Callon maintains 70% EBITDA margin despite lower commodity prices; company’s borrowing base was increased to $300 Million

The lower price of crude oil has put a significant squeeze on earnings for oil and gas companies in the last year. With both U.S. crude oil benchmark WTI and international benchmark Brent trading at 35% and 33% of their value in June of 2014, the whole industry is facing hard times. Despite the historic low price of crude oil, Callon Petroleum (ticker: CPE) has managed to maintain its EBITDA margin, increase production, increase its borrowing base, and has a goal of being self-funded next year.

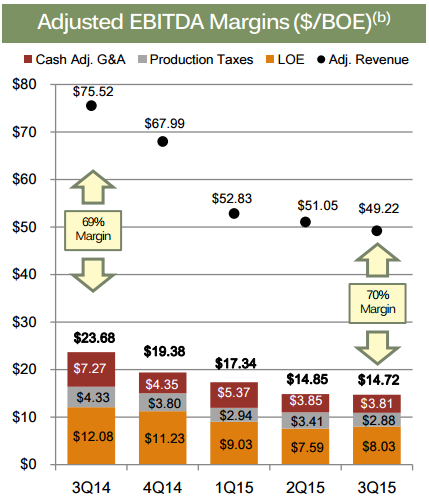

Callon’s total adjusted EBITDA for the quarter ended September 30, 2015, amounted to $30.2 million, an 11% increase from $27.2 million in Q3’14, and a 5% decrease from Q2’15. The company’s EBITDA margin was at 70%, compared to 69% a year ago, in large part to lower G&A and LOE costs. Callon’s EBITDA margin is well above the median for a group of 82 E&P companies in EnerCom’s E&P Weekly, which was 52% for the week ended December 24, 2015.

“We continue to focus on improving our operating cost structure and capital efficiency in the current environment,” commented Fred Callon, Chairman and Chief Executive Officer.

Increasing production

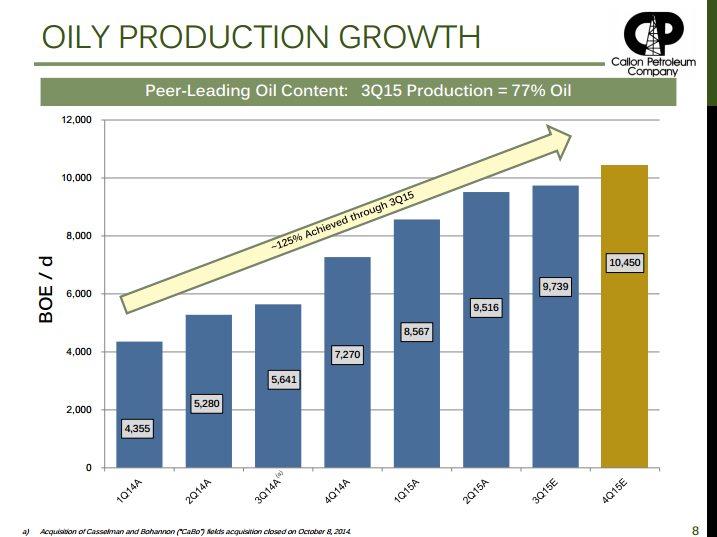

Callon also announced that it had increased its production 73% (77% oil-weighted) year-over-year in its third quarter results. Net daily production reached 9,739 BOEPD in the third quarter, with the company anticipating production of 10,450 BOEPD by the end of the year, according to a recent investor presentation.

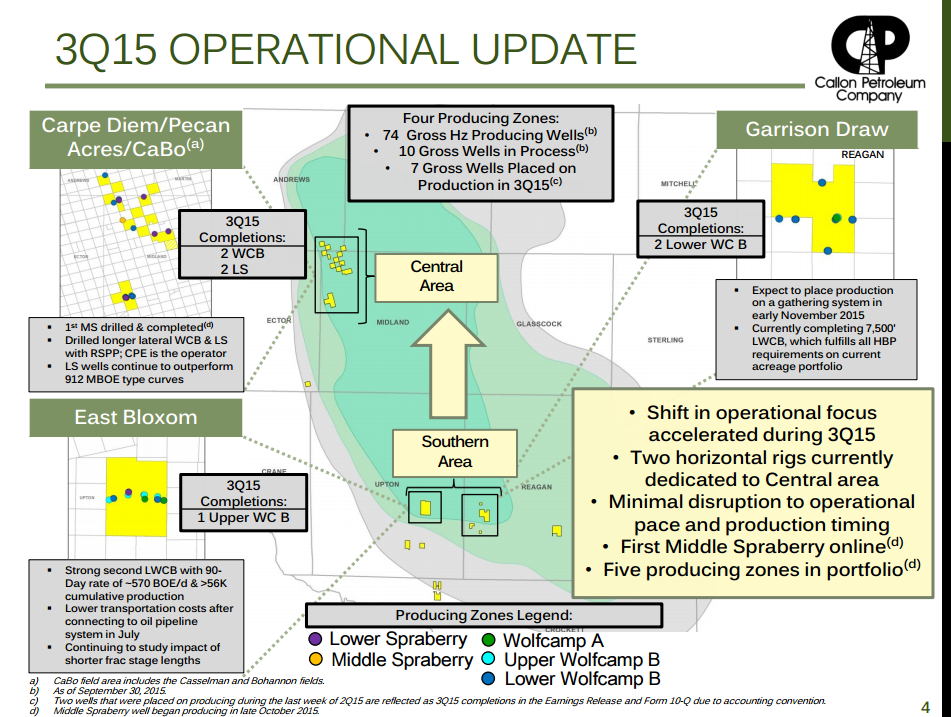

For 2016, Callon plans to remain focused on its Central Midland assets, where it recently added 628 acres through a bolt-on acquisition. Callon added 360 BOEPD (84% oil) and assumed full working interest (79.19% net revenue interest) of the Carpe Diem field for $29.5 million.

The company’s Central Midland acreage is 100% held by production, giving Callon greater flexibility in its operations. Callon was able to quickly pivot in the current environment due to a property base that is entirely held by production, with no drilling commitments that would prevent us from targeting our highest return opportunities,” said Fred Callon.

Borrowing base increases, with plans to pay off debt

Many oil and gas companies are facing less available funding as banks reduce company credit facilities based on reduced reserves values stemming from the drop in commodities prices. With the SEC price deck used to determine reserves down 48% in 2015, most companies have faced borrowing base reductions of 11.7%, according to EnerCom Analytics.

Callon has been one of handful of companies in the oil and gas sector which has actually seen its borrowing base increased. The company’s borrowing base was increased to $300 million – $50 million more than was previously available – on October 7, with no other changes made to its credit facility.

The company also plans to use a recent stock offering of 12.0 million shares with a greenshoe of 1.8 million additional shares in order to pay off its existing debt. According to a company press release, the total proceeds from the offering were $109.9 million, which it has earmarked to pay off its $99 million debt (reported as of September 30, 2015).

Management expects to be cash flow neutral by the second half of next year, potentially expanding its opportunities in the Permian. CPE’s recent investor presentation noted that the company plans to increase production by about 20% while reducing capex by 40% from 2015.

A powerful statement

“We can deliver 20% production growth and growth into the teens the following year by living within our means,” said Joe Gatto, Chief Financial Officer of Callon Petroleum, in a recent conference. “We feel that’s a pretty powerful statement.”

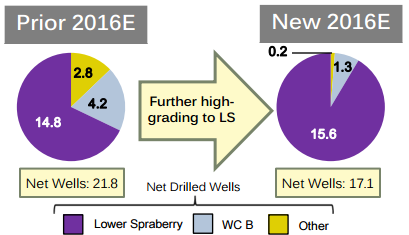

The focus of the 2016 capital budget will be to continue targeting the Lower Spraberry, where the company plans to approximately 15.6 net horizontal wells, about 91% of its planned wells for next year. The 2016 capital budget assumes a current well cost of $5.9 million for a 7,500’ latera.