environmental groups have sought to stop the development of the resource. First came the anti-hydraulic fracturing demonstrations which led to moratoria and bans. But those who are opposed to fossil fuels have a new target: pipelines, LNG export terminals, and related oil and gas infrastructure. By preventing the permitting and development of the infrastructure necessary to transport energy, these groups seek to halt further development and use of fossil fuels.

Oil & Gas 360® recently spoke with one of the movement’s loud voices, attorney Maya van Rossum, known as “the Delaware Riverkeeper.” Van Rossum is actively protesting several pipeline projects in the Pennsylvania region with her non-profit, the Delaware Riverkeeper Network (DRN).

A Rubber Stamp for the Pipeline Industry

Van Rossum and the DRN have taken aim at the Federal Energy Regulatory Commission (FERC) and its role overseeing development of interstate pipelines. DRN claims that FERC is a corrupt, rogue agency acting as a rubber stamp for the pipeline industry. Van Rossum and the DRN have filed several cases in federal courts against FERC.

“We are dealing with a flawed process,” van Rossum told Oil & Gas 360®. “These pipelines are not getting the level of review or scrutiny that they need about whether or not they should be built,” she said. Van Rossum believes it is wrong that FERC almost never rejects a pipeline application.

Previous court decisions have noted that pipeline companies are unlikely to submit project plans with strong likelihoods of rejection. This business practice results in a high pipeline approval rate. As a matter of business best practice, why would any company invest millions of dollars in engineering studies, environmental studies, pipeline routing studies, planning and applying for permits to build a pipeline if the developer believed the project would be more unlikely to gain approval than likely?

Large capital investments for pipelines must also be supported by revenue certainty from firm service agreements. If there is no demonstrated need for a new pipeline in the form of service contracts, projects would be uneconomic and companies would not build them.

Oil & Gas 360® asked van Rossum about the validity of these explanations.

“I’m not aware of any other agency where 100% of the time, their process always works or where a final decision maker, who has a more objective, distant perspective, says ‘yes’ every single time,” she said. “It just doesn’t happen that way.”

Van Rossum has frequently cited FERC’s denial of the Jordan Cove LNG export facility in Coos Bay, Oregon as an acknowledgment of prior wrongdoing on the agency’s part, as the denial was issued one week after DRN had sued FERC in federal court. FERC justified its denial on the grounds of unfavorable economics due to diminished LNG demand in Asia.

Structural Bias in its Funding Mechanism

In a complaint filed March 4th, 2016 in the D.C. District Court, van Rossum and the DRN claimed FERC’s pipeline program is subject to structural bias due to its funding mechanism, citing the proposed PennEast pipeline as the basis of harm. The agency assesses and collects fees and annual charges for pipeline use, resulting in its being “100% funded by the industry it regulates,” according to the suit.

Such bias, DRN argues, would violate its constitutional right to Due Process guaranteed under the Fifth Amendment. This requires an adjudicative agency to be neutral in its decision making process by being free from actual bias as well as the appearance of bias. “Could an umpire call balls and strikes objectively if he were paid for the strikes he called,” reads the filing’s epigraph.

Uses its Fees to Pay Back its Federal Funding

In its motion to dismiss DRN’s complaint, FERC argues that van Rossum’s claims of bias are “unsubstantiated and unconnected to alleged, generalized and indeterminate harms.” Additionally, because the agency has not acted upon the PennEast pipeline application, DRN lacks standing to sue on the basis of harm, the agency states.

Like other agencies, FERC’s budget is set through annual appropriations from the U.S. Congress, as laid out in the Omnibus Budget Reconciliation Act of 1986. The agency is unique in its authority to raise revenue to reimburse the Treasury through fees on the transport of natural gas, oil, and electricity.

Like other agencies, FERC’s budget is set through annual appropriations from the U.S. Congress, as laid out in the Omnibus Budget Reconciliation Act of 1986. The agency is unique in its authority to raise revenue to reimburse the Treasury through fees on the transport of natural gas, oil, and electricity.

The revenue collected must match annual appropriations, resulting in a net balance of zero, as stated in the Full Cost Recovery section of the agency’s FY 2017 Congressional Performance Budget Request.

A pipeline approval does not increase the agency’s annual revenue; it only spreads it over a greater number of pipelines. “It does not increase the pie – it only changes how the pie is divided,” the motion reads.

Tolling Orders

Another of DRN’s accusations of Due Process violation relates to FERC’s use of “tolling orders,” which DRN sees as legal loopholes that prevent projects from being challenged prior to start of construction. Before challenging a FERC-issued project approval, concerned parties must submit a rehearing request. In response, the agency often grants tolling orders to note these requests and extend the 30-day statutory period to consider their merits before granting or denying them.

Van Rossum and other environmentalists sees these actions as delay tactics, arguing that FERC and the courts are less likely to halt construction or order pipelines torn up if they are already under way. “In our case against the Leidy SE pipeline project, we were placed in legal limbo for 15 months, during which FERC issued 20 notices to proceed,” van Rossum told Oil & Gas 360®.

FERC has justified its use of tolling orders on the grounds that many requests require more than 30 days to properly assess. The agency states that Due Process is provided and not precluded by a project’s stage of construction. As such, companies must make necessary changes to projects in the event that changes are ordered by FERC or courts.

Filed her Biggest Case: Eminent Domain

Van Rossum cited her most recent attempt as “probably the most important legal filing” of her campaign thus far, as it seeks a declaration that FERC’s ability to grant the power of eminent domain is unconstitutional. This process is used to secure easements for pipelines if negotiations with landowners fail.

“The fact that FERC gives power of eminent domain to pipeline companies is a fundamental problem that results in a lot of destruction that needs to be ended through a judicial decision or Congressional action following a General Accountability Office review,” van Rossum told Oil & Gas 360®.

As of publishing time, the D.C. District Court had not yet agreed to hear DRN’s suit against FERC.

NatGas Pipelines: “Locking Us into a Fossil Fuel Future”

In addition to its legal cases, DRN questions whether fossil fuel and pipeline development serves the public interest. Many in industry and government agree such development is crucial to meet current energy demand and “to provide a bridge to a clean energy future.”

Environmental groups for the past few years have said that natural gas’s role in the energy mix is as a bridge to renewables. Natural gas emits approximately half the carbon dioxide of coal when it is burned. For the generation of electricity this offers greater flexibility and scalability than intermittent renewables such as wind and solar.

Oil & Gas 360® asked van Rossum for her views on this issue.

“I see continued [natural gas] development as more of a hurdle than a bridge. Experts, including those in the industry, acknowledge that fracked gas from shale will peak in 2020 and be out the door in 2040. Yet these pipelines have 40 to 50 year lifespans. By continuing to invest in pipelines, we are locking ourselves into a fossil fuel future,” continued Van Rossum.

Van Rossum further disagreed with the need for more pipelines in the region to meet strong demand and lower prices offered by natural gas, citing the proposed PennEast Pipeline that will deliver natural gas to New Jersey and Pennsylvania.

“There are studies on record showing that there is no need for gas in New Jersey and that if PennEast were built, there would be a 40-50% gas surplus, as well as price increases,” van Rossum told Oil & Gas 360®.

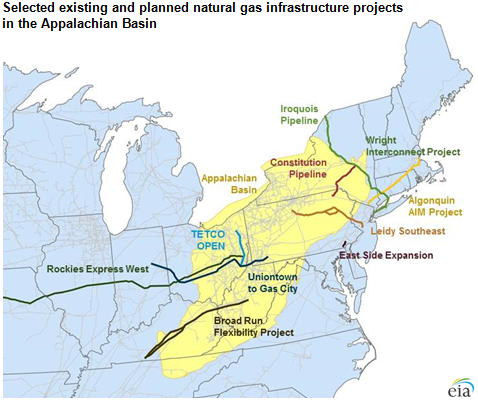

Analyses from EIA, Analysis Group, and the Department of Energy have shown that a large portion of power generation and heating in the Northeast U.S. is natural gas-fired, while supply constraints from strained infrastructure have served to cause regional energy prices to represent some of the highest levels in the country. While new pipelines to get the gas from production locations to market would balance supply and demand in the region and would likely lower prices for heating, the issue of how to properly meet these needs remains hotly contested in the region.

The Future

While van Rossum does not suggest stopping all fossil fuel-related activities immediately, she certainly doesn’t see a future for the industry. And she continues to work hard to force the transition away from fossil fuels.

“Of course we need time, which is why we need to manage fossil fuel decline,” van Rossum said. “You can’t turn off the tap, but we should not build more fossil fuel infrastructure. We should be building more clean energy infrastructure … .”

Pipeline Safety Bill Unanimously Passes Both House and Senate this Week

As a side note, on June 13, 2016, the U.S. Senate unanimously passed a bill to reauthorize the federal pipeline safety oversight board. It’s known as the PIPES act.

The PIPES act extends the Pipeline and Hazardous Materials Safety Administration (PHMSA) and enhances PHMSA safety policies, including an effort to provide more insight into the regulatory process and give the Department of Transportation more power in the event of pipeline emergencies, according to The Hill. PHMSA is an arm of the federal government that is within the Department of Transportation, rather than the Department of Energy, under which FERC resides.

The House of Representatives unanimously passed PIPES on June 8, 2016.

The PIPES act has been sent to President Obama for his signature.