90 oil and gas operators with more than $60 billion in debt have already filed for bankruptcy: here’s what it’s like

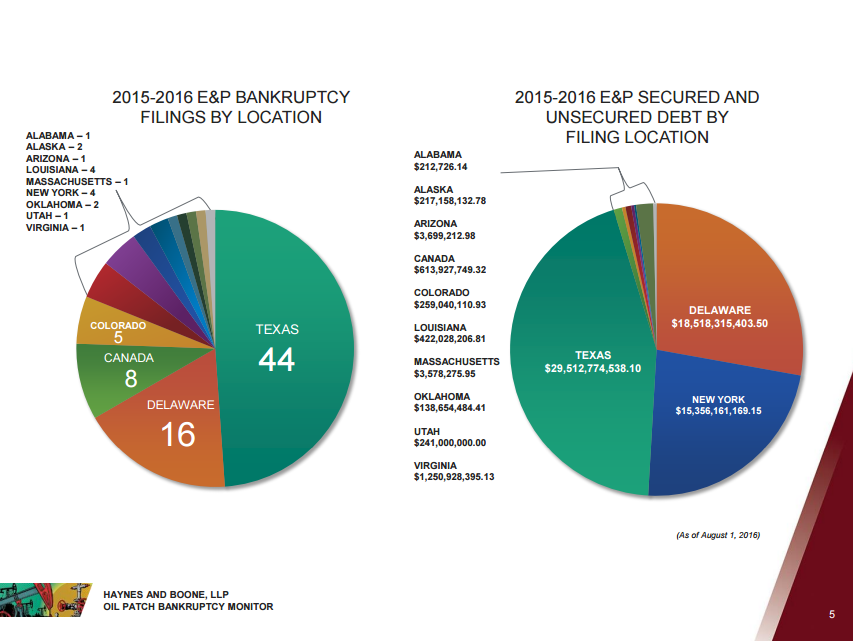

Depressed oil prices that are unable to support heavy debt loads have pushed 90 oil and gas companies into Chapter 11 since the beginning to of 2015, according to the Haynes and Boone Bankruptcy Monitor. These companies have approximately $66.5 billion in total defaulted debt.

The oilfield service sector has also been feeling the squeeze of lower prices, with 80 service companies declaring bankruptcy with a total debt default of $13.5 billion. As recently as August 24, Key Energy Services filed for bankruptcy, with a plan that would make private-equity firm Platinum Equity LLC its largest shareholder.

A lot of operators have learned to adapt. They are surviving in today’s mid-$40s pricing conditions.

Completion techniques and new technologies that were developed when oil was $90 and $100 a barrel in the 2011-early 2014 era have been further refined, and oil companies are using them to make production economic at $45 per barrel in some parts of the U.S. But that may not be enough to stop further bankruptcies in the sector in the next year or two, according to some experts.

Oil & Gas 360® spoke with Haynes and Boone Partner Patrick Hughes about the challenges facing companies filing for Chapter 11. When asked how many more companies might go into bankruptcy at $45 oil, Hughes indicated that analysts with whom he had spoken thought the industry was only one-third of the way through the bankruptcy cycle.

Much in the way the oil and gas industry itself has changed since the last downcycle, the financial system around it has transformed over the last 30 years. Deals are made at a much faster pace, and private equity players with access to huge amounts of capital offer a new wellspring of funding for new management teams to drill and develop resources.

“I don’t think it’s going to be [like it was in the ‘80s], in part because we have liquidity that never existed back then,” said Hughes. “The sophistication level of the lenders and of the equity sponsors and participants is so much higher than it was back then, that the system is able to work faster, which I think is a good thing. But, like most systems, it’s not perfect.”

Companies have an intense desire to move through the process quickly

The whole goal of a bankruptcy filing is to fix the company’s balance sheet, capital structure, and to give it a plan to continue operations. Sometimes, however, companies move through the bankruptcy process quickly to get back to their regular business, and issues are not addressed properly.

“These cases are outliers,” said Hughes, but “there’s an intense desire to minimize the friction of the process, and there’s a perception that, the longer you’re in the process, the more likely you are to have friction and additional expense, and potentially litigation.

“So there’s a real push to get in and out because I think everyone involved would rather not have to go through the oversight of a bankruptcy process where any transaction of significance and all actions outside the normal course of business have to get court approval,” Hughes said.

If the company comes out of the other side of the bankruptcy process with an unwieldy capital structure, or too much debt to service, it can go back under again, filing what Hughes jokingly referred to as “Chapter 22,” or the company’s second round of Chapter 11.

Setting up the bankruptcy in advance

This is not typically the case for companies that move through the process quickly though, explained Blackhill Partners Managing Director Jeff Jones. Blackhill Partners works as an advisor to companies and creditors in restructurings and bankruptcies.

“There are a lot more folks today taking companies into bankruptcy, and they’re looking to pre-negotiate the whole deal,” said Jones. “So they cut a deal with the bond holders and they cut a deal with the lien holders, and they get the agreement of 80% of the parties on what this plan structure is going to be, and therefore, it goes much more quickly. Those are usually well negotiated and researched, and they’re usually set up a good amount of time in advance.”

Companies are beginning to take a more sober view of the future

Part of the problem was that early in the cycle, many companies expected prices to rebound further and faster than they have so far. Companies restructured outside of court with the assumption that prices would come back quickly, and are now having to face the reality of a future that is not expected to hold $100 oil again for some time.

“I think if you look at the futures curve, it’s a pretty sober view of the next five years. It’s the best projection that anyone really has, so I think you need to gear your cash flow projections to that. Certainly no more optimistic than that,” said Jones.

Because prices continue to remain depressed, many debt-holders are also being forced to take a more sober view of their options as well. While some large-scale acquisitions have been taking place in recent weeks, including PDC Energy’s (ticker: PDCE) $1.5 billion entry into the Delaware Basin, very few companies in the Chapter 11 process want to sell their assets because they feel they are out of the money.

Wholesale conversion of unsecured debt into equity

“You’re seeing wholesale conversion of unsecured bond debt to equity simply because they’re already out of the money,” said Hughes. “As companies saw what was happening in the sale-at-auction process that was going on in 2015, seeing secured debt that was receiving bids from buyers at 20% to 25% of the amount of the secured debt on those assets, it became a pretty easy call. ‘Out of the money’ creditors, secured or otherwise, are saying ‘I’m better off retaining the upside of equity than simply putting these assets out on the market and take my lumps today,’” explained Hughes.

“To make that work, a company has to have committed on exit financing that gives you the capital you need to do workovers to replace your reserves. Otherwise, you’re simply in a liquidation mode.”

Facing the future of lower oil prices

To that end, groups like Blackhill have been working with creditors to take as much debt off the balance sheet as possible. The temptation is to leave some there so that it continues accruing interest, but for those that choose to convert some of their debt to equity, this can prove to be counter-productive. Having a company come out of Chapter 11 proceedings then turn back around because it wasn’t able to service its debt does little to help anyone, said Jones.

Embarrassed by an unwieldy capital structure

“I think a lot of people are opting for very conservative capital structures so you don’t end up in Chapter 22,” said Jones. “It’s an embarrassment to all the advisors, especially the financial advisors who should know better than to let their client come out with an unwieldy capital structure.”

Lenders are also expecting hedges to be put in place, even at $45 oil, said Jones. Many companies have been using their hedges as a source of cash flow through the downturn, liquidating them as they need more capital, but companies coming out of bankruptcy need to have a floor on their cash flow.

“The lenders for almost any company coming out of Chapter 11 are going to insist on hedges. Even at $45, that at least puts a floor under today’s oil and gas prices, so you’re limiting the risk coming out. That’s prudent, and that’s what lenders want to see. In most of these exit loan documents, you’re going to see a requirement for half of production, or 60% to 70% of production hedged to provide a floor,” the Blackhill managing partner said.

More to come?

Lenders and companies alike are beginning to take a new view when they look at the future. Lenders are already out of the money, and they would rather wait for the potential upside companies may generate after exiting Chapter 11. For their part, companies continue to become more efficient, but as prices remain below $50 per barrel, and the hedges that companies put in place at high oil prices are largely gone, Haynes and Boone’s bankruptcy expert may be right: the courts may see a new wave of filings coming down the pipe.