A stabilization in oil prices and fewer claims of oil dropping to $20 (or less) has quelled investor fears in recent weeks, and companies are taking advantage of the calmer markets to build their balance sheets. Noble Energy (ticker: NBL) and Plains All American Pipeline (ticker: PAA) have both announced equity offerings of more than $1 billion, with each intending to pay down current debt levels. The offerings come just days after Chevron (ticker: CVX) raised roughly $6 billion for similar intentions.

“I believe these companies are recognizing that the debt markets might not be optimal at this time, plus do not want to risk being over-levered in this market” said Byron Cooley, Senior Vice President of DNB Bank, in an interview with Oil & Gas 360®.

Insurance Policy?

Earnings season is nearing the end, and roughly 30 companies held conference calls today in what was one of the busiest days of the quarter. Borrowing base redeterminations are now approaching, and Cooley says banks may be less inclined to lend in a margin-strained environment.

“We’re seeing a lot of these insurance policy type moves, and in the reserve base lending market we’ve seen instances where companies have increased their bank revolvers,” he said. Larger, well-positioned companies like Noble and Plains All American can access the capital markets easier than their peers due to their strong balance sheets.

Jason Wangler, Senior Vice President of Equity Research for Wunderlich Securities, says the corporations are taking advantage of an oil market that has seen more than its fair share of volatility in recent months. “Things are relatively better in the short-term, so why leave it to chance?” he told OAG360 from his office in Houston. “Stocks have done better of late, so why not take advantage of it, lock up whatever you need and move forward.”

The PAA decision is intriguing considering its MLP structure and the flexibility of its balance sheet, but Wangler believes the company is positioning itself to throw around its weight in the market. “From the midstream side it seems those guys are getting ramped up to buy some assets,” he said. “Kinder Morgan (ticker: KMI) has already been very aggressive, so PAA may be looking to snap up some assets.”

Redeterminations on the Horizon

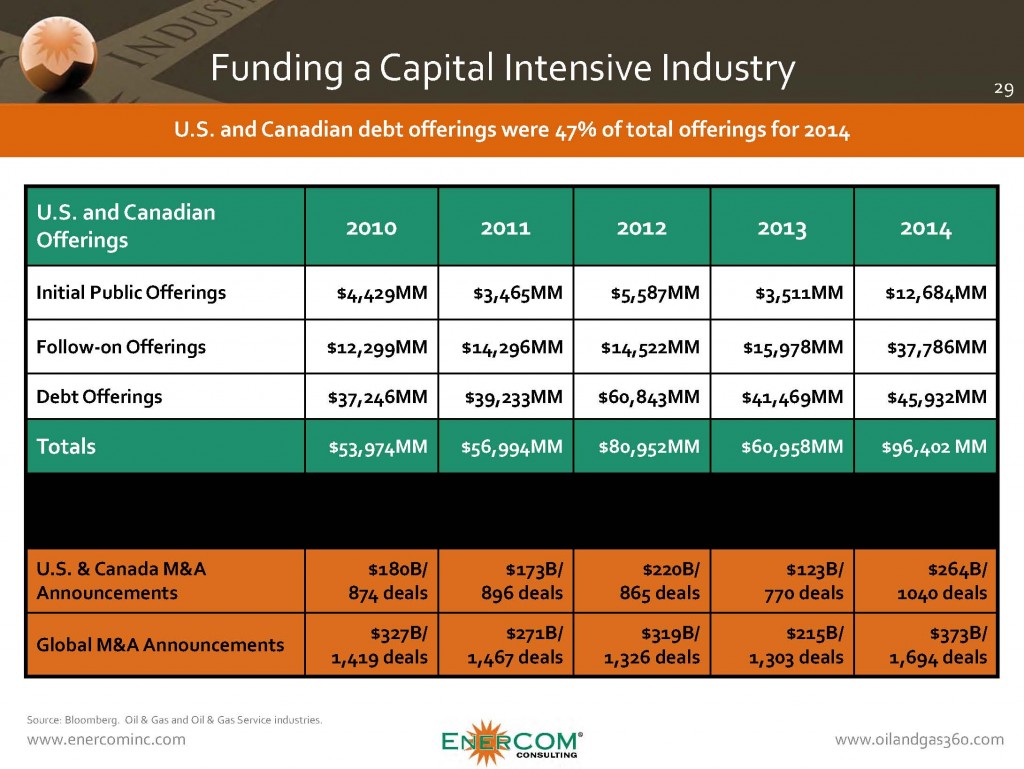

The widespread inflation of debt to market cap percentage among the oil and gas industry has placed tremendous pressure on company balance sheets, and companies are not out of the woods yet. The median debt to market cap in EnerCom’s most recent E&P Weekly was 61% – more than 50% higher the percentage in September 2014. March is generally the prime month for borrowing base redeterminations, and the smaller producers tend to be more highly levered.

“A lot of times smaller companies are already tapped out on their borrowing bases, and we see the possibility where a number of those companies are going to have reductions in their borrowing bases coming up,” Cooley said. He noted smaller and mid-sized companies like Contango Oil & Gas (ticker: MCF), Resolute Energy (ticker: REN) and Comstock Resources (ticker: CRK) have been pro active in anticipation of their borrowing base reviews and have already secured alternative non-bank debt financing of a more mezzanine nature.

The Reserves Issue

Reserves values currently in effect are generally on the basis of last fall’s pricing, meaning the updated reserve values will be smaller in comparison. Cooley says the majority of banks had yet to begin reducing pricing at the time of the last review, meaning the latest updates could result in further negative implications for balance sheets. Some companies have already assumed the loss in their latest quarterly reports by writing down the value of their reserves.

“The SEC pricing isn’t all that bad because it’s an average of the price on the first day of each month,” Cooley explains. “The prices started to slip in September so you have eight months of pretty solid pricing, but it also means some of the SEC reserve value you’ll see in the 10-k’s will probably be inflated.”

Inflated or not, an integral part of moving forward in the market is at the discretion of the banks. Cooley says the decisions of lenders can vary, but their determinations will be an integral step for many companies trying to keep pace in the difficult market. “The true mark is the bank’s borrowing base review,” he said.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.