ETE Becomes Largest Energy Infrastructure Group

Enterprise Value Now Exceeds that of BP, Total and Petrobras

Energy Transfer Equity’s (ticker: ETE) long pursuit of Williams Companies (ticker: WMB) has come to an end.

On September 28, 2015, ETE announced the acquisition of WMB for total consideration of $37.7 billion, including debt, representing a 10% premium to WMB stock price prior to the opening bell. The new purchase price is a far cry from its $53.3 billion offer in June 2015, which was turned down by WMB due to “undervaluation.” The June offer represented a 32.4% premium to WMB’s closing price on June 19, 2015, but the latest offer provides a cash option for WMB as opposed to the previous offer that was an all-stock offering.

“What Williams has done is provide a cash-exit strategy for its shareholders, but at a lower price,” said Skip Aylesworth, a manager for Hennessy Funds Trust, in an interview with Bloomberg. Investors “thought they were going to see a higher number.”

The belief is certainly reflective of WMB’s stock performance, which fell more than 12%. ETE didn’t fare any better, falling by a similar amount. Both stock prices tumbled to reach their lowest levels since December 2013. Commenters in public forums on Barron’s and The Wall Street Journal expressed displeasure at Williams’ perceived discount on the sale.

“The broader market has obviously impacted by the volatility that we’ve seen,” said Jamie Welch, Chief Financial Officer of Energy Transfer Equity, in a conference call following the release. “Our expectation is that with the announcement of this transaction and the key value tenets that we’ve outlined, we will be out to get the broader message out and hopefully stem that decline and start to correct it.”

Pursuit Complete

The acquisition announcement marks perhaps the final chapter in ETE and WMB’s unusual merger negotiations, which have spanned back to the beginning of the year. WMB made ETE’s offer public in June, encouraging other major midstream companies to place bids. About two weeks ago, Energy Transfer was apparently the last one standing in the process after Reuters reported that Spectra Energy (ticker: SE) pulled out of the Williams sweepstakes. Kinder Morgan (ticker: KMI) was also rumored to be in the picture but analysts believed KMI would have difficulty meeting anti-trust issues. ETE remained steadfast in completing the acquisition, saying they were “fully committed” to finalizing the deal.

Some industry analysts believed ETE could gear up for a hostile takeover if a deal could not be reached with WMB’s board of directors. In association with the takeover, WMB will terminate plans to merge with its master limited partnership, Williams Partners (ticker: WPZ). The latter will retain its name and continue to operate in Tulsa, Oklahoma. The transaction is expected to close in the first half of 2016.

Energy Transfer Ascends into a Midstream Supergiant

Upon closing of the merger, Energy Transfer will be the third largest energy franchise in North America and one of the five largest energy companies in the world. Its pro forma enterprise value of nearly $150 billion is surpassed only by ExxonMobil (ticker: XOM), PetroChina, Royal Dutch Shell (ticker: RDS.B) and Chevron (ticker: CVX).

ETE management said its balance sheet, combined with the footprint of Williams, will “benefit customers by enabling further investments in capital projects and efficiencies that would not be achievable absent the transaction.”

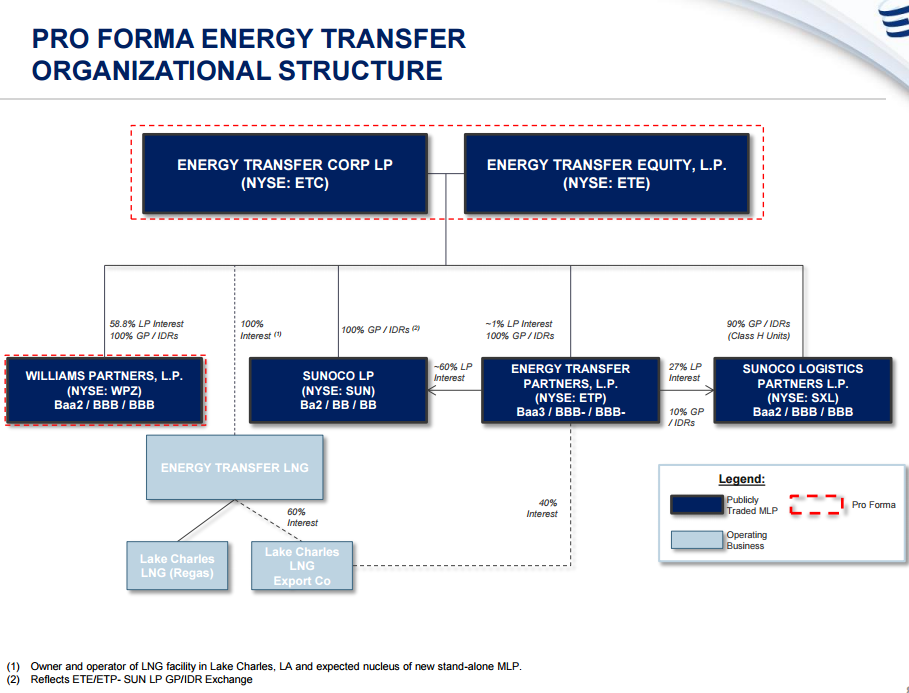

Consistent with previous forecasts, the combined entity will be taxed as a C-corp. Anticipated EBITDA from the synergies is expected to exceed $2 billion annually by 2020 and will require overall incremental capital investment of more than $5 billion to achieve. Williams Partners becomes the fourth publicly traded MLP involved in ETE’s organizational structure, joining Sunoco LP (ticker: SUN), Energy Transfer Partners (ticker: ETP) and Sunoco Logistics Partners (ticker: SXL).

ETE says its distribution growth rate is expected to remain intact, and its dividend payouts would exceed the proposed payouts from the WMB/WPZ merger, which has been terminated as a result of ETE’s purchase of the midstream provider. WPZ will receive a $428 million break-up fee in accordance with the termination.

In a conference call following the announcement, ETE management mentioned it now has a footprint in every basin in the United States. Its authorized project backlog consists of $23 billion in developments, while Williams was pursuing as much as $30 billion in potential projects.