Multi-year acceleration of Permian development slated for 2016 start

Wolfcamp B and C benches in Glasscock County may warrant two laterals per zone

Energen Corporation (ticker: EGN) took measures to secure stable near-term growth this week, adding its first oil hedges for 2016 and tapping the equity markets. The measures include:

- Public offering of 5,700,000 shares of stock, resulting in gross proceeds of $405 million after expenses. The offering includes a 30-day underwriter option for 885,000 additional shares, which would boost gross proceeds to about $420 million. The closing date is June 22.

- Hedged 1.1 MMBO of 2016 production at $63.80 per barrel – its first hedges of 2016. The amount is about 5% of anticipated production.

- Hedged an additional 2.9 MMBO of 2015 production at $62.46 per barrel. EGN’s adjusted 2015 hedge position now covers 82% of volumes (14.3 MMBO) at an average price of $80.76 per barrel.

According to the company news release, Energen plans on using the proceeds to “slightly” increase Permian drilling activity in 2015 and then “begin a multi-year acceleration of development activities in the Permian Basin in 2016.” Expenditure guidance for its 2015 drilling program is $1.0 billion, while next year’s activity is slotted at “$1.0 billion or more.” The proceeds may also be used for general corporate purposes and paying down the $685 million outstanding on its $1.6 billion credit facility.

The stock offering will dilute EGN’s shares by about 9% if the greenshoe is included. A note from Global Hunter Securities said Energen is now better positioned to exploit its Permian properties. “[We’re] not surprised to see EGN tap the market given its valuation (EGN trading at 11.6x projected FY16 EV/EBITDA), a decent outspend in FY16 (we estimated >$500MM outspend on a $1.1B budget) and rising leverage (we previously had estimated net debt/EBITDA increasing to 2.6x),” the firm said.

Its debt to market cap percentage before the offering was just 23%, according to EnerCom’s Weekly Benchmarking Report. The percentage is well below an 88-company median of 68% and is the fifth lowest among its 22 mid-cap competitors.

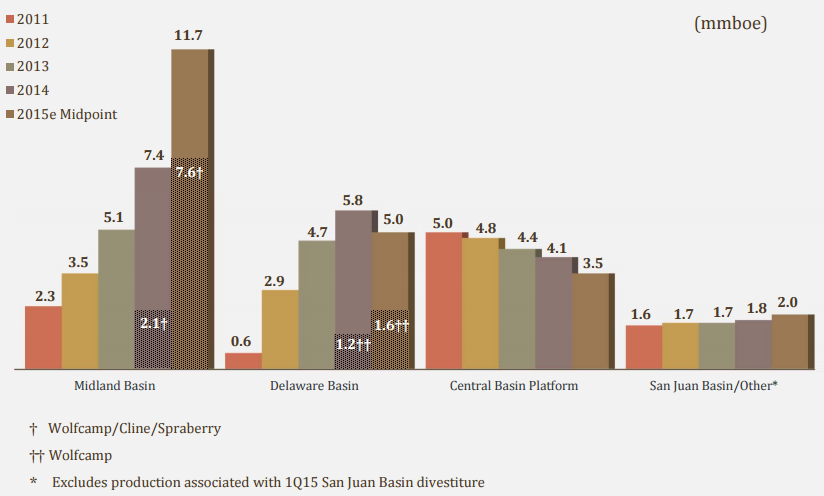

Energen at Home in the Permian

Energen has about 373 MMBOE of proved reserves in its portfolio, largely consisting of acreage in the Permian and San Juan Basins. About 281 MMBOE are located in the Permian – the focal point of 2015 operations. EGN plans on running eight to 11 rigs in 2015, and all but one will be in West Texas. About 90% of its budget will be allocated to the region, and an estimated 118 net operated wells (123 gross) will be drilled.

Management believes its Permian drilling inventory consists of 5,701 net unrisked locations. The company added 676 locations in the Lower Spraberry in the latest quarter as a result of a successful testing program. “We think there could be more to come,” said James McManus, Chairman and Chief Executive Officer of Energen, in the company’s Q1’15 conference call. “The thick Wolfcamp B and C benches in Glasscock County may well offer the potential for two laterals per zone.”

The dominance of the Permian is well-documented, but Energen’s position offers some tremendous returns. EGN says it can generate a 60% rate of return from its Lower Spraberry locations at $60/barrel prices. McManus discussed the Lower Spraberry value in the call, explaining the PV-10 value of a 7,500 foot Wolfcamp A well is about $7 million, even though its two most recent wells were outperforming type curves.

“Let’s just be conservative and say that that $7 million number is right, even though it is too low…It’s likely to be much higher than that,” he said. “If we take our 414 locations in the North [Midland] and multiply by $7 million PV-10 value, that’s $2.898 billion or $2.9 billion of undiscounted value created in the Northern Lower Spraberrys alone.”

The PV-10 value of those assets alone are more than half of the company’s current market cap.