Oil & Gas Companies are Finding Ways to Meet Capital Requirements in a Down Market

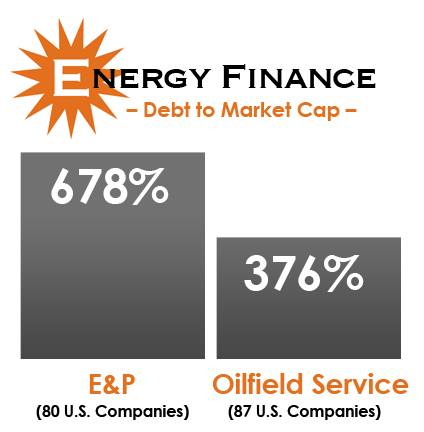

Energy Finance: with oil prices still searching for a bottom, energy companies have been in search of ways to lighten burdens through good financial decisions. The ubiquity of capital needs and consequent debt associated with the oil and gas sector necessitates that many companies use multiple debt vehicles to meet their capital requirements.

Among the most common debt vehicles are corporate bonds. The upside to issuing a corporate bond is that the primary responsibility for the term of the bond is paying the interest, with the principal being repaid at the maturity of the bond.

The downside comes when the balloon payment associated with the maturity falls at a point where commodities prices have plunged to $30 for the first time in more than 12 years. This requires companies to meet debt obligations and make interest payments on issuances that were secured when commodities prices were substantially higher than today. In other words, the debt obligation (whose size doesn’t change with the commodity direction), doesn’t match cash flows. It’s the CFO’s nightmare: the company’s finances are being impacted by events which stand outside the company’s control.

In an effort to postpone the balloon payments while still maintaining go-forward capital liquidity, several E&P companies have issued tender exchange offers to push out the maturity of their corporate bonds.

There are several reasons that bond holders would choose to exchange their current bonds for new ones. One reason is the lower risk of default and bankruptcy. By granting more time to the company to work through difficult financial times, the investor stands to benefit from a successful effort, while the risk is real of potentially receiving nothing in a default. Another reason is the investor may not be ready to cash in on the bond.

However, the most common reason for bond holders is that the company will incentivize the investors to make the switch by paying a premium on the bond.

Following are some recent energy finance examples that involve debt exchanges:

Denbury Resources (ticker: DNR)

On December 21, 2015, Denbury Resources announced an exchange offer for three sets of senior subordinated notes. The notes that are being replaced are:

| Title of Old Notes | Principal Amount Outstanding ($MM) | Early Exchange Consideration | Late Exchange Consideration |

| 6 .375% Senior Subordinated Notes due 2021 | $ 400 | $ 650 per $1,000 par value | $ 600 per $1,000 par value |

| 5.5% Senior Subordinated Notes due 2022 | $ 1,250 | $ 650 | $ 600 |

| 4.625% Senior Subordinated Notes due 2023 | $ 1,200 | $ 650 | $ 600 |

Denbury offered to replace these notes up to $650 million with new 7.5% senior notes with a maturity date of May 15, 2022.

At the time of the Denbury announcement, the three bonds were trading at a significant discount relative to the issue price. Relative to an original trading price of $100, the 6.375% notes were trading at $40.00, the 5.5% notes were trading at $36.50, and the 4.625% notes were trading at $35.75 on December 21, 2015.

In this case, Denbury is willing to offer a premium to the publicly traded price for investors to exchange the notes, particularly if they participate in the early exchange consideration. While the new notes offer a higher interest rate, by reducing and postponing the balloon payments from the old notes, the company will save money in the long run.

Chesapeake Energy (ticker: CHK)

Another example of companies offering to exchange bonds is Chesapeake Energy. On December 2, 2015, the company released a list of outstanding bonds with the offer to exchange them for new 8.00% senior secured second lien notes due in 2022.

The list of bonds is as follows:

| Title of Old Notes | Principal Amount Outstanding ($MM) | Early Exchange Consideration | Late Exchange Consideration |

| 6.25% Euro Denominated Senior Notes due 2017 | $ 364 | $ 1,000 per $1,000 par value | $ 950 per $1,000 par value |

| 6.5% Senior Notes due 2017 | $ 660 | $ 970 | $ 920 |

| 7.25% Senior Notes due 2018 | $ 669 | $ 825 | $ 775 |

| Floating Rate Senior Notes due 2019 | $ 1,500 | $ 600 | $ 550 |

| 6.625% Senior Notes due 2020 | $ 1,300 | $ 610 | $ 560 |

| 6.875% Senior Notes due 2020 | $ 500 | $ 609 | $ 559 |

| 6.125% Senior Notes due 2021 | $ 1,000 | $ 578 | $ 528 |

| 5.375% Senior Notes due 2021 | $ 700 | $ 570 | $ 520 |

| 4.875% Senior Notes due 2022 | $ 1,500 | $ 565 | $ 515 |

| 5.75% Senior Notes due 2023 | $ 1,100 | $ 568 | $ 518 |

In this case, the motivations are a little different from Denbury’s. The notes listed above are in sequence of maturity. Notice the highest value relative to par offered for exchange is also the earliest maturity date. Chesapeake is offering the increased premium to push back the maturity date of the bonds, in this case, they are offering a one-for-one exchange.

The 6.5% senior notes that are due in 2017 were trading at a value of $75 relative to $100 on December 2, 2015, when the exchange offer was announced. That would equate to a 29% premium relative to the trading value. In the case of the 4.875% notes due in 2022, these notes were trading at $44.99 relative to $100 on December 2, 2015. This would entail a premium of 25% for the exchange offer. By incentivizing the investor to exchange the earlier notes for a greater premium, Chesapeake has effectively pushed back maturity dates and maintained necessary liquidity while doing so.

At the time of the Chesapeake announcement, the 12-month forward strip for WTI crude was $44.54, and the 24-month strip was $46.90; they have declined to $35.20 and $38.01, respectively as of January 12, 2016.

Noble Energy (ticker: NBL)

On June 29, 2015, Noble Energy announced an exchange offer for notes that were outstanding from their acquisition of Rosetta Resources. The timing of the maturity remained unchanged as did the terms of the notes. However, in an effort to move the notes under the Noble umbrella, the company offered early exchange terms of a one-for-one trade, or an offer of par value for the bond.

Carrizo Oil and Gas (ticker: CRZO)

On April 24, 2015, Carrizo Oil and Gas announced a cash tender offer to buy back all of their outstanding 8.635% notes due in 2018 while simultaneously announcing the issue of new notes with the same terms due in 2023. In order to incentivize investors to take the cash offer, Carrizo offered $1,046.13 for each $1,000 principal note outstanding. The investor would also continue to receive interest for the remainder of the original terms, concluding in 2018.

To receive the free EnerCom Oil & Gas 360® “Closing Bell” end-of-day report, delivering commodities prices, indices, global currencies and the industry’s key financial, company and geopolitical news, plus interviews with energy industry leaders, click here.