“There’s a lot of capital on the sidelines. … From a timing perspective, I would imagine there’s a major effort to deploy capital this year.” – Jason Downie, Tailwater Capital

The energy space has changed. But with change comes opportunity, and private equity companies are chomping at the bit to use their dry powder in a market starved for capital.

Co-Founder & Managing Partner of Tailwater Capital

One of those firms is Tailwater Capital, a Dallas-based enterprise founded in 2013. Under the leadership of Jason Downie and Edward Herring, Tailwater’s co-founders, the firm has established itself across the United States in both the midstream and upstream segments. The co-founders have worked with each other for more than 15 years, and the 2016 version of this market downturn has created opportunities for these savvy PE investors.

Oil & Gas® spoke with Jason Downie in this exclusive interview.

OAG360: On your web site, you mention a “one-size-fits-all” approach to private equity can get in the way of creating a strong foundation. What kind of approach does Tailwater use, and how has that benefitted your company and your portfolio companies?

DOWNIE: We like to call ourselves a middle market-focused, energy-specific private equity firm. And really, we focus primarily on midstream and upstream as two different fund vehicles.

Our midstream vehicle is a traditional “control equity” style fund, and our upstream vehicle today is a non-operated working interest fund. By having those two different pools of capital and being middle market-focused, we can be very creative in terms of how we approach capital solutions for either companies that need a partner or management teams that have ideas and opportunities to build a business around.

And so, where many energy private equity firms are focused on the more traditional model of backing a management team with a commitment of equity capital and many different management teams per fund, Tailwater’s approach is much more specific around growth capital and a partner-oriented approach with the management team on a specific concept, which allows our firm to have more focused management relationships.

OAG360: In November 2015, Tailwater had a fourth closing for a total of $217 million of capital under its TAILWATER E&P OPPORTUNITY FUND II LP. What do you have in mind as far as specific targets are concerned? Are you targeting certain basins?

DOWNIE: We’re very focused on what I would call the core onshore United States, liquids-weighted basins. So that would be the Bakken, Niobrara, Permian, Eagle Ford and SCOOP/STACK, for the most part.

We are partnering or acquiring interests in wellbores directly behind best in class operators who have both experience and scale in the basin. For us, it’s a great way to help provide capital to an E&P counterparty but also a great source of information for our midstream efforts that can lead to potential opportunities.

I should mention we also raised a $650 million midstream fund (final close in December of 2014), which is about 20% invested. So between that and the E&P fund we recently closed, we have quite a bit of dry powder available.

OAG360: Why is Tailwater more focused on liquids producers as opposed to gas producers?

DOWNIE: Well “liquids” involves more than just crude – it can be crude, condensate, NGLs and water, so it’s a more complicated wellhead stream which generally leads to more opportunities for midstream services. In addition, the liquids rich reservoirs are typically more economic, especially when you have a normalized commodity price environment. That leads to more activity, more players, and historically more opportunities for deal flow and capital deployment.

OAG360: How are you working through the current environment with your portfolio companies?

DOWNIE: Our existing portfolio companies, for the most part, have no leverage on their balance sheets. We’re encouraging our teams to very actively pursue opportunities to either acquire assets or partner with operators in a win-win format. Our goal is to create value for their counterparties while remaining in a position to create proprietary deal flow.

We’re being patient, we’re viewing this as an opportunity to deploy capital aggressively. I don’t believe you can say we’re at the bottom yet, but I think we’re close and I don’t think this price deck is sustainable for more than a couple of years.

People are starved for capital, so now is the time where you can find opportunities that you normally wouldn’t see. That doesn’t always mean buying something for cheap – that can mean providing someone an opportunity through a partnership. Normally, operators might build their own gathering system and today, quite frankly, they could use a capital partner. So we’re trying to look at all of the above.

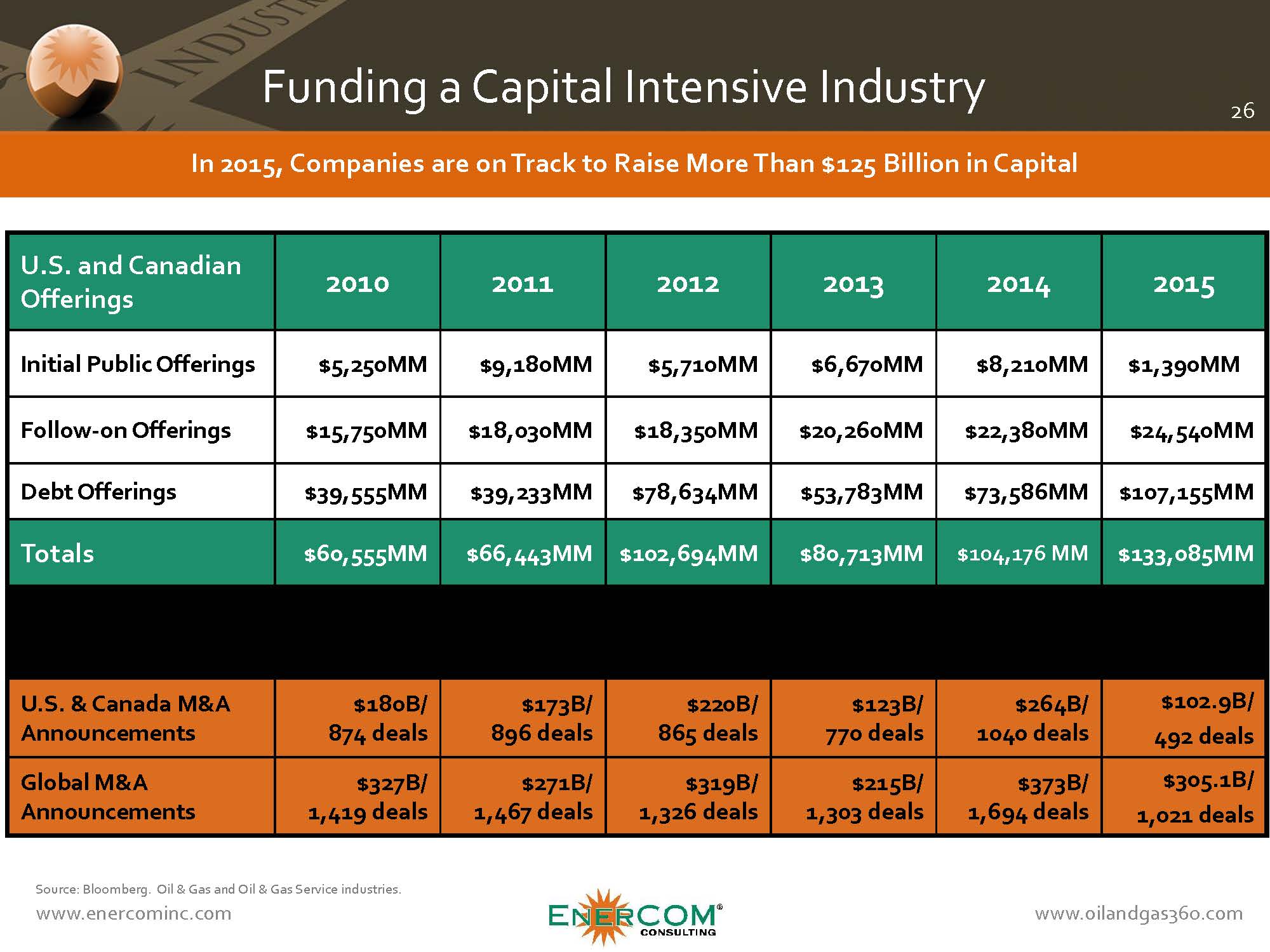

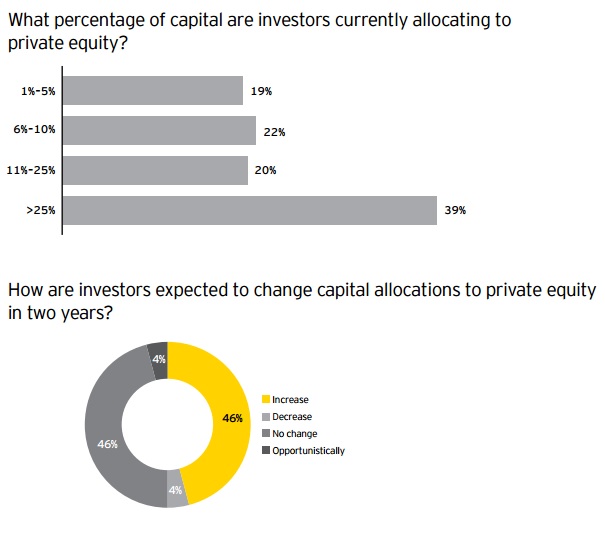

OAG360: On a larger scale, private equity investments in energy have increased in recent years. Do you expect the trend to continue in 2016?

DOWNIE: I do. I can’t say exactly how much, but I know there’s a lot of capital on the sidelines. I know I’m not alone in thinking that commodity prices are somewhere near the bottom. So from a timing perspective, I would imagine there’s a major effort to deploy capital this year.

OAG360: Do you also expect mergers and acquisitions to increase?

DOWNIE: Most likely. We’re surprised that the lending counterparts haven’t forced parties to sell their assets. The senior lenders have been, in a sense, kicking the can down the road. Our expectation is that M&A activity will increase their year, whether it’s consolidation (which is what should happen) or the sale of non-core assets.

We’re already seeing it on the midstream side. Kinder Morgan, for example, publicly disclosed that they’re looking to offer up stakes in $3 billion of projects and build other joint ventures. That is not the norm for the MLP landscape.

OAG360: What kind of an impact does Tailwater have in board rooms, as far as guidance is concerned?

DOWNIE: We look at everything we do with a bottoms-up approach. From an energy standpoint, that means everything starts at the drill bit. You have to fundamentally have a perspective on the economic profile of the reservoir in question.

Our general focus is on management teams, and since all basins are not created equal, we encourage these teams to focus on their core competencies. So collectively, we aim to marry our capital with a conviction on the upstream economic profile of a particular basin, combined with a talented management team.

With such a partnership, we’ve been able to help set the strategy for capital deployment. Whether that’s direct M&A, building a gathering or processing system on the back of an anchor tenant contract, or even buying a platform and growing it through tuck-in or non-core acquisitions.

So if you have conviction around the reservoir and you have a team that knows the basin – that includes knowing landowners and various E&P operations management leaders – that’s how you develop opportunities to either make an acquisition or solve a problem for a portfolio company.

Visit Tailwater Capital’s new web site at www.tailwatercapital.com, designed and launched by EnerCom, Inc. When the Dallas-based energy investors approached EnerCom about upgrading their website, the goal was to create a dynamic, energy-centric experience that quickly communicates the firm’s E&P/midstream focus. The creative team at EnerCom has created more than 100 web sites for oil and gas E&P, midstream, oilservice, financial services and other companies that serve the energy sector. For more information, read the story on Oil & Gas 360®.