Enterprise Products Partners (ticker: EPD), the largest Limited Partnership listed on EnerCom’s MLP Scorecard, has announced Phase Two of the acquisition of Oiltanking Partners (ticker: OILT) in a unit-for-unit merger agreement. Per the agreement, OILT shareholders will receive a 30% premium on EPD shares. Total consideration for the transaction is $6.0 billion, including the $4.6 billion acquisition ($2.2 billion in cash) of Oiltanking Holdings in October. Completion is expected in early 2015.

Backgrounds

Enterprise Products Partners holds a market capitalization of more than $70 billion in the MLP Scorecard for the week ended November 7, 2014. The company is one of the world’s largest publicly traded partnerships and is a leader in the midstream energy services sphere, owning more than 51,000 miles of pipeline and 24 natural gas processing plants, with access to maritime, storage and export terminals.

Oiltanking Partners provides EPD with additional access to both midstream and downstream assets in the Gulf Coast region. OILT has connectivity to 23 different facilities along the coast and is the world’s second largest independent storage provider. The company held a market cap of approximately $7.5 billion in the latest MLP Scorecard. Its initial public offering in July 2011 raised approximately $230 million.

Oiltanking Partners provides EPD with additional access to both midstream and downstream assets in the Gulf Coast region. OILT has connectivity to 23 different facilities along the coast and is the world’s second largest independent storage provider. The company held a market cap of approximately $7.5 billion in the latest MLP Scorecard. Its initial public offering in July 2011 raised approximately $230 million.

Breakdowns

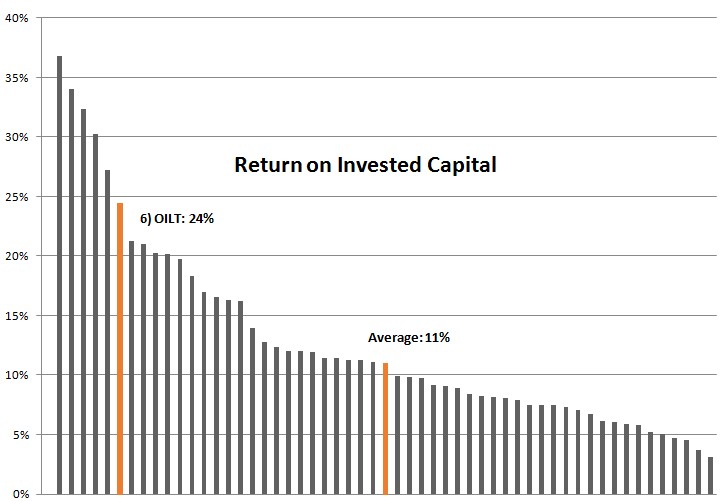

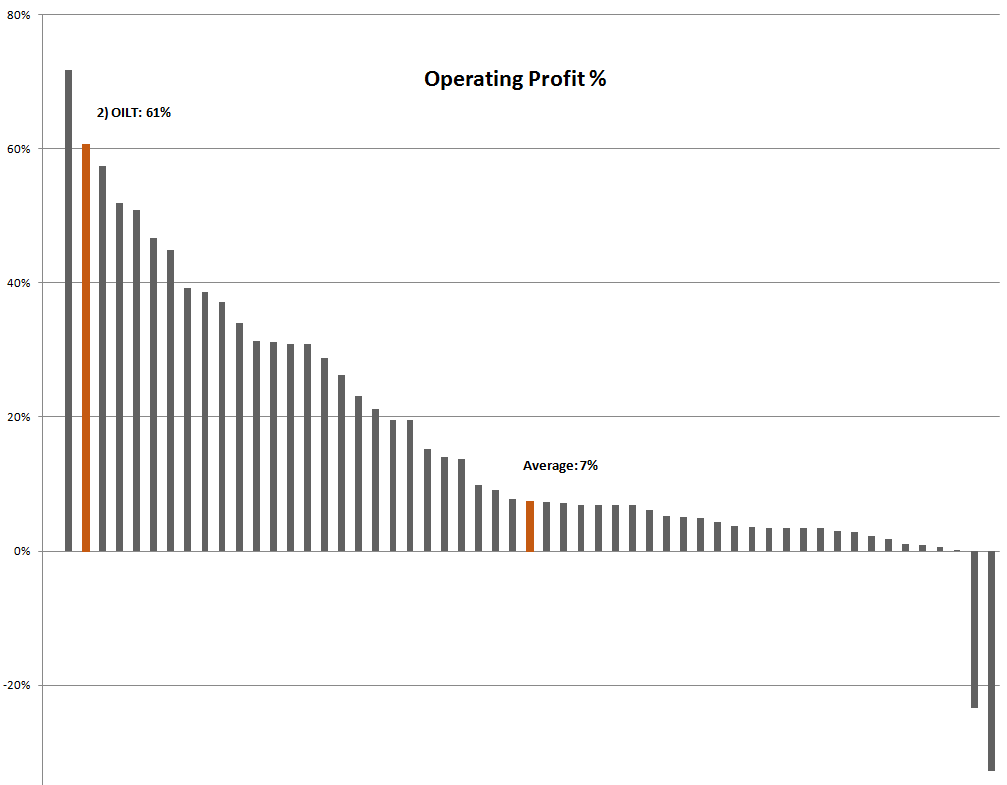

Oiltanking Partners has some of the best metrics of any of the 56 companies listed on the MLP Scorecard. Its 2.1% yield is well below the average of 4.8% (and EPD’s, which is 3.6%), but key metrics place it near the top of the heap. As identified by the charts on the right, its return on invested capital is the sixth highest in the group. Its 3% debt to market cap is among the lowest of its peers while its operating profit percentage is the second highest of the group. EPD places on the average to above-average spectrum in all three mentioned factors. However, EPD’s higher yield represents a 74% increase in cash distribution for current OILT shareholders.

Despite the size of the overall acquisition, the $6.0 billion merger accounts for only 6.7% of EPD’s $88.5 billion standalone enterprise value. EPD management believes the deal will become financially realized in 2016, which will include annual synergies of at least $30 million. In a conference call in October, EPD management said the merger deal is approximately 60% equity and will maintain the company’s debt to EDBITDA ratio of 3.5x to 4.0x.

Despite the size of the overall acquisition, the $6.0 billion merger accounts for only 6.7% of EPD’s $88.5 billion standalone enterprise value. EPD management believes the deal will become financially realized in 2016, which will include annual synergies of at least $30 million. In a conference call in October, EPD management said the merger deal is approximately 60% equity and will maintain the company’s debt to EDBITDA ratio of 3.5x to 4.0x.

EPD’s Role in the Export Market

Enterprise, along with Pioneer Natural Resources (ticker: PXD) became the first two U.S. companies to win federal approval for condensate exports in July. Rick Rainey, EPD’s Vice President of Public Relations, told Oil & Gas 360® in an exclusive interview that the company is increasing its Gulf Coast outlets to ramp up its condensate export capacity. In a conference call in October, EPD management said the integration of OILT’s assets provide a platform for petroleum products growth in the Houston Ship Channel in addition to the Beaumont plant.

Baird Energy believed the deal was bullish for the MLP sector, especially since it closely followed the surprising consolidation announcement by Kinder Morgan. Global Hunter Securities maintained its “Buy” rating when the deal was first announced, and said: “[We] continue to view [EPD] as one of the best defensive MLPs. With more than 85% of margins from fee-based revenues, diversified asset mix, simplified corporate structure, strong growth pipeline, excess coverage ratio and an investment grade balance sheet, EPD enjoys visibility to multiple years of distribution growth, with little sensitivity to short-term movements in commodity prices and interest rates.”

Baird Energy believed the deal was bullish for the MLP sector, especially since it closely followed the surprising consolidation announcement by Kinder Morgan. Global Hunter Securities maintained its “Buy” rating when the deal was first announced, and said: “[We] continue to view [EPD] as one of the best defensive MLPs. With more than 85% of margins from fee-based revenues, diversified asset mix, simplified corporate structure, strong growth pipeline, excess coverage ratio and an investment grade balance sheet, EPD enjoys visibility to multiple years of distribution growth, with little sensitivity to short-term movements in commodity prices and interest rates.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.