Cimarex Balances Innovation and Efficiency

Cimarex (ticker: XEC) continues to look for the best long-cycle returns on their drilling, and the company appears to have found it in its long-length laterals.

The company is increasingly looking to improve the efficiency of its two-mile laterals, reporting that its first lateral of this length in the Meramec in Oklahoma is showing a peak 30-day IP of over 16 MMcfe.

Tom Jorden, president, chairman and CEO of Cimarex said during a recent conference call that the new well, called the Clayton, represented a 72% uplift versus the average one-mile lateral being drilled there.

When asked how the company balances innovations like longer laterals with the lower price of oil and gas during the conference call, Jorden said capital efficiency and return on capital was the priority, but “you always have to have room for innovation,” said Jorden.

During the company’s conference call, Jorden also drew attention to the fact that Cimarex has followed the idea of not growing simply for growth’s sake for the last 20 years. This, along with a focus on returns, allows Cimarex to “model [its] investments using realized prices with room for draconian downside,” Jorden said.

Cimarex highlights:

- Cimarex is a relatively low cost producer compared to its large-cap E&P peers in EnerCom’s E&P weekly with a three-year F&D cost of $11.53, compared to a group median of $19.02.

- The company has a low debt-to-market cap at 16%, compared to 56% for the large-cap group, and a net-debt-to-TTM EBITDA of just 0.6x, compared to a group median of 2.5x.

- According to the company’s Q3’15 results, Cimarex has no borrowings under its revolving credit facility and a cash balance of $899 million.

According to John Lambuth, vice president of exploration for Cimarex, the company invested $184 million during the third quarter for drilling and completions, with about 60% of that targeted in the Permian, and the rest going to the company’s Mid-Con assets. “Companywide we brought 56 gross, 14 net wells on production during the quarter,” he said during the conference call.

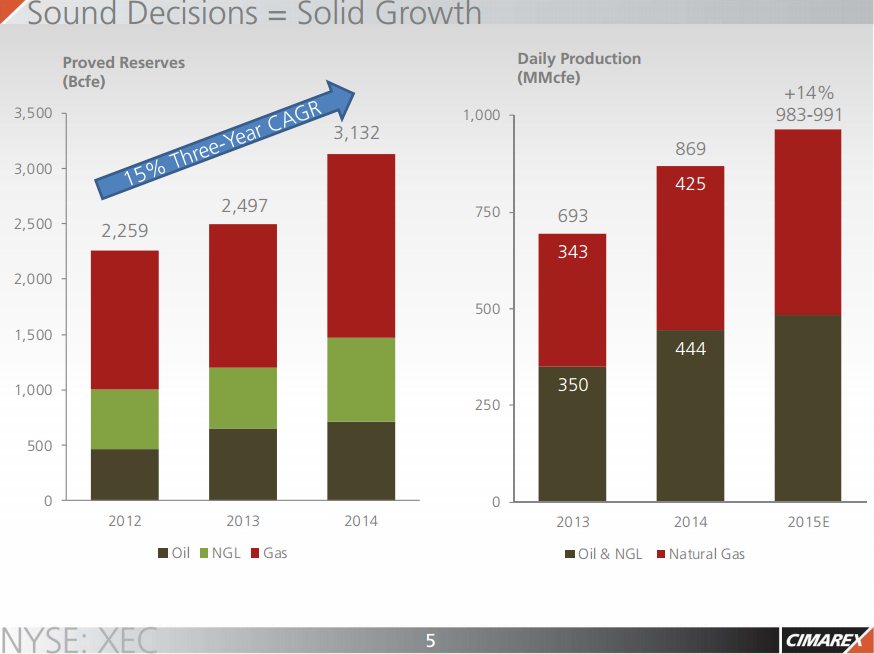

Total company production averaged 979 MMcfe/d during the third quarter, the company said in its release. The volumes represented a 4% year-over-year increase, with a 15% increase in oil volumes. Cimarex projects average production in the fourth quarter to reach 980-1,010 MMcfe/d, putting full-year production at 983-991 MMcfe/d, a 14% increase over 2014 at its midpoint.

Cimarex also believes that it will come in under cost on its 2015 capital budget, it said in its third quarter release. The company expects capital for exploration and development in 2015 to total $900-$950 million, down from its guidance of $1 billion.