OAG360 Publishers Note: Enverus subscribers (because Enverus is tasked as the data collector for weekly rigs counts from Baker Hughes) se this data weekly on Thursday’s, while non-subscribers see rig counts updating 11 AM MST each Friday

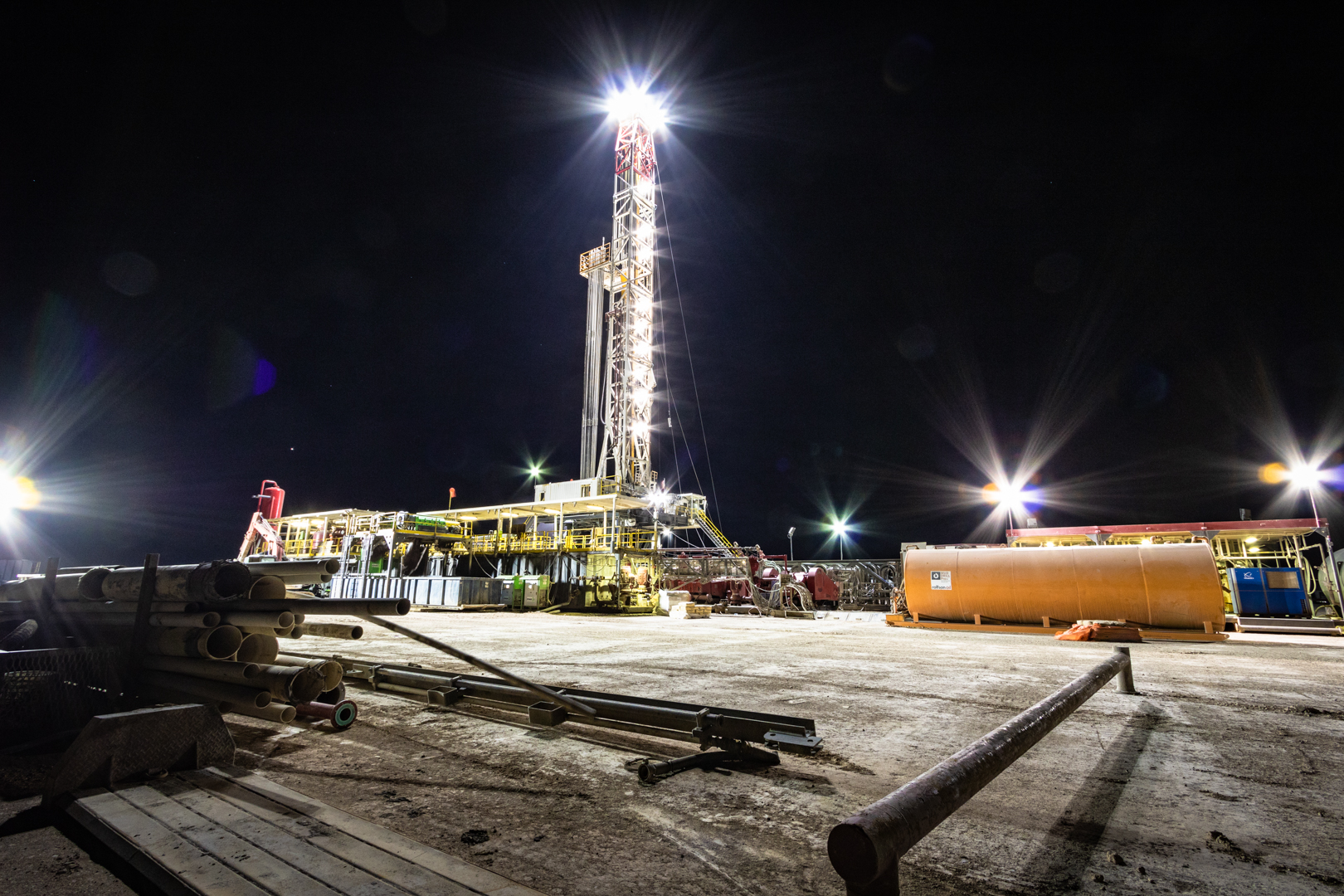

Houston — The US oil and gas rig count rose by 15 to 308 in the week ending Sept. 23, rig data provider Enverus said, marking the largest weekly gain in the more than six months since the current industry downturn began.

The week-on-week increase brought the nationwide rig count, which had been rangebound in low 280s to the mid-290s for 14 weeks, above 300 for the first time since early June.

The Permian Basin accounted for nearly half the added rigs, or seven, for a total 135, the highest number in that West Texas/New Mexico play since late July. The Eagle Ford Shale in South Texas gained three rigs, making a total of 12, also the highest since late July.

All rigs added to the domestic fleet in the past week were oil-directed. The oil rig count rose by 17 to 217, while rigs chasing natural gas dropped by two to 91.

“The rig increase could be part of a Q4 push” as operators spend the last of their 2020 capital budgets before the holiday season from late November until the new year, S&P Global Platts Analytics analyst Matt Andre said.

“I’m also guessing operators were waiting to see what prices are going to do,” Andre added. “It appears they will continue to hover around $40/b, which allows some producers to make money in the Permian, and we’re seeing some rigs added to profitable areas of the basin. That should provide Permian producers an uplift in internal return rates [and] lower breakeven prices.”

Platts Analytics projects WTI oil prices for next year to average $40.70/b, with Q1 averages at $37.60/b and Q4 at $44.40/b.

For the rest of the story: S&P Global